Since the beginning of the COVID-19 lockdowns, Zoom Video Communications Inc. (Nasdaq: ZM) has been among the biggest winners … until Zoom stock’s recent decline.

Zoom online meetings replaced face-to-face conferences and classrooms all around the world.

The stock soared as much as 800% since the beginning of the year. In the recent broad stock market pullback, Zoom shares fell more than 17%.

This rapid decline prompted concerns that it signaled an end of the work-from-home (WFH) trend.

At Nasdaq.com, an analyst noted:

At this point, it’s too early to say whether the bull market in COVID-19 stay-at-home plays is over. But [recent] moves lower in Zoom and Peloton should prompt shareholders to make sure they know exactly why they’ve chosen to invest in these stocks — and whether they plan to stay the course even if declines in the share price continue.

Zoom Stock Decline: WFH Trend Still Intact

Despite Zoom’s stock decline, the WFH trend is still intact.

Every month, I’ve updated you on a unique tool for measuring this trend. You can read my September update here.

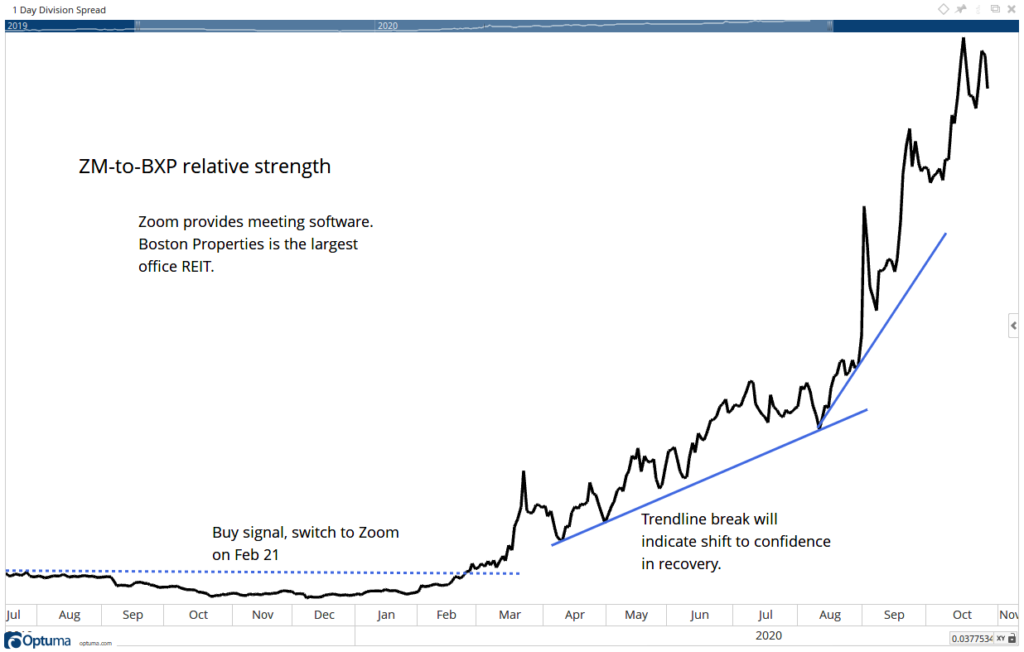

As Zoom became popular, offices became less popular.

Stocks of companies associated with leasing office space declined. Boston Properties Inc. (NYSE: BXP) is the largest publicly traded developer and owner of Class A office properties in the United States.

Shares of BXP dropped more than 50% from their February high and are now testing the lows reached in May.

Comparing the performance of ZM and BXP provides insight into the economy. The chart below shows the ratio.

ZM-to-BXP Relative Strength Index

When the relative strength line in the chart above is rising, Zoom conferences are more popular than office spaces. A reversal in this ratio will signal a return to normalcy.

The current trend is higher in the reaction. That means, for now, there is no sign that the economy is on track to recovery.

When life finally does start to return to normal, Zoom-watchers will be the first to know.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.