Not all energy companies are the same.

The three different categories oil and gas companies fall into are:

- Upstream — Produces raw crude oil and natural gas.

- Midstream — Focuses on processing, storing, transporting and marketing oil and natural gas.

- Downstream — Refines crude oil into gasoline, diesel, jet and other fuels.

Costs are higher in the upstream market, while downstream activities depend on supply and demand.

Midstream profits come from long-term, fixed-fee contracts, so their profits are more stable than their counterparts’. And a little stability sounds nice in these current market conditions.

Earnings before interest, taxes, depreciation and amortization (EBITDA) is a metric used to show the value of a company. The higher a company’s EBITDA, the better its bottom line is.

Goldman Sachs reports EBITDA for midstream companies was $52 billion in 2019.

By the end of next year, the firm expects that number to jump 21.2% to $63 billion.

Today’s Power Stock is a $1.6 billion midstream energy company: Torm PLC (Nasdaq: TRMD).

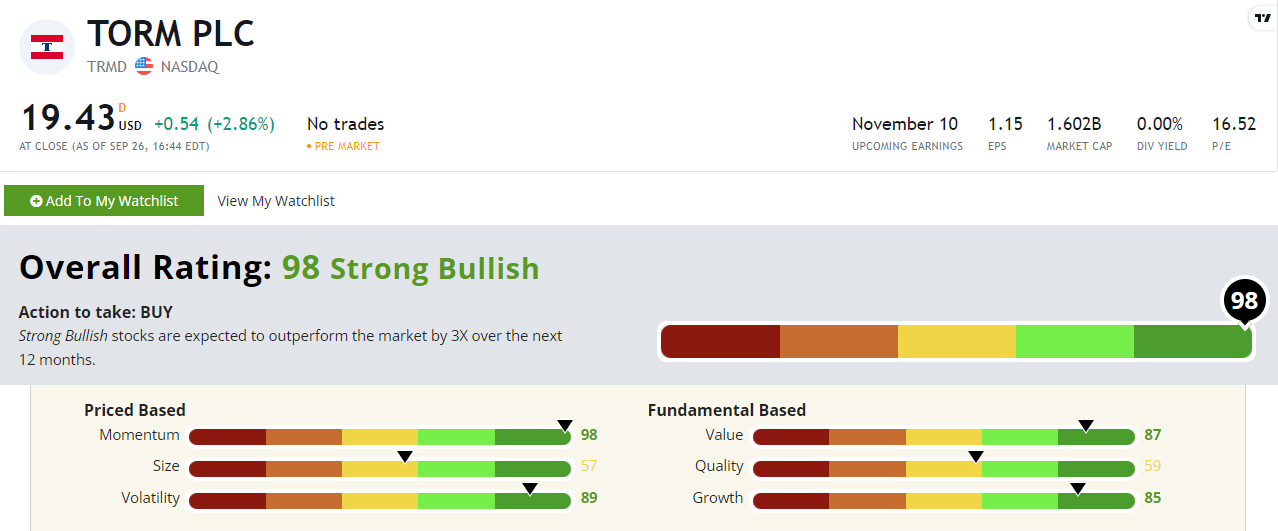

TRMD’s Stock Power Ratings in September 2022.

U.K.-based Torm owns and operates tankers used to transport oil and natural gas from upstream miners to downstream refiners.

TRMD scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

TRMD Stock: Outstanding Value, Quality and Momentum

I discovered two notable items when looking into TRMD stock:

- In the first six months of 2022, Torm reported $322.9 million in total revenue — a 26.7% increase from a year ago.

- The company also trimmed its operating expenses by 28.6%.

Those numbers show why TRMD scores an 85 on our growth metric.

It earns a solid 87 on value, based on its price-to-cash flow ratio of 7, compared to the industry average of 8.75.

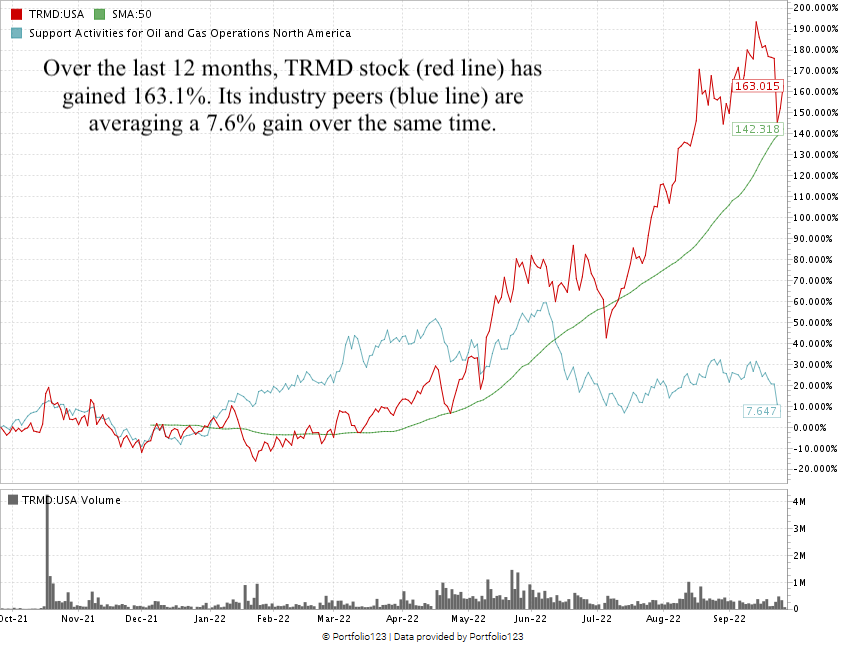

Created September 2022.

The stock is up 163.1% over the last 12 months, beating the industry by more than five times!

TRMD’s run includes a 105.6% gain from a low point in July 2022 to a new 52-week high in September.

Torm stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Midstream energy companies are profitable but not reliant on the price of oil or natural gas to maintain or grow those profits.

That’s why TRMD is a great contender for your portfolio.

Bonus: Shareholders earn a healthy 2.73% dividend yield, meaning the company will pay you $0.58 per share per year to own the stock.

Stay Tuned: Downstream Energy Company Outperforms Peers by 85%

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a downstream energy company in the top 1% of all stocks we rate.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.