Analysts have developed thousands of tools to explain the markets.

Many of the tools involve ratios. For example, the price-to-earnings (P/E) ratio is used to compare the value of one stock to another. For value investors, low P/E ratios are more attractive than higher ratios.

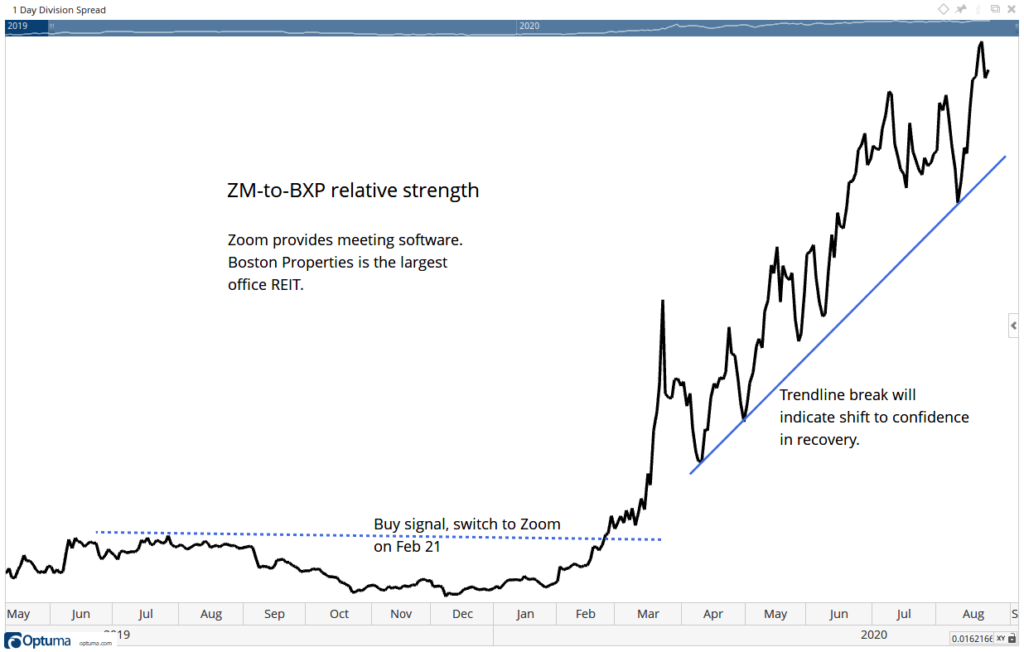

Investors also use ratios to compare the performance of two stocks. This is called relative strength analysis, and it’s easy to apply to current market conditions.

Working from home is one of the most important market trends right now. Zoom meetings have replaced conference rooms.

We can quantify this relationship with a simple ratio.

The chart below compares the performance of Zoom Video Communications, Inc. (Nasdaq: ZM) to Boston Properties, Inc. (NYSE: BXP).

ZM provides the popular online meeting software. BXP is the largest publicly traded owner of office buildings.

Zoom Stock Took Off as COVID-19 Hit

Source: Optuma

What Zoom Stock’s Outperformance Means

When the line is rising, Zoom stock is outperforming BXP. The chart shows that the two stocks performed about the same in the year leading up to the crisis.

ZM began to outperform at the end of February, before most people realized how significant the crisis was. The U.S. reported its 100th case of the coronavirus on March 2, two weeks after Zoom began its rise.

The trend accelerated after March 11, when the NBA suspended its season. The severity of the problem came into focus for policymakers.

What to Look for Next

From this chart, we see that the market was ahead of the news.

The market may signal a return to normalcy before many of us realize the crisis has passed.

It’s impossible to forecast when everyday life will be normal again. But the price of Boston Properties will outperform Zoom when there is a degree of confidence in the economic recovery.

That makes the ZM-to-BXP ratio among the most important indicators to watch right now.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.