As someone who has moved a few times in my life, I can tell you that moving isn’t fun.

Downsizing, packing boxes, organizing moving trucks and, finally, the actual move … no part of that is exciting.

Even so, 15.3 million American households pack up and move … every year.

At an average of 2.3 members in a household, that’s 35.2 million Americans packing up and moving annually.

Needless to say, there is big money for companies in the moving industry:

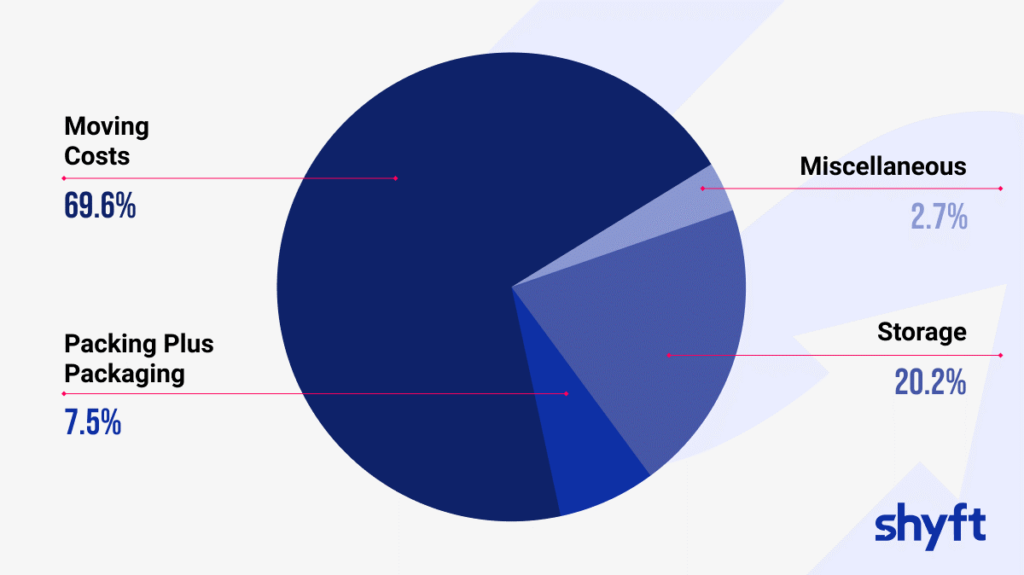

Chart courtesy of Shyft.

Shyft reports that nearly 90% of all moving industry revenue in 2021 came from storage and moving costs (truck and equipment rentals, labor, etc.).

That leads me to today’s Power Stock … a massive player in the moving industry: U-Haul Holding Co. (NYSE: UHAL).

U-Haul offers everything under the sun when it comes to moving:

- Truck rentals.

- Portable moving units (think trailers used to move).

- Storage facilities.

- It even provides property and life insurance.

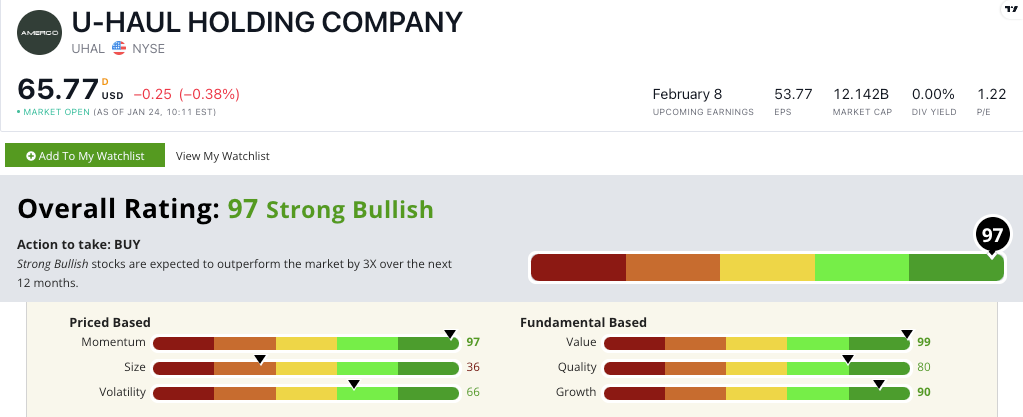

U-Haul stock scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

Fun fact: Until November 2022, U-Haul traded on the New York Stock Exchange under the name Amerco.

