Economists have a simple formula for determining how large an economy is. They find the amount of money in the economy and multiply that by how many times each unit of money is spent.

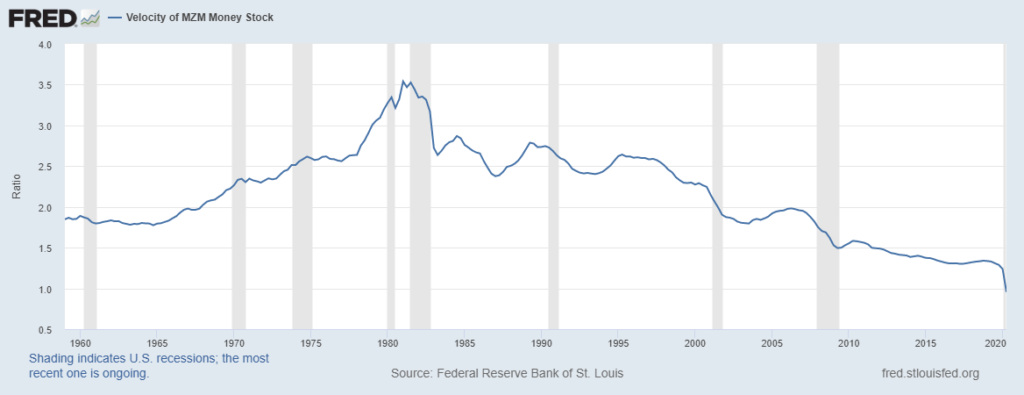

For the U.S., the amount of money in the economy is controlled by the Federal Reserve. Over the years, each dollar was spent between 1.5 and 3.5 times a year. This is called the velocity of money.

The chart below shows the velocity of MZM, the broadest measure of money supply. Data is updated quarterly. At the end of September, the Fed reported velocity dropped to 0.955.

Money Isn’t Being Spent as Rapidly

Source: Federal Reserve.

For the first time in the data series, velocity is less than 1. This means every dollar the Fed creates leads to less than $1 in economic activity.

The good news is that this decreases the risk of inflation. The bad news is that this also reduces the probability of economic recovery.

For now, money isn’t being spent as fast as its being printed. Instead, some dollars are being removed from the economy, perhaps being invested in gold or bitcoin for a rainy day.

The Fed no longer controls that money. It’s another example of standard economic models breaking down.

In the short run, lower velocity means stimulus and easy money policies won’t be as effective as expected. Slower growth, or even contraction, is likely for a few more quarters.

In the long run, there is a hidden inflation risk that the Fed can’t control. This makes future policy decisions more difficult since outcomes are even less predictable.

There’s no easy solution to this problem. The Fed knows that. And they are certainly trying to understand how to create inflation when money is being hidden from the central bank.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.