Earlier this morning, Nvidia (NVDA) made a critical breakthrough that might surprise you…

Because for the first time in 2025, NVDA turned positive.

That’s right. After more than two years of scorching performance — with shares piling on an unprecedented 740% gain — NVDA has barely gone anywhere for the last month and a half.

And it’s not alone, either.

NVDA’s fellow “Magnificent Seven” counterpart, Tesla (TSLA), has actually lost 6.4% so far this year. Microsoft (MSFT) is also down more than 2% for the year so far.

While these mega-cap stocks were soaring over the past few years, the market was practically on “easy mode.” All you had to do was invest in index funds, and you could ride the wave.

But now, it’s clear that we’re headed into a different kind of market … one where the ability to find the right stocks (at the right time) will make all the difference.

And that’s precisely when having a robust investing system like Green Zone Power Ratings can make all the difference…

Your Source for Instant Stock Ratings

I designed Green Zone Power Ratings with only one goal in mind:

Provide Main Street investors with a powerful trading system they’d actually want to use.

Let’s face it: There are thousands — if not millions — of analytical investing tools out there for you to choose from. But if you’re like most investors, you’re probably not using any of them.

And it’s easy to see why…

Many are way too complicated, with millions of options and a manual that reads like something out of an electrician’s school.

Most of these systems were designed “by experts, for experts.” So they don’t really give a second thought to making their insights more accessible.

So you could spend hours upon hours learning how to read stock charts and “Ichimoku Clouds” (yes, that’s a real strategy)…

Or you could spend about 30 seconds learning everything you need to know about a stock with Green Zone Power Ratings.

My system is a unique hybrid that combines fundamental and technical analysis. Fundamental and technical factors drive returns, and they always have.

The six factors I included in my Green Zone Power Ratings system are…

- Momentum: Stocks trending higher, faster than their peers, tend to outperform stocks that are moving higher at a slower rate (or trending down).

- Size: Smaller stocks tend to outperform larger stocks.

- Volatility: Low-volatility stocks tend to outperform high-volatility stocks.

- Value: Stocks that trade at low valuations tend to outperform stocks that trade for high valuations.

- Quality: Companies that exhibit certain “quality” characteristics — such as healthy balance sheets and persistently strong profit margins — tend to outperform the stocks of lesser-quality companies.

- Growth: Companies that are growing revenues, earnings and cash flow at higher rates tend to outperform the stocks of slower-growing companies.

All told, my Green Zone Power Ratings system considers 75 individual metrics, each of which falls into one of these six “factors.”

Each of the six factors is tallied to give us the stock’s overall Green Zone Power Rating on a scale of 0 to 100:

- Strong Bullish (81 to 100): Expected to outperform the market by 3X.

- Bullish (61 to 80): Expected to outperform the market by 2X.

- Neutral (41 to 60): Expected to perform in line with the market.

- Bearish (21 to 40): Expected to underperform the market.

- High-Risk (0 to 20): Expected to significantly underperform the market.

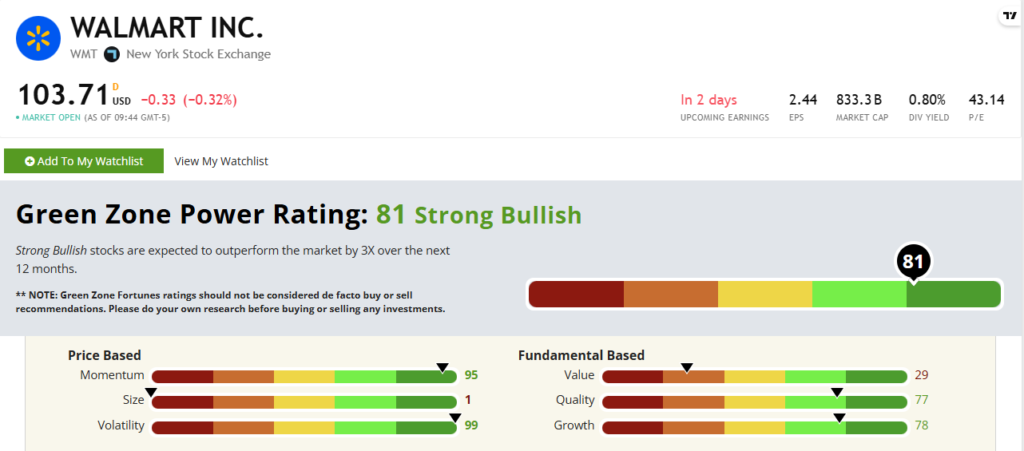

For example, here’s the Green Zone Power Ratings for Walmart Inc. (WMT):

WMT’s Green Zone Power Ratings in February 2025.

As you can see, WMT’s score is now a “Strong Bullish” 81 out of 100. It should outperform the market over the next 12 months.

Why?

As you can see, it’s got strong Momentum, with Volatility working in its favor. Year to date, WMT stock is up more than 14% compared to NVDA’s 2% gain.

It also has high marks on both Quality and Growth.

But it’s weighed down by its massive size (limiting growth potential) and a weaker score for Value.

This is the kind of information that could’ve otherwise taken hours to parse out from press releases, financial documents and analyst writeups.

Direct access is currently only available to Green Zone Fortunes subscribers (details on how to join HERE).

Once you’re a member, all you have to do is type in a stock’s ticker in the search bar HERE, and you get it all in seconds.

Will Green Zone Power Ratings instantly make you an expert on WMT stock? Of course not.

But it will guide you to the key issues that might be holding a stock back or give you the green light on a stock that’s ready to take off.

Things get especially exciting when you find the rare stock with a perfect 100 out of 100 on Green Zone Power Ratings…

I’ll share a little more on that next week…

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets