As an investor, you’re always looking for the next big opportunity. Could Toll Brothers stock be the answer?

The home builder and real estate development company’s stock price has been climbing higher since October, but sometimes we need a little extra data to know if it’s a sustainable trend.

Today, we’ll take a closer look at what makes Toll Brothers tick, as well as its outlook for 2023 using our proprietary and incredibly useful tool, Stock Power Ratings.

What Toll Brothers Is All About

Toll Brothers was founded in 1967 by brothers Robert I. and Bruce E. Toll and has since grown to become one of the largest luxury home builders in the United States.

The company focuses on developing high-end homes in desirable areas, with an emphasis on luxurious amenities such as tennis courts, golf courses, swimming pools and spas. It also offers custom homebuilding services to give customers a unique living experience.

TOL Revenue and Outlook for 2023

In 2020, despite the economic downturn caused by COVID-19, Toll Brothers reported record sales numbers of $8 billion — proving that its business model is resilient even in difficult times.

And revenue has been steadily climbing since then. The company reported $3.71 billion in revenue for the quarter ending on October 31, 2022 — a 22% increase year-over-year!

The company has also made strides towards sustainability and energy efficiency over the past few years. In 2020, it launched its ClimateSmart Home program, where it is committed to using energy efficient materials throughout the building process.

It has also started investing in green projects like solar panel installation on newly built homes and is partnering with renewable energy companies to reduce its environmental impact even further moving forward.

Let’s see if that has translated into a solid company within our system.

Toll Brothers Stock Power Ratings

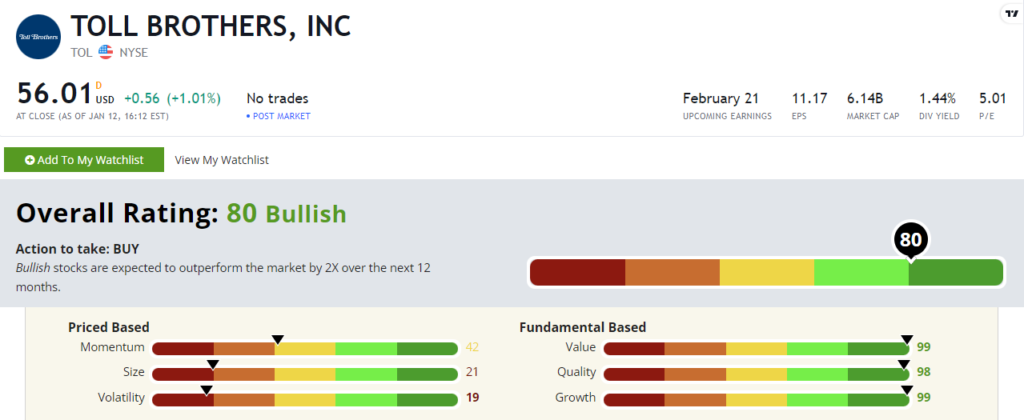

Looking at Stock Power Ratings, Toll Brothers stock rates a “Bullish” 80 out of 100. That means we expect the stock to 2X the broader market over the next 12 months.

Its fundamental ratings are about as good as it gets, with near perfect scores on value (99), quality (98) and growth (99).

I mentioned its revenue up above, and that’s a huge factor contributing to its quality score.

And it trades at a 5.48 price-to-earnings (P/E) ratio. The broader homebuilding industry trades at a P/E ratio of 6.51 as I write.

That’s why it sports such a strong value factor rating.

Its momentum score is only at 42 out of 100, but that could improve since Toll Brothers stock has gained 10% over the last month.

Bottom Line: Overall, Toll Brothers is showing strong signs of growth despite economic uncertainty.

With record sales figures expected in 2023, and a “Bullish” rating within our proprietary system, it looks like Toll Brothers stock is set to outperform.

What about you? Do you own TOL stock, or did you sell it during the market turmoil of 2022? Let us know by leaving a comment below or emailing StockPower@MoneyandMarkets.com. We love to hear what our readers think about some of the top stocks in the market.