Politics is a big part of my life. I covered local and state politics during my journalism days, I studied it as part of my graduate program, and I try to keep up with the flurry of headlines today…

But I rarely, if ever, get into a discussion about politics … simply because no good comes from it.

I keep my cards close to my chest…

However, politics are at the core of this Chart of the Week.

Let me explain…

Last week, Vice President JD Vance gave a speech at the Munich security conference in which he suggested that the biggest threat to Europe was … Europe itself.

Agree or not, it isn’t the kind of speech you would have heard 20 years ago … or even 10 years ago.

Say what you will about Europe; there is one thing that has performed better in Europe than in the United States…

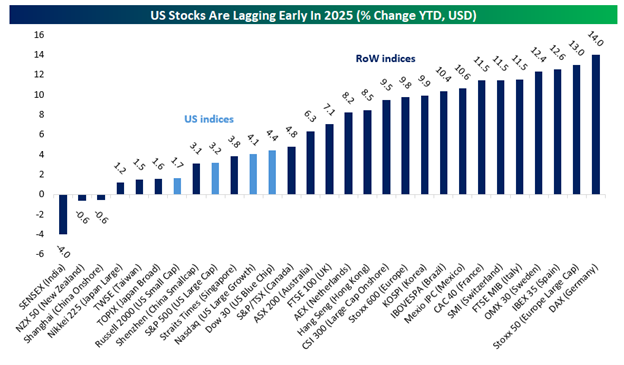

American Markets Lagging International Cohorts

After Donald Trump was elected president, European markets sank across the board.

Uncertainty isn’t exclusive to the U.S., and without knowing Trump’s endgame, European markets slumped following his win.

That all changed in December when European markets reversed course, and stocks have been rallying since.

Since Christmas 2024, European stocks have broadly outperformed the S&P 500 by 9%.

This is despite political issues in France and an ongoing war in Ukraine.

One factor that helped European markets was the relative cheapness of their stocks compared to their U.S. counterparts.

Another factor is the European defense sector, which has received a massive boost as countries help Ukraine and bolster their own defenses simultaneously.

According to Bloomberg, the STOXX 600 Aerospace and Defense Index has outperformed the Bloomberg Magnificent 7 since Trump was elected in November 2024.

It’s not just European markets that are outperforming the U.S.:

The S&P 500, Dow 30, Nasdaq and Russell 2000 are being beaten, not just by the FTSE Eurofirst 300 but by individual indexes in Canada, Australia, the UK, South Korea, Brazil, Switzerland, Italy, Spain and Sweden … to name a few.

The Russell 2000 (+1.7%), S&P 500 (+3.2%), and Nasdaq (+4.1%) gains are lagging some of these foreign markets significantly.

Here are some “fun” facts from the chart above:

- Of the 29 indexes above, the best-performing U.S. index ranks No. 18.

- The DAX Index in Germany has gained 14% since the start of 2025, more than 4X the S&P 500.

- If you combine the percent gains of the four U.S. indexes above, they still would not beat the outperformance of the DAX. (13.5% vs. 14.4%).

None of this suggests that Europe is doing better than the U.S. or that you should rush out and pack your portfolio with European stocks.

Europe still has a bevy of issues. You have continued political unrest in the continent’s largest economy, Germany, and a seasonally adjusted unemployment rate of more than 6%.

That means you have a shortfall in workers in an economy that has to adjust for increased defense spending.

It’s not the best equation for a robust economic rebound.

This is why I don’t think these gains seen in European markets will last, nor do I believe that, by the end of the year, a majority of European markets will outpace the U.S.

At the end of the day, it is not the time to buy into European stock hype.

That’s all from me today.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets