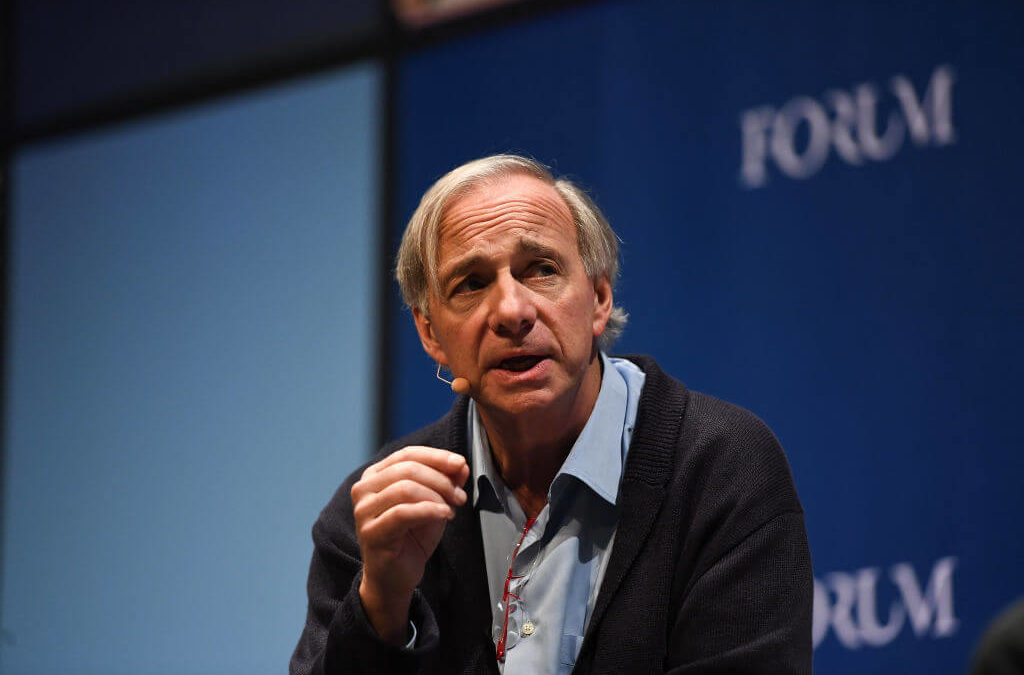

Billionaire Ray Dalio said governments cannot be relied upon to protect its citizens financially.

The 13,000-word essay was published on LinkedIn on Thursday and previews his upcoming book, “The Changing World Order.”

The post comes at a time when the Federal Reserve has increased its asset purchase program “in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy,” the Fed said in a statement.

It’s something that gives the U.S. government a great deal of power, Dalio said, but has a big consequence.

“Governments that have the power to do so are printing money to help ease the debt burdens and help finance the expenses that are denominated in their own currencies, which will weaken their own currencies and raise their levels of monetary inflation to offset the deflation that is coming from reduced demand and forced asset sales that are happening as those that are stretched have to raise cash,” he said.

That creates a risk.

Dalio said by putting dollars in the hands of Americans — as was done with the $2.2 trillion coronavirus stimulus package passed by Congress in March — “the U.S. risks losing this privileged position by creating too much money and debt.”

Dalio: Don’t Rely on the Government

Small businesses and everyday Americans were excited about new programs to purchase assets and stimulus measures. But Dalio said “we shouldn’t rely on the government to protect us financially.”

“On the contrary, we should expect most governments to abuse their privileged positions as the creators and users of money and credit for the same reasons that you might do these abuses if you were in their shoes,” he said. “That is because no one policymaker owns the whole cycle. Each one comes in at one or another part of it and does what is in their interest to do at that time given their circumstances at the time.”

Because governments contribute to the accumulation of debt and become a large debtor when the debt bubble bursts currency like the dollar becomes devalued as the government prints more and more currency.

Quantitative easing helps, but governments can only do so much. Once the government gets into a situation of having to bail out debtors, it creates a massive cash flow issue.

Cycles Lead to Changes

Dalio said that big cycles start when there is a new way of operating domestically and internationally. This includes new monetary and political systems.

But in the middle of that are short-term debt and economic cycles like recessions and expansions.

“With time investors extrapolate past gains into the future and borrow money to bet on them continuing to happen, which creates debt bubbles at the same time as the wealth gaps grow because some benefit more than others from this money-making upswing,” Dalio said.

That will continue until central banks run out of ammunition to stimulate the economy. Then, money is tighter, the debt bubble bursts and economies contract.

This happened as the coronavirus took hold of global economies.

But one thing is for sure: The cycles are constant. Economies fall and economies rebound.

The only question is how long does it take for an economy to come back from a recession?