Interest rates are at historic lows. That’s well known. Less well understood is the fact that risk in bonds is at historic highs.

Bond prices move in the opposite direction of rates. When rates rise, prices will fall. This relationship is well defined.

The rate on 10-year Treasury notes is about 0.84%. If that rate rises 1%, the price of the note will fall by about 7.7%.

In other words, investors will lose more than nine years’ worth of interest payments if rates increase 1%.

There is a type of bond that reduces this risk.

A Treasury Inflation-Protected Security (TIPS) is a Treasury bond that is indexed to inflation to protect investors from the decline in the purchasing power of their money.

The principal value of TIPS rises as inflation rises while the interest payment varies with the adjusted principal value of the bond.

This means now is an ideal time to consider TIPS since inflation expectations are rising, and TIPS will adapt to inflation.

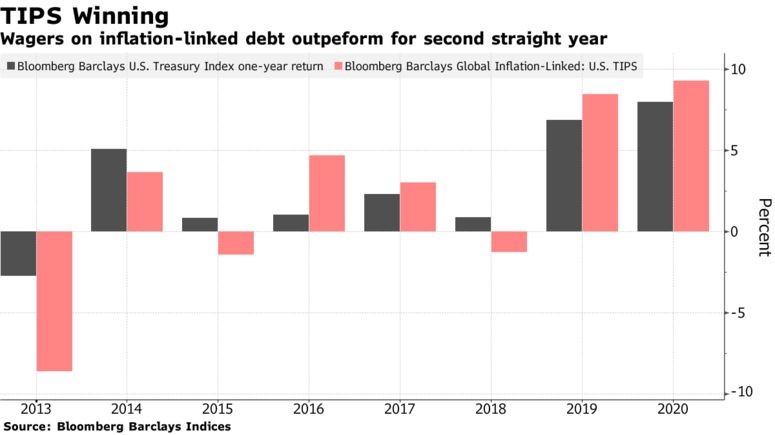

For the past two years, TIPS beat non-inflation-indexed bonds.

Source: Bloomberg.

Government-Issued TIPS Bonds Could Beat Inflation

The level of outperformance is small, but if inflation rises, TIPS could protect fixed-income investors against large losses.

TIPS are available directly from the Treasury, at no cost through the TreasuryDirect platform.

Or, investors can gain exposure to the asset class through exchange-traded funds (ETFs).

iShares TIPS Bond ETF (NYSE: TIP) invests in U.S. Treasuries. More aggressive investors can consider SPDR FTSE International Government Inflation-Protected Bond ETF (NYSE: WIP).

WIP offers higher income and carries more risk. The fund’s holdings include bonds issued by Chile, Columbia and other governments. About half of the assets are in bonds issued by governments with more credit risk than the U.S.

While TIPS don’t eliminate risks, they do decrease risks associated with inflation. They don’t eliminate inflation risks, however. The government that issues the bonds defines inflation, so there is a chance actual inflation will exceed the index used to set interest rates.

But, given the risks of unindexed bonds, inflation-protected could be the safest choice for income investors.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.