I write about Warren Buffett on a regular basis, and with good reason.

The Oracle of Omaha has withstood the test of time and put up numbers that would seem impossible to mere mortals.

Under him, holding company Berkshire Hathaway (NYSE: BRK-B) stock grew by over 2.7 million percent between 1964 and 2019.

Buffett is arguably the best investor in history.

But even the great ones stumble from time to time, and Buffett has made some high-profile mistakes of late.

Buffett took major losses on his airline positions during the COVID sell-off, for example. And apart from Apple (Nasdaq: AAPL), most of Berkshire Hathaway’s largest stock positions are still sitting on large losses for the year.

More Than Its Stock Portfolio

Of course, Berkshire Hathaway is more than just its stock portfolio. It also owns an expansive collection of private businesses and insurance operations, though many of these have had issues of their own.

Berkshire Hathaway took a massive $10 billion writedown on Precision Castparts earlier this month. COVID-19 obliterated the aircraft parts business.

Let’s do a deep dive on Berkshire Hathaway stock using Adam O’Dell’s Green Zone rating system.

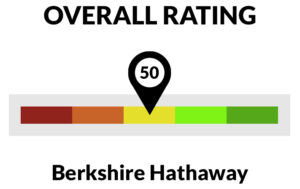

Overall, Berkshire rates as a 50, making it the definition of mediocrity.

Half the stocks in our trackable universe are rated higher and half lower. Let’s dig into the details.

Berkshire Hathaway Stock: A Deep Dive

Volatility — Berkshire Hathaway’s highest rating is in volatility, where it rates a 77. In this case, a higher number signifies lower volatility. Over time, low-volatility stocks tend to deliver better returns than their high-volatility peers. Buffett himself knows this. He’s made a career out of using Berkshire Hathaway’s massive insurance float to buy positions in high-quality, low-volatility names.

Quality — Berkshire Hathaway also rates high in quality at 70. Buffett has spent a lifetime building the company into the financial powerhouse it is today. When he took over in 1964, the failing textile mill was the definition of a low-quality piece of junk you’d never want in your portfolio. Today, it’s a global conglomerate with a fortress balance sheet. Berkshire scores well in cash flows (91) and debt (90). But it scores poorly in profitability. It rates a 46 in margins and a 41 in returns on equity, assets and investment. Though to be fair, given the complexity of Berkshire’s sprawling empire, I’d take the profitability metrics with a grain of salt.

Growth — Buffett’s creation doesn’t rate especially high in terms of growth at 65. But remember: Berkshire is essentially an insurance company with a portfolio of businesses attached to it. You wouldn’t expect it to compete with high-growth tech names. For what it’s worth, Berkshire has a few growth monsters in its portfolio. For instance, Apple makes up about 35% of its publicly-traded stock portfolio.

Value — Berkshire Hathaway rates an above-average 58 in value. Its price-to-book ratio rating is high, at 76. But it drops off after that. Its price-to-sales rating is 57. None of its other valuation metrics place it in the top half.

Momentum — Tech names have been strongest in recent years, so it shouldn’t be too surprising that Berkshire rates only a 31 in momentum. Old-school stocks simply haven’t kept pace with tech.

Size — And finally, we get to size. Berkshire Hathaway is enormous, with a market cap of over half a trillion dollars. It rates a 0.8, meaning that 99.2% of companies are smaller.

Takeaway: Don’t Rush Into BRK

Based on the numbers, Berkshire doesn’t look like a winner that’s poised to beat the market in the months ahead.

But one investor sees plenty of value left in the shares: Warren Buffett.

Earlier in August, Berkshire announced $5.1 billion in buybacks in May and June. That’s a record for the company, and more could come. As of quarter end, Berkshire had $147 billion in cash on the balance sheet.

That gives the company a huge degree of optionality. Buffett may still have one or two “elephants” left to hunt. He’s indicated he’s on the lookout for a major acquisition if he can find one at the right price.

Or he may just continue buying back his own shares.

I don’t like to bet against Buffett. But based on Adam’s Green Zone rating system, I wouldn’t be in a hurry to buy today. Buffett is a notoriously patient investor, and we could learn from his example by being patient and not rushing into Berkshire Hathaway.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.