Every week, the Labor Department reports on the number of claims for unemployment insurance. In the past year, this has been viewed as an indicator of the economy’s recovery from the pandemic.

Last week’s report left analysts pessimistic. The Wall Street Journal noted: “U.S. Jobless Claims Remain at Elevated Level After Steady Declines” in a headline. In the details, we learned that “U.S. jobless claims fell slightly to 385,000 last week, as worker filings for new unemployment benefits settled this summer at a level that is nearly double the pre-pandemic average.”

This is true based on a short-term perspective. In 2019, before the pandemic, the weekly average of new claims was about 218,000. But this isn’t the right way to look at the data.

In 2019, the unemployment rate was below 4%. The last time unemployment was that low for an entire year was 1969. It’s not fair to compare current data with an unusually strong economy. The unfortunate truth is that it’s unlikely unemployment will dip below 4% in the near term.

A Long View on Unemployment

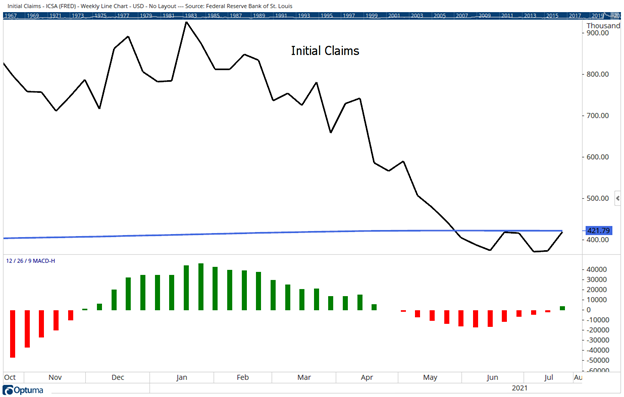

A better way to evaluate the average level of initial claims is with a ten-year average. That timeframe includes both a recession and an economic expansion. Nobel Prize-winning economist Robert Shiller argues that analysts should consider earnings for the stock market over a ten-year period to avoid short-term anomalies in the data.

Using that long-term perspective, new claims are almost back to average. The ten-year average of weekly new claims is 421,790. Last week’s report was slightly below average.

Initial Unemployment Claims Normalized

Source: Optuma.

A momentum indicator is shown at the bottom of the chart. Momentum turned positive, indicating higher numbers are likely in the next few months. The chart pattern, a double bottom, confirms initial claims should increase.

Unemployment might be disappointing when compared to the booming economy of 2019. But it’s unlikely we can get back to that level of growth given current government policies.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.