Wealth inequality in the United States has been a hot topic of debate for some time now, with many top candidates in the Democratic primary basing their campaigns around it.

And data released this week will likely add more fuel to the fire of candidates like Sens. Bernie Sanders, I-Vt., and Elizabeth Warren, D-Mass.

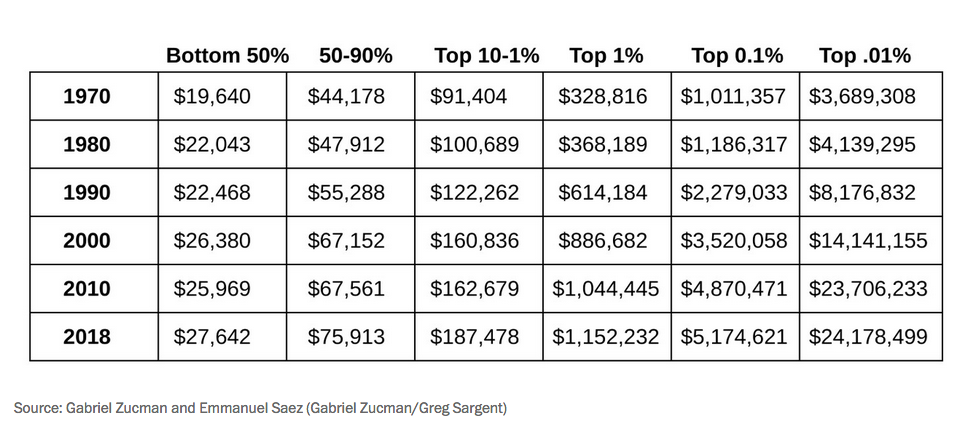

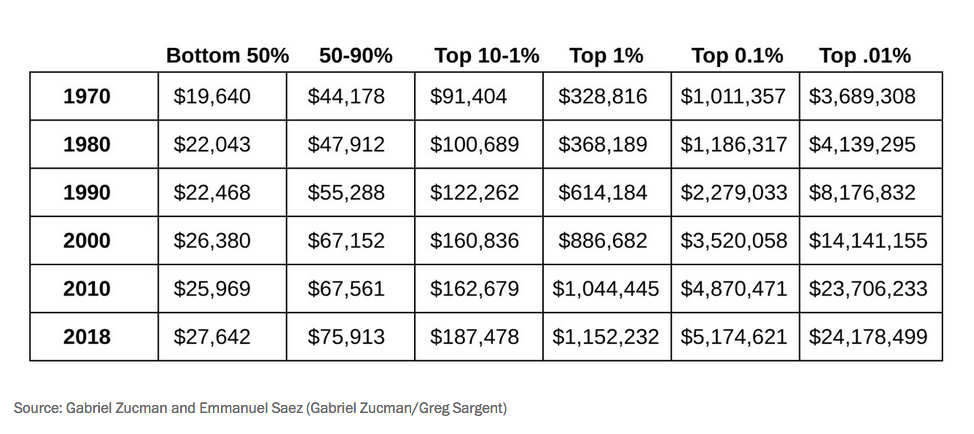

The study was done by University of Cal Berkeley economist Gabriel Zucman, and the findings are quite stunning. The numbers show an explosion in annual earnings coupled with regressive tax policies have caused the income of the top 1% of Americans to triple over the past 50 years with working class people taking home just $8,000 more per yer than they did in 1970.

Essentially, the richer a household is, the more its wealth has grown since 1970.

Washington Post columnist Greg Sargent covered the study:

New data:

For top 1%, average income has risen by $800,000 since 1970.

For top 0.1%, it has risen by $4 million.

For top .01%, it has risen $20 million.

Bottom 50%? $8,000.

All this is *after taxes and transfers.*

Great work from @gabriel_zucman:https://t.co/iaxntlHdvl

— Greg Sargent (@ThePlumLineGS) December 9, 2019

The top-line finding: Among the bottom 50 percent of earners, average real annual income even after taxes and transfers has edged up a meager $8,000 since 1970, rising from just over $19,000 to just over $27,000 in 2018.

By contrast, among the top 1 percent of earners, average income even after taxes and transfers has tripled since 1970, rising by more than $800,000, from just over $300,000 to over $1 million in 2018.

Among the top 0.1 percent, average after-tax-and-transfer income has increased fivefold, from just over $1 million in 1970 to over $5 million in 2018. And among the top .01 percent, it has increased nearly sevenfold, from just over $3.5 million to over $24 million.

Zucman and fellow Berkeley economist Emmanuel Saez recently released a book called “The Triumph of Injustice” highlighting how regressive the tax code has been for top earners. The effective tax rate (federal, state, local and other taxes), according to the economists, paid by the wealthiest Americans has steadily declined since the 1950s and ’60s to the point where the highest income groups barely pay more than the bottom as a percentage.

Indeed, in 2018, the top 400 earners for the first time paid a lower effective overall tax rate than working-class Americans. There are many reasons for this radical decline in progressivity, including domestic and international tax avoidance, the whittling away of the estate and corporate taxes, and the repeated downsizing of top marginal rates.

The duo also provided a chart to show how each group’s take-home pay has changed since 1970. The richest Americans’ wealth has skyrocketed while the bottom 50 percent’s take-home income actually decreased.

For the middle class, income-plus-effective tax rates have risen from $44,000 to $75,000, which is better than the bottom 50% “but their income growth rate has been very low,” Zucman told The Washington Post.

“You have two trends reinforcing each other,” Zucman said. “There has been the rise in market income inequality — the rise in pretax income inequality. At the same time, the tax system has become much less progressive at the top of the income distribution.

“People have this idea that government redistribution has upset some of the rise in inequality, but essentially that’s not the case.”