Don’t get bogged down in searching for individual stocks to capitalize on and focus instead on these four artificial intelligence ETFs to buy now.

As an investor, you try to find the best bang for your buck. But you don’t have hours every day to do specific sector research and locate companies that check off all the important markers for being a good “buy.”

A way you can capitalize on an entire sector without the pain of pouring over tons of research and charts is investing in exchange-traded funds. ETFs are automatically diversified by holding numerous companies in specific sectors.

One hot sector in the market, in addition to 5G, is artificial intelligence. It is one of the most important trends to watch for in the tech space.

You may have already seen our top five artificial intelligence stocks to watch in 2020 but to make things even simpler, check out our AI ETFs.

4 AI ETFs to Buy Now

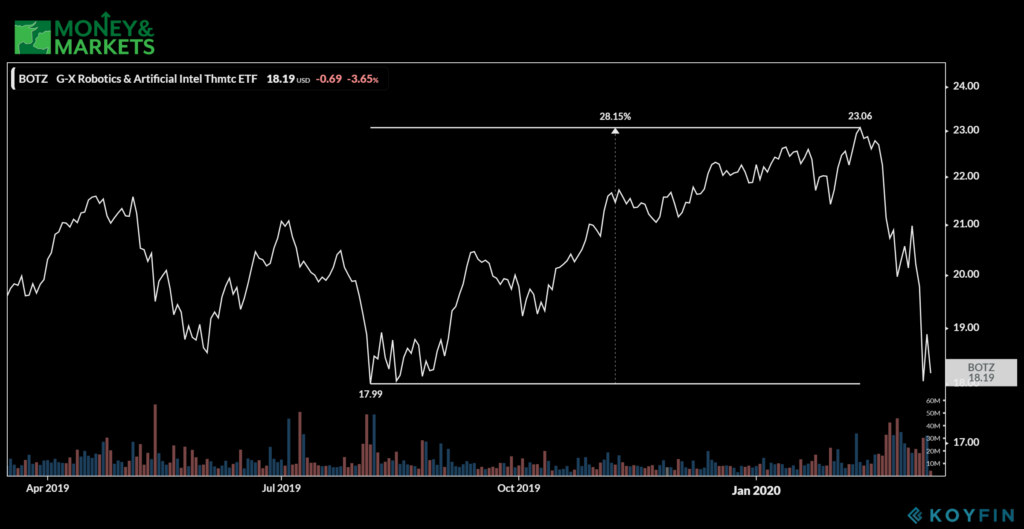

1. Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ)

Assets Under Management: $1.2 billion

Annual Dividend Yield: 1.01%

Management Fee: 0.68%

Fund Family: Global X Management

The Global X Robotics & Artificial Intelligence Thematic (Nasdaq: BOTZ) ETF is the largest artificial intelligence ETF on the market. It has more than $1.2 billion in assets under management.

The largest holding for this ETF is Nvidia Corp. (Nasdaq: NVDA), which is a powerhouse in both 5G and artificial intelligence.

Before the market drop-off in mid-February, BOTZ was a strong performer in the market. Since August 2019, the ETF grew more than 28% to reach a high of $23 per share.

That drop in February could mean good things for investors as it is trading well below its 52-week high, giving it more room to grow when the market rebounds. It also means BOTZ is an extremely cheap ETF to get into.

Another bright spot for BOTZ is its dividend yield. Its annual dividend yield is 1.01% and the most recent dividend was $0.03 per share. It’s not high, but it’s certainly not bad either.

Its potential for further growth and its strong asset management makes the Global X Robotics & Artificial Intelligence Thematic ETF one of our four artificial intelligence ETFs to buy now.

