The economy continues to struggle. Stores are not as crowded as they once were, and small businesses are closing at a faster-than-usual pace.

Economists can point to data that shows the economy is far from recovery. In January, more than 10 million Americans were unemployed.

Policymakers have a plan to address this problem — another $1.9 trillion in government spending funneled through a program called “stimulus.”

Treasury Secretary Janet Yellen threw her weight behind stimulus, stating in an interview that, “There’s absolutely no reason why we should suffer through a long, slow recovery. I would expect that if this package is passed that we would get back to full employment next year.”

Full employment is associated with the natural rate of unemployment or the non-accelerating inflation rate of unemployment (NAIRU). As its formal name implies, this is the best level of unemployment from an economist’s perspective.

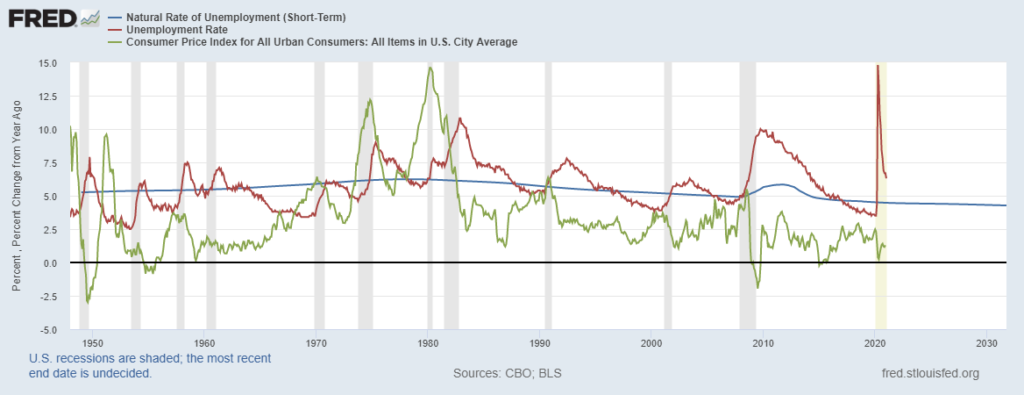

It’s the level where inflation and unemployment are both low. If unemployment falls below NAIRU, inflation is expected to rise. If unemployment is above NAIRU, the economy is not growing as fast as it should.

There is a problem with NAIRU. As shown below, inflation and unemployment don’t behave as expected. In the chart, NAIRU is the blue line, unemployment is the red line and inflation is the green line.

NAIRU Since 1950

Stimulus Does Not Cure Unemployment

The relationship between unemployment and inflation is almost random. That randomness exists whether unemployment is above or below NAIRU.

It’s interesting to note that the large stimulus spending after the 2008 recession did not have a noticeable impact on unemployment. In fact, after every recession since 1950, if unemployment was above NAIRU, it took years for unemployment to fall.

There are many reasons to desire low unemployment, but there is no reason to believe that the proposed stimulus is a magic bullet that will decrease unemployment.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.