When the bear savages the stock market, as it has many times since 1900, you have to be prepared as an investor to find companies that still provide gains when things are as awful as they are in the present, so here are our three stocks to buy in a bear market.

In a bear market, the most common reaction by investors is to sell.

After all, it’s a sell-off that put markets into bear territory — a 20% dip from a recent record high — to begin with.

But there are some companies that can actually provide gains for investors when the overall markets are down. Of course, trading options is the best way for experts to battle the bear, but if you don’t have time or the investing chops for that, there are other options.

The best way to buy companies in a bear market is to examine what stocks performed well during the market drop-off. But remember, like life, there are no guarantees.

So be smart with your investments and don’t invest any more than you are willing to lose because the bear is volatile.

Three Stocks to Buy in a Bear Market

1. Autozone Inc.

Market Capitalization: $27 billion

Annual Dividend Yield: 0.0%

The bull market we’ve been in for more than 11 years has caused AutoZone Inc. (NYSE: AZO) to trade pretty flat, but there’s a good reason for such machinations.

When markets are good, new car sales tend to be strong. That means people have little use for auto parts because their cars are either still under warranty or have no need for repair.

But the opposite is the case when markets are in bear territory.

As vehicles get older, they require more maintenance — and parts. As people turn to do-it-yourself auto repairs, Autozone is where they go.

Also, consider that vehicles purchased five years ago or later will start needing that routine maintenance older cars require.

That’s what makes Autozone one of our three stocks to buy in a bear market.

2. AT&T Inc.

Market Capitalization: $257 billion

Annual Dividend Yield: 5.8%

We’ve talked about AT&T Inc. (NYSE: T) before. It was one of our seven 5G stocks to buy now.

It’s on this list for another reason: reliability.

AT&T shares jumped 53% in 2019, but it has experienced the same drop like every other stock during the March 2020 sell-off.

But AT&T’s drop hasn’t been hit nearly as big as a lot of others. It’s still trading well above its 52-week low — with growth potential.

Even in a bear market, telecommunications companies typically still do well.

Another big benefit of AT&T is the dividend yield. Its annual dividend yield is currently 5.8%. In 2019, the company paid out $0.51 per share in dividends.

That dividend is a big reason why AT&T is one of our three stocks to buy in a bear market.

3. Duke Energy Corp.

Market Capitalization: $69 billion

Annual Dividend Yield: 3.98%

The energy sector is one of the most volatile on Wall Street. However, there’s one company that’s consistently grown.

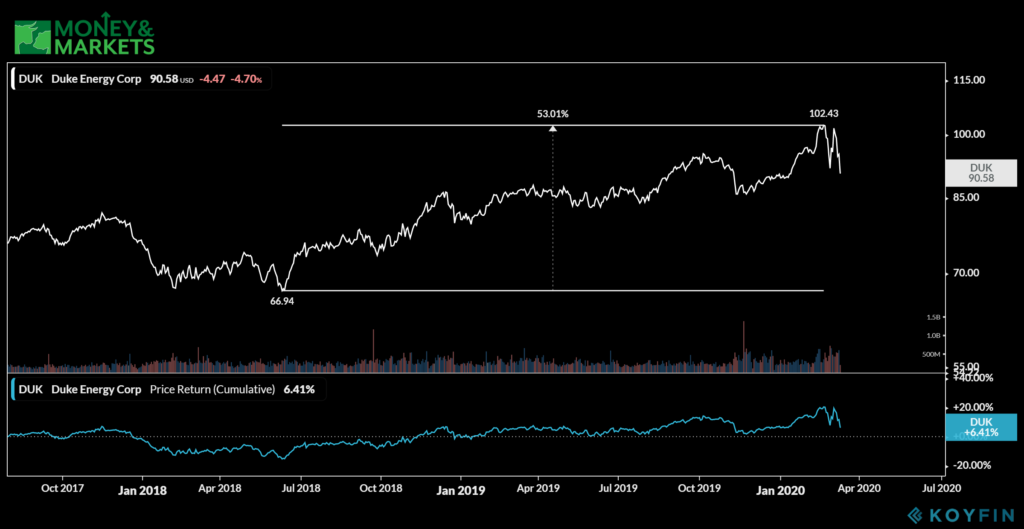

Charlotte-based Duke Energy Corp. (NYSE: DUK) saw its share price jump 53% from June 2018 to the end of February 2020.

It did so with a solid customer base — nearly 8 million customers across six states in the South and Midwest.

Even with a bear market potentially on the horizon, Duke still plans to invest $37 million to expand its natural gas and electric base. That could translate to a 4% to 6% annual earnings-per-share growth into 2022.

On top of that, the company kicks out a solid dividend. Its annual dividend is 3.98%, and the last dividend payment to shareholders was $0.94 per share.

Consistent growth, despite market conditions, is one of the main reasons why Duke Energy Corp. is one of our three stocks to buy in a bear market.

Now, it’s easy to get discouraged about investing during a bear market. But if you do your homework and take a little time to study historical trends, you can find those diamonds in the rough.

For now, you can check out these three stocks to buy in a bear market.

Editor’s note: Looking for stocks to buy not on our list or have some good suggestions? Let us know in the comments section below.

Related:

- 6 Stocks to Buy and Hold for the Next Decade

- 3 Gold Stocks to Buy Now — Investing in the Precious Metal

- What Is the Best S&P 500 ETF to Buy?

- 3 Cheap 5G Stocks to Buy Right Now

- 6 5G Dividend Stocks to Buy Now

- 4 Tech Dividend Stocks to Buy Now

- 4 Cloud Software Stocks to Buy Now

- 4 Semiconductor Stocks to Buy Now

- 7 5G Stocks to Buy Right Now

- Top 5 ETFs to Buy in 2020

- 4 Stocks to Buy and Hold for 2020

- 5 Tech Stocks to Buy in 2020