Money’s invention was about making taxes easier to pay. Before economic theories, the amount of money in an economy was tied to tax receipts.

Of course, money serves additional purposes. It’s used to complete commercial transactions and to store value for the future. But paying taxes is still one of the primary purposes of money.

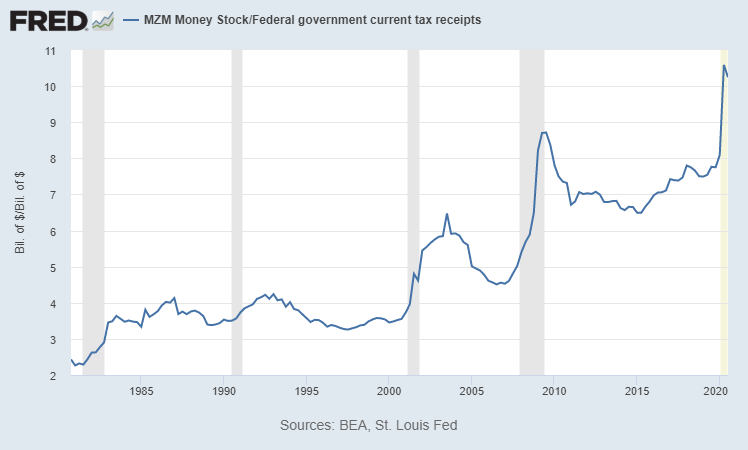

The chart below shows inflation based on that purpose.

Ratio of Money to U.S. Tax Receipts

Source: Federal Reserve.

Tax Receipts Show That With Recovery Comes Inflation

The amount of money in circulation is based on the MZM Money Stock, the broadest measure of the money supply.

The ratio rose quickly along with inflation in the early 1980s. The Federal Reserve then stabilized the relationship, growing money in line with tax receipts until adopting an easy money policy to limit the recession that began in 2001.

The Fed’s inability to reign in the money supply is often cited as one of the causes of the bubble in real estate that unfolded in the early 2000s.

Quantitative easing after the financial crisis that began in 2008 pushed the ratio above 8, more than double the level in the stable 1990s. In response to the recent economic shutdowns, the Fed pushed the money-to-taxes ratio above 10.

This increase comes before tax receipts decline in 2021. That decline is likely to be substantial as tax receipts drop to reflect lower income caused by the shutdown. There will also be some delayed CARES Act stimulus payments that further depress receipts.

Some individuals who saw their income decline in 2020 are eligible for $1,200 individual credits on their taxes. Some tax payers will target this credit as they prepare their 2020 taxes, which means even less taxes will be collected.

Low tax receipts will push the money-to-tax ratio even higher, and that’s a concern.

If economic activity picks up and the Fed cannot remove money from the economy, inflation will rise. If economic activity continues to lag, the ratio will rise even more, delaying the eventual recovery’s impending inflation problem.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.