We all read Yelp reviews. They help us find restaurants and highlight places to avoid.

Yelp also offers a wealth of business closure data.

Businesses know customers turn to Yelp for information. Many businesses update their operating hours on the site to help consumers. Those updates provide insight into the number of closures in recent months.

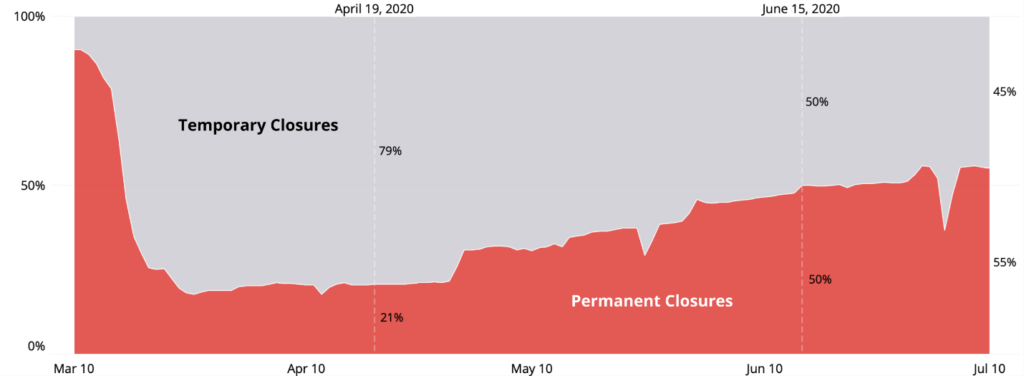

Yelp’s real-time economic data paints a discouraging picture.

At the peak of the shutdown in April, Yelp reported that more than 175,000 businesses had closed.

The most recent data shows that only 24% of businesses closed in April have reopened.

Just 45% of the 132,580 businesses that are shuttered now will reopen.

Over 75,800 businesses updated their information to show they are permanently closed.

Permanent Closures on the Rise

Source: Yelp

The recent lockdown hit some sectors especially hard. Almost 60% of restaurants announced permanent closures. That’s 15,700 restaurants.

Over 12,500 retailers are permanently closed, along with 4,900 hair salons.

Each closed business puts people out of work. And these job losses will have a significant impact on the economic recovery.

Small business accounted for 955,000 new jobs in 2019 and more than 1 million in 2018. In the first six months of 2020, the Bureau of Labor Statistics estimates small business created 111,000 jobs. And that number will likely be revised lower.

In an uncertain environment, one trend is certain to continue. The number of permanent closures will rise. This is especially true in states that are restricting businesses again after attempting to reopen. The cost of a second shutdown will be too much for some businesses.

Permanent closures adversely affect local communities and make recovery more difficult. Data shows that many communities will not enjoy a V-shaped recovery even if national data shows a quick recovery.

Yelp is warning us that local data is bad and getting worse. And national data is a collection of all the local data.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.