Two weeks ago, I wrote about how International Paper (NYSE: IP) was a good way to play the underlying macro trend of a permanent shift to e-commerce without rolling the dice on a pricey stock like Amazon.com Inc. (Nasdaq: AMZN).

Today, I’m going to make a similar case for shipping and logistics firm United Parcel Service Inc. (NYSE: UPS).

This isn’t an “Amazon play,” per se, as Amazon is building out its own shipping and logistics infrastructure — directly competing with UPS. It’s more of a play on the rise of e-commerce at the expense of brick-and-mortar retail.

Remember, while the COVID-19 pandemic gave “stay at home” stocks a major boost in 2020, the underlying shift in consumer behavior is nothing new. It’s been a steady progression for the past quarter-century. In nature, most objects follow the path of least resistance. We, humans, are no exception. When given a choice between getting in our cars and driving to a store or continuing to sit on the couch with one hand on the remote control and the other deep into a bag of Cheetos, the couch is going to win. Even to the extent we buy from a store with a traditional brick-and-mortar presence, with every passing day, it gets easier to order from their website than to go to their retail location.

UPS is a major beneficiary of that trend. Yes, the threat from Amazon is real. But a large and growing market has room for multiple strong competitors, and UPS has decades of experience and an established global fleet. According to Federal Reserve data, even after two and a half decades of strong growth, e-commerce only makes up about 14% of all U.S. consumer spending. And this data comes from 2020 when most of retail America was still under virus restrictions.

This is to say there is still a long runway for growth here.

With that as background, let’s see how UPS stacks up on Adam O’Dell’s Green Zone Ratings model.

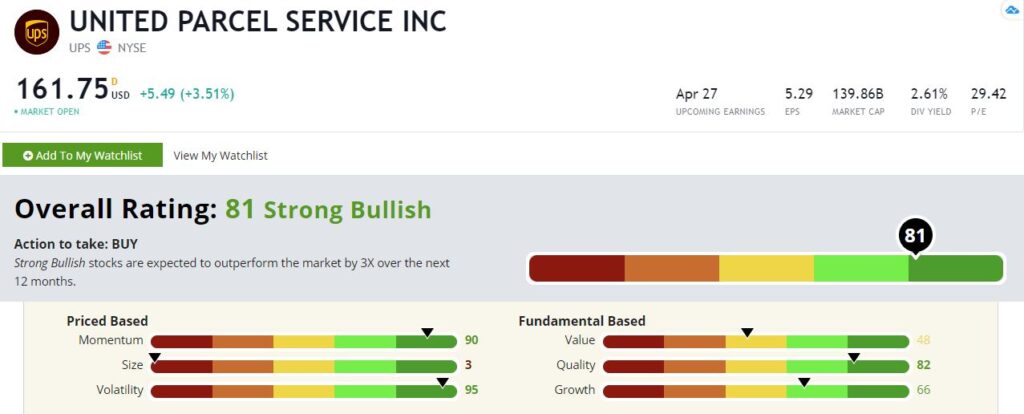

United Parcel Service’s (UPS) Stock Rating

UPS sports an overall rating that rounds up 81, putting it in “Strong Bullish” range. Our historical data suggests that Strong Bullish stocks outperform the market by 3X on average over the following 12 months.

United Parcel Service’s Green Zone Rating on February 2, 2021.

This to say that, based on our model, UPS looks poised to enjoy a nice run. Let’s break it down further.

Volatility — UPS rates extremely high on volatility, coming in at 95, which means that by our criteria, UPS is less volatile than all but 5% of the stocks in our universe. Historically, lower-volatility stocks have outperformed higher-volatility stocks … and done so with a lot less investor heartburn!

Momentum — UPS also rates highly based on momentum, scoring an 90. This is noteworthy because we wouldn’t normally expect a low-volume stock to show market-beating momentum in a bull market. Yet, it makes perfect sense if you understand the underlying trends. Investors understand the rise of e-commerce and see UPS as a good way to play it.

Quality — This is also a high-quality stock, rating an 82 on that metric. We measure quality primarily with various measures of profitability and balance sheet strength. UPS scores particularly well on its return on equity, which came in at a whopping 82% over the past 12 months.

Growth — UPS scores reasonably well on growth, at 66. I wouldn’t expect to see UPS scoring in the top 10%, as this isn’t some new hypergrowth tech upstart. It’s an established company with decades of experience. But the macro trends underpinning it should keep its growth rating firmly in the top half of all stocks for the foreseeable future.

Value — UPS is very much in the middle of the pack in terms of value, rating at 48. That means it’s more expensive than a little over half the stocks in our universe. That’s OK. It’s rare to find stocks that rate well on momentum and quality that also rate exceptionally high in value. It’s normal to pay up for quality.

Size — And finally, we get to size. This is a large company with a $135 billion market cap. Not surprisingly, it rates low on this metric at a 3.

Bottom Line: UPS might not be the cheapest stock in our universe. But it rates exceptionally highly on our model and is backed by one of the strongest macro trends of the past century.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.