U-Haul Stock: Incredible Value and Excellent Momentum

UHAL recently reported a strong quarter:

- Total revenue for the first six months of the fiscal year was $3.3 billion — a 6.5% increase from the same period a year ago!

- Quarterly revenue from self-storage increased $32.1 million, or 21%, from the same quarter last year.

Those numbers show why UHAL scores a 90 on our growth factor.

While those stats are impressive, UHAL earns its highest fundamental rating on our value factor at 99.

Its price-to-sales ratio is 10 times lower than the industry average while its current price-to-cash flow is 12 times lower than its peer average.

These numbers tell us UHAL’s growth and value potential is high compared to the rest of its industry peers.

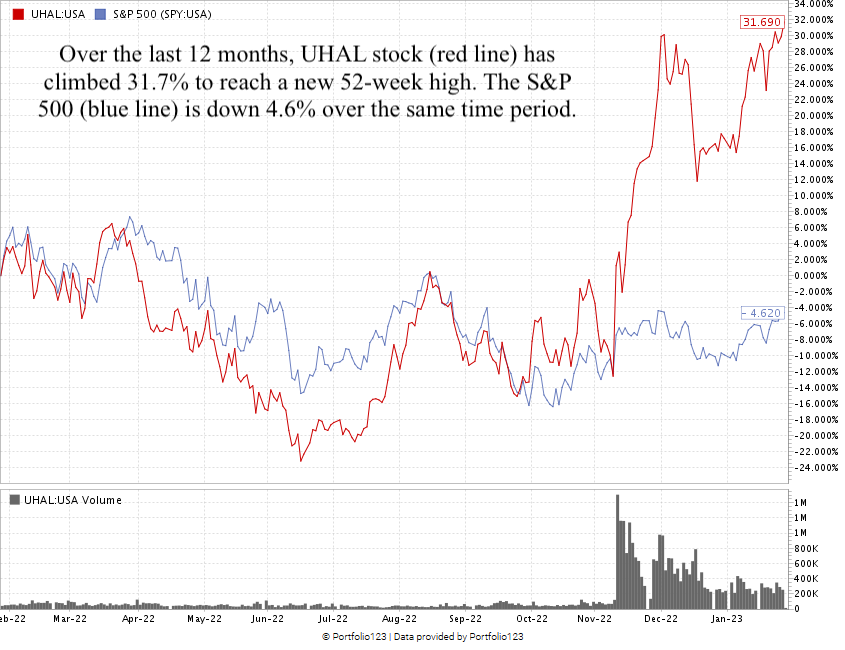

Let’s look at U-Haul stock’s momentum on its chart.

Created in January 2023.

From its recent low in November 2022 to its previous 52-week high a month later, UHAL stock jumped 48.8%.

The stock is currently trading at a new 52-week high. I’m confident it will go higher.

U-Haul Holding Co. stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish,” and we expect it to beat the broader market by at least 3X in the next 12 months.

As an added bonus, UHAL’s 2.27% forward dividend yield means shareholders earn $1.50 per year for every share they own.

Bottom line: Nearly 10% of all Americans move every year.

When you’re moving, you want reliable trucks and available storage … anything to make the moving process easier.

U-Haul is an industry leader in providing services that keep the moving process seamless, making U-Haul stock a great addition to your portfolio.

Stay Tuned: A Strong Bullish Breakfast Brand

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a breakfast cereals company that is riding its strong brand to profitability.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets