2020 brought in a bunch of new trends:

- We were all trying viral dances we saw on TikTok or daily talk shows.

- A tiger-themed reality show on Netflix was on everyone’s minds.

- And let’s not forget the whipped coffee that took over social media.

Because we were all pretty much stuck inside, everything went online — even work and school.

Virtual meetings were the new norm, and Zoom became the software of choice for many companies.

But now that the pandemic is winding down, demand for Zoom’s service is tanking.

This isn’t good news for the company or its stock.

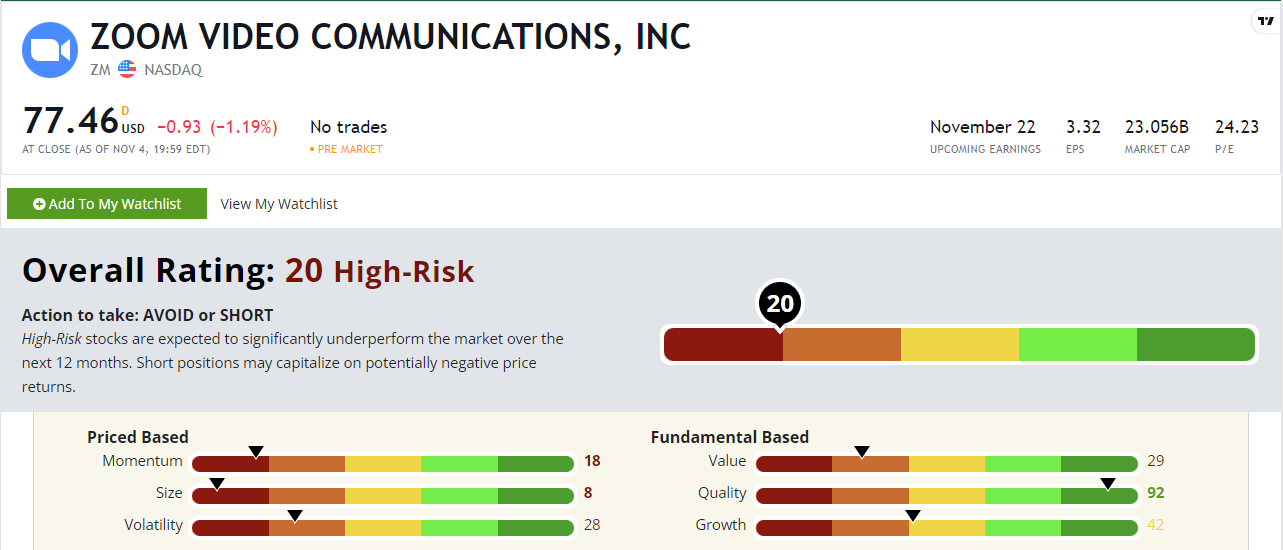

Zoom Video Communications Inc. (Nasdaq: ZM) rates a “High-Risk” 20 out of 100 on our proprietary Stock Power Ratings system.

Pandemic Powers Zoom’s Profits

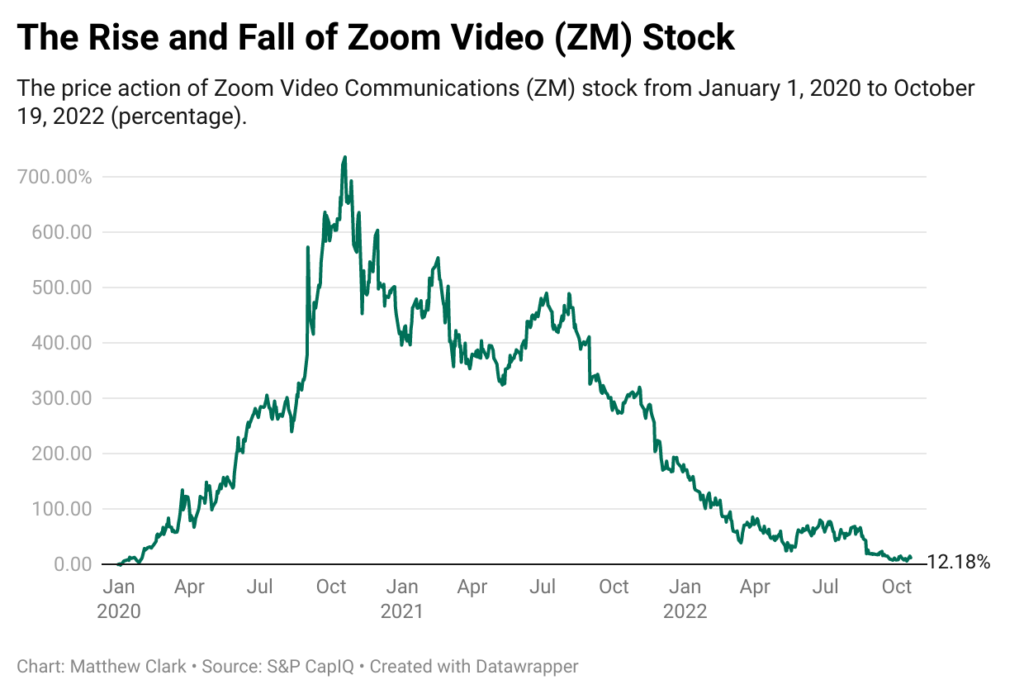

The COVID-19 pandemic was a massive tailwind for Zoom stock.

