Old floor traders were generally happy. And they should have been. Their job was simply to make money.

Big traders who bought on the way down have profits, and their selling will create the second down leg of the ongoing bear market.

Every day, they went to work on the floor of the stock exchanges. They made the market work.

If you wanted to trade, they took the other side of the trade. When you bought, they sold. For this, they got paid at least $0.125 a share, an eighth of a dollar when stocks traded in fractions. Those eighths added up to billions of dollars a year.

Floor traders are long gone, replaced by computers. Computers take the other side of your trade for less than a penny. That’s a big savings for investors. But computer programmers don’t do this for fun. They too are seeking profits.

Right now, they have a profit on shares they bought on the way down. That means they might start selling, and that would kill this bull market bounce.

Volume-Weighted Average Price Signals Potential Profit Taking

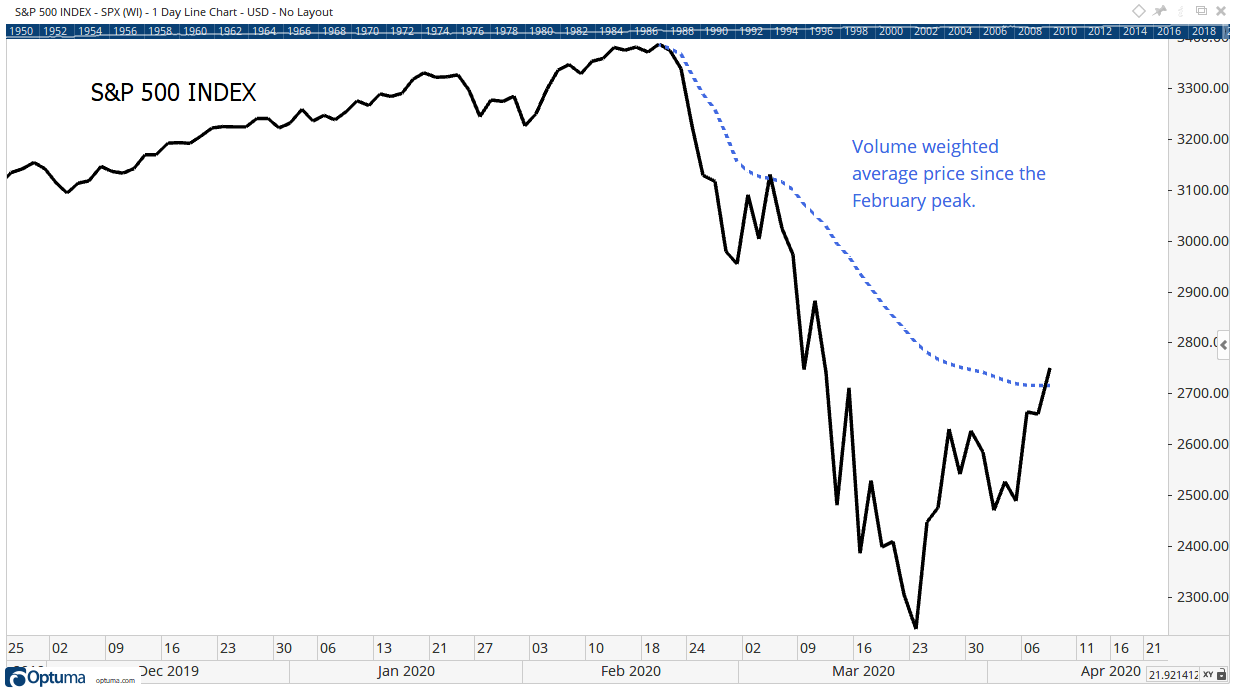

The chart below shows the S&P 500 with an indicator known as the volume-weighted average price, or VWAP, shown as the blue line.

VWAP combines price and volume. To find the indicator, multiply the price of each trade by the volume for that trade. Sum these products of all the trades and divide the sum by the total volume.

In the chart, VWAP is measured from the market top in February. Comparing the latest price to the VWAP, it shows if the average investor over that time has a gain or a loss.

The chart above shows that investors who bought on the way down now have a profit. That could lead to a fresh wave of selling.

In the current market environment, potential risks outweigh potential rewards. So, it makes sense to take profits when you have them.

Big traders who bought on the way down have profits, and their selling will create the second down leg of the ongoing bear market.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru