We have conducted hours of research and scoured growth charts, technical data and … well just about anything we could get our hands on to bring you the Top 5 ETFs to buy in 2020.

Sometimes we just want investing to be easy, right?

Well, one way to keep things simple is to look at exchange-traded funds, or ETFs.

These are investment funds traded on stock exchanges, but they typically work within the framework of trading close to its net asset value — thus, limiting the risk to you, the investor.

Investing in ETFs is also a good way to dip your toe in the investment waters as you can pick a sector and have your investment scattered across several companies, rather than trying to zero in on just one company.

Lower volatility, lower risk, tax efficiency and higher liquidity make ETFs a popular form of investing.

With that, here are our Top 5 ETFs to buy in 2020:

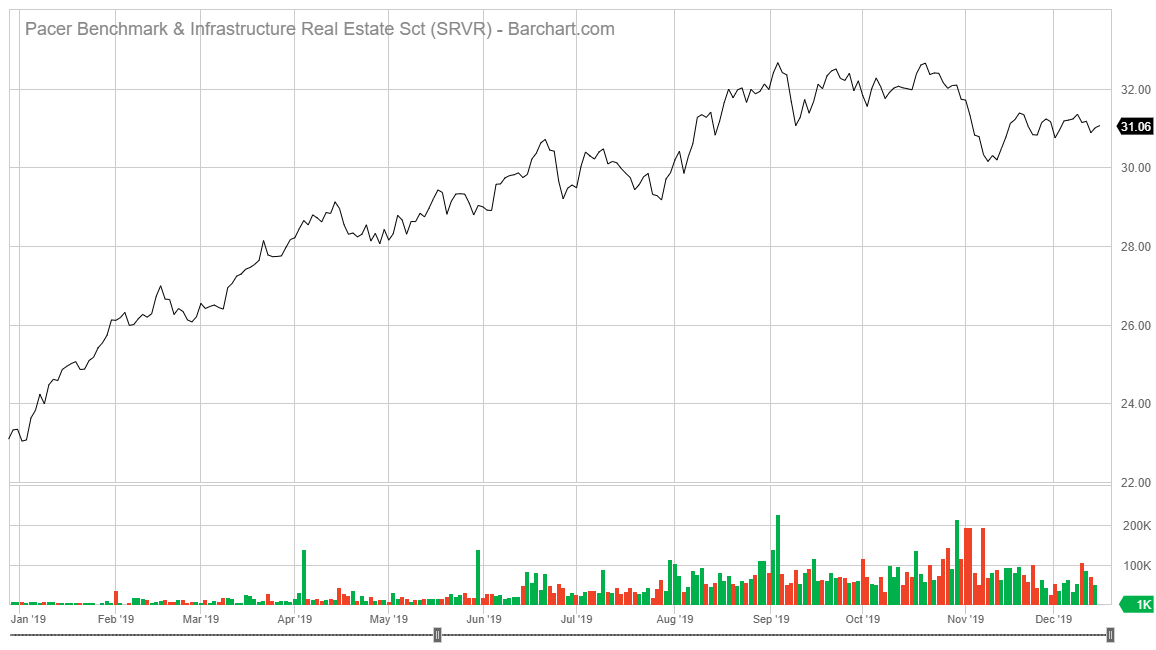

1. Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF

Let’s face it, the 5G revolution is like a freight train and there is nothing on the tracks that’s going to stop it.

So it would make sense, as an investor, to find a way to profit from it, right?

One of the best ways to do it is to find the sector that stands to benefit the most from that revolution.

That leads us to the Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (NYSE: SRVR). It’s a fund that carries companies like Equinix Inc. (Nasdaq: EQIX), Crown Castle International Corp. (NYSE: CCI) and American Tower REIT (NYSE: AMT).

These are all companies that lease cell phone tower space to larger companies that provide signals you pick up on your cellphone. So as the rollout of 5G gets closer, cell tower companies will get more in rent from telecom companies who are installing 5G equipment — thus increasing profits and share price.

The Pacer has been a strong ETF in 2019, jumping from a close of $23.04 on Jan. 2 to trading at more than $31 in December.

This ETF also pays a dividend to shareholders. In 2019, that dividend ranged from $0.09 to $0.18 per share.

Where this ETF will shine is with the rollout of 5G technology across the U.S. in 2020. Its companies will see huge gains as will those who own shares in the ETF.

That is the reason why it is one of the Top 5 ETFs to buy in 2020.

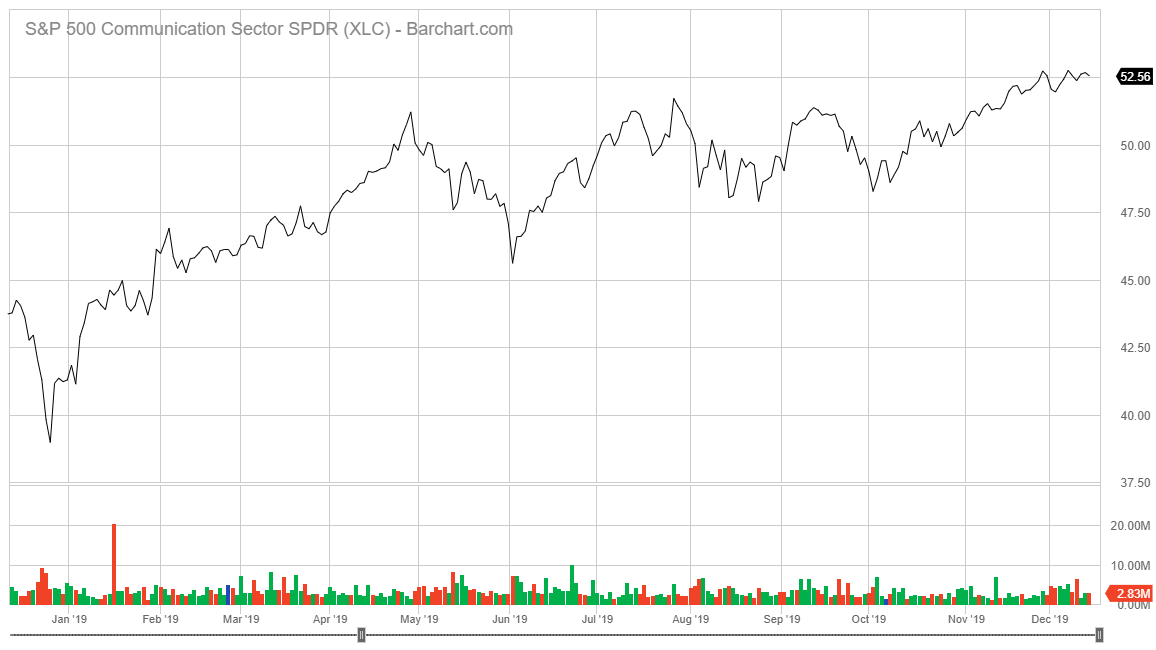

2. Communication Services Select Sector SPDR

If it’s well-known communications companies you are looking to invest in, then the Communications Services Select Sector SPDR (NYSE: XLC) is where you want to look.

The ETF has been up 28% in 2019, outperforming the S&P 500 by nearly 100 basis points.

It is a cap-weighted fund — the largest market capitalization companies have the most weight in the ETF — that includes Facebook Inc. (Nasdaq: FB), Alphabet (Nasdaq: GOOGL), Netflix Inc. (Nasdaq: NFLX) and Walt Disney Co. (NYSE: DIS).

In fact, Facebook and Alphabet comprise of around 43% of the ETF.

The Communications Services Select Sector SPDR started 2019 with a close price of $41.83. But it has jumped to more than $52 and still continues to jump in stock price.

Oh, this ETF also pays a dividend to shareholders. In 2019, it paid dividends between $0.08 and $0.11 per share.

The fact that companies like Facebook and Comcast Corp. (Nasdaq: CMCSA) should see huge growth in a presidential election year and Disney continues its dominance in both streaming and the box office, the Communication Services Select Sector SPDR ETF stands to make even more gains in 2020.

That is the reason it is one of our Top 5 ETFs to buy in 2020.

3. Vanguard Small Cap Growth ETF

If you’re looking for growth in an ETF, then the Vanguard Small Cap Growth ETF (NYSE: VBK) could be right up your alley.

This ETF holds growth stocks of small U.S. companies with a market capitalization of between $300 million to $2 billion. It is weighted heavily in technology and health care stocks — which combine for more than 47% of the fund.

Companies like Docusign Inc. (Nasdaq: DOCU) — one of our Top 5 tech stocks to buy in 2020 — RingCentral Inc. (NYSE: RNG) and Zebra Technologies Corp. (Nasdaq: ZBRA) are in this ETF.

In 2019, the Vanguard Small Cap Growth ETF has been a strong performer. Its year-to-date returns are up 30% and its price is still below its 52-week high, meaning it has not quite broken out and still has room to grow.

Another big benefit of the Vanguard Small Cap Growth ETF is its dividend payout. In 2019, the ETF paid out between $0.23 and $0.55 per share — which is pretty remarkable.

Couple that with the growth potential of the companies inside the ETF and that’s why this is one of our Top 5 ETFs to buy in 2020.

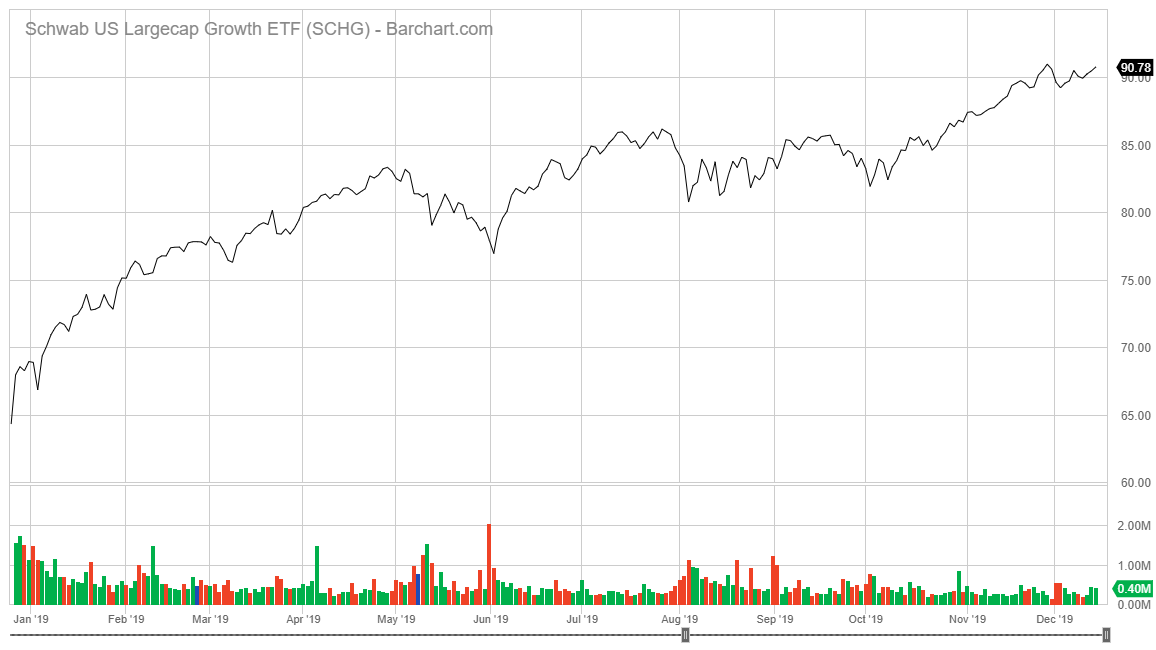

4. Schwab U.S. Large-Cap Growth ETF

Sometimes you just want to invest in something you know is stable.

The Schwab U.S. Large-Cap Growth ETF (NYSE: SCHG) strictly carries companies with a market capitalization of more than $10 billion.

That means it has companies like Apple Inc. (Nasdaq: APPL), Microsoft Corp. (Nasdaq: MSFT), Amazon.com Inc. (Nasdaq: AMZN) and other large companies that you have likely heard of.

This ETF performed remarkably well in 2019. Its share price jumped from $68.87 on Jan. 3 to a close of $90.78 on Dec. 13.

The Schwab U.S. Large-Cap Growth ETF is weighted heavily in information technology companies (33.25%0 and communication services (13.83%). It does carry some financials (7%) and real estate (3.6%).

Because of the large- to mega-cap focus, the risk is relatively low and the gains are steady.

That is the reason the Schwab U.S. Large-Cap Growth ETF is one of our Top 5 ETFs to buy in 2020.

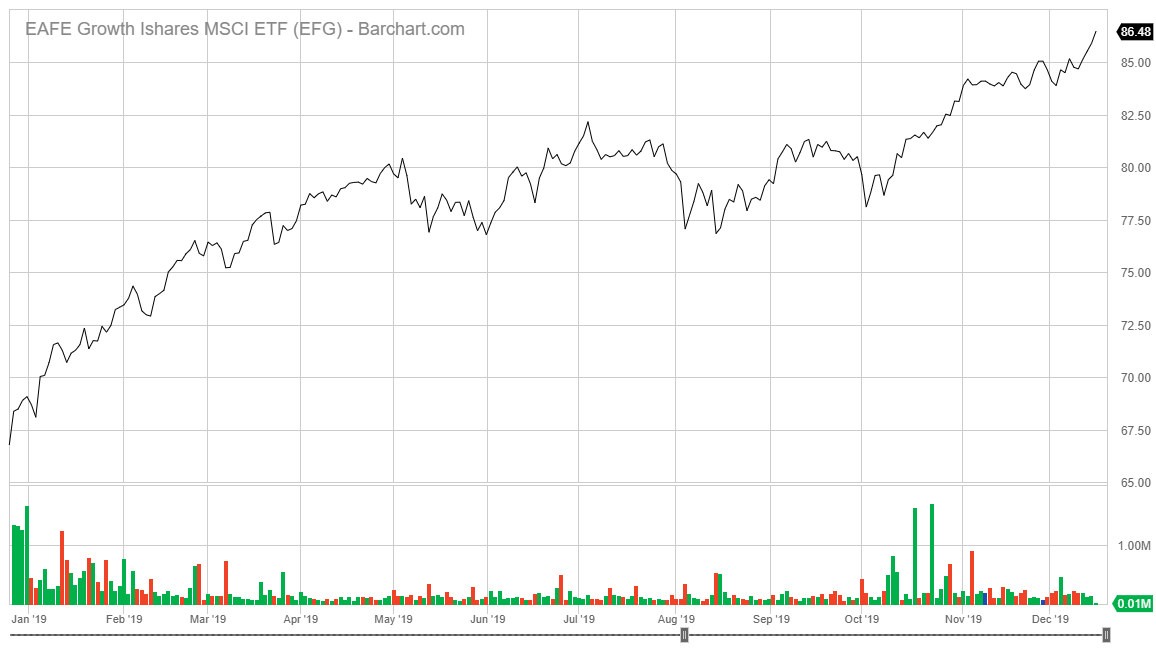

5. EAFE Growth iShares MSCI ETF

Sometimes you want to broaden your horizons and look for strong companies outside the U.S.

That’s where the iShares MSCI EAFE Growth ETF (NYSE: EFG) comes in to play. It only holds growth companies that aren’t in the United States or Canada.

It has a strong base of companies, such as Astrazeneca PLC (NYSE: AZN) — based in the United Kingdom — and other companies not on the NYSE or Nasdaq — like Switzerland’s Nestle SA and Roche Holdings, Germany’s SAP and Denmark’s Novo Nordisk Class B.

As of mid-December 2019, this ETF was trading 13% higher than its 200-day moving average. It also broke out of its 52-week high and continues to grow.

This ETF has also paid a dividend to shareholders. It doesn’t pay every quarter, but the one dividend payment in 2019 was $0.96 per share, which is huge.

The EAFE Growth iShares MSCI ETF has consistently grown and been a stable investment for those maybe wanting to look outside the United States for growth.

That is why it is one of our Top 5 ETFs to buy in 2020.

So there you have it, Money and Markets’ recommendations for the Top 5 ETFs to buy in 2020. They are a mix of ETFs from different sectors and have different degrees of volatility.

But they all have strong benefits and enticing indicators for a strong 2020.

If you have questions about how to invest in an ETF, make sure you check out our Wall Street 101 on how to invest in an ETF.

And if you missed it, make sure to check out our Top 5 AI stocks and Top 5 tech stocks you should know about for 2020.