Because everyone was working from home, companies needed its services — quick.

Lucky for Zoom, the company founded in 2011 was prepared for this very moment.

School, work and many other social gatherings moved to video meetings. And ZM stock skyrocketed.

From the beginning of 2020 to its $568 peak on October 19 just 10 months later, Zoom stock soared 744%!

It appeared to be smooth sailing for the company.

But with the pandemic winding down and workers heading back to the office, ZM learned the hard way that trends don’t last forever.

Created November 2022.

Let’s see how that has affected its Stock Power Ratings.

ZM’s Stock Power Ratings & Mediocre Momentum

ZM’s stock has been in steady decline since its October 2020 peak, but I’ll get into that in a second with its momentum factor rating.

First, let’s take a look at ZM’s overall stock rating.

Zoom stock rates a “High-Risk” 20 out of 100.

Let’s see why.

ZM’s Stock Power Ratings in November 2022.

ZM rates in the red for 4 out of our 6 factors. Its low size (8) and value (29) scores tell us the stock is too large — with a $23 billion market cap — to experience outsized gains now after investors bid its price up during the pandemic tech bubble.

Now let’s get back to ZM’s momentum…

Created November 2022.

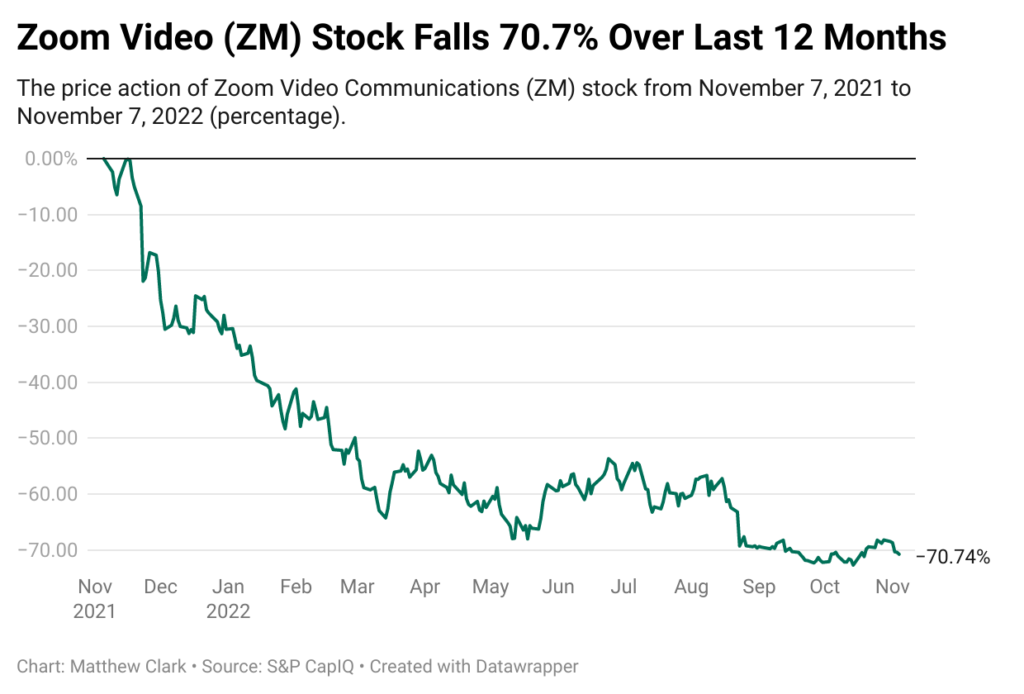

ZM’s stock price has had a downward trajectory for all of 2022.

After hitting its 52-week high of $268.88 on November 16 last year, ZM’s stock price dropped more than 70% to its 52-week low in October of this year.

Once it hit its low of $70.44, ZM has climbed about 9% higher.

All of this earns ZM an 18 on our momentum factor.

The Bottom Line

Zoom scores a “High-Risk” 20 out of 100 on our Stock Power Ratings system.

Our system has much more in store for you!

To get one highly rated stock you should consider investing in or some more to avoid — check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid on our system and tells you why.

All for free!