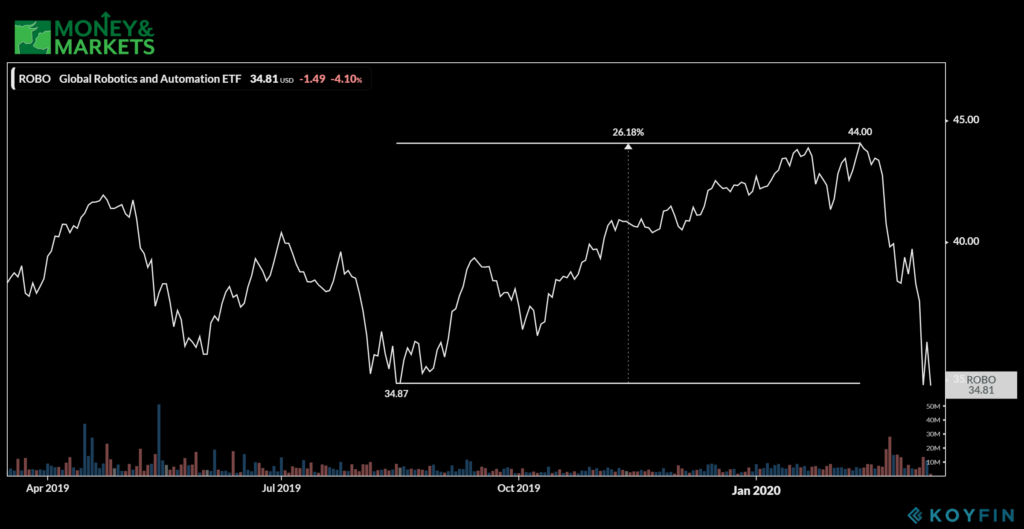

2. Global Robotics and Automation Index ETF (ROBO)

Assets Under Management: $1 billion

Annual Dividend Yield: 0.45%

Management Fee: 0.95%

Fund Family: Exchange Traded Concepts

Just behind the Global X ETF in terms of assets under management is the Global Robotics and Automation Index ETF (NYSEARCA: ROBO). It has around $1 billion in assets under management.

While the fund also holds Nvidia, it also has Qualcomm Inc. (Nasdaq: QCOM) and automation giant Rockwell Automation Inc. (NYSE: ROK) in its portfolio.

Just like with BOTZ, ROBO had a strong end of 2019 that carried over into the start of 2020. From August 2019, the share price of ROBO jumped more than 26% before the market dip in February 2020.

Again, that means there is a lot of growth potential for this ETF when the market rebounds.

One advantage it has over BOTZ is its dividend payment to shareholders. With a 0.45% annual yield, the last payment was around $0.16 per share.

That dividend along with the potential for share price growth makes the Global Robotics and Automation Index ETF one of our four artificial intelligence ETFs to buy now.

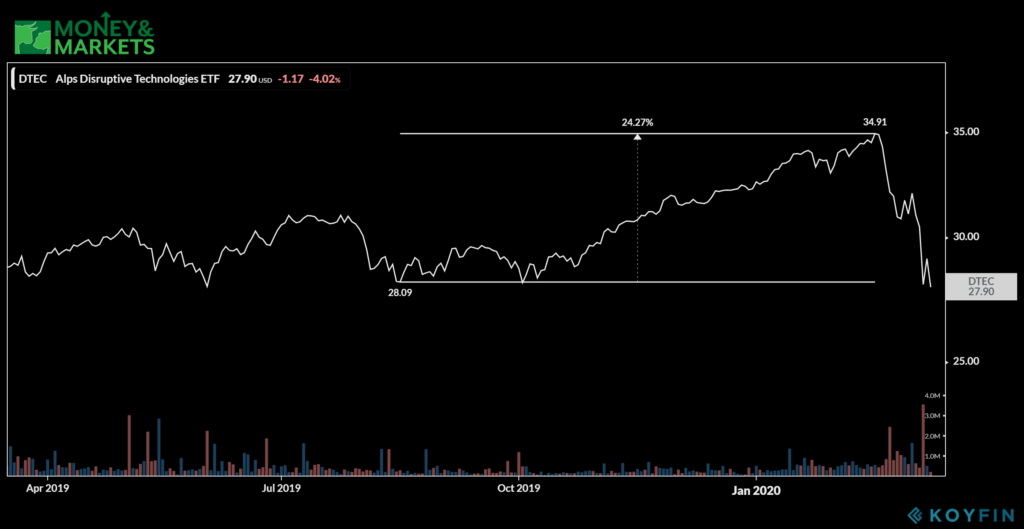

3. ALPS Disruptive Technologies ETF

Assets Under Management: $53 million

Annual Dividend Yield: 0.49%

Management Fee: 0.5%

Fund Family: ALPS Holdings

If you are looking for an ETF that focuses on disruptive technology companies as a whole, the ALPS Disruptive Technologies ETF (NYSEARCA: DTEC) is the way to go.

It carries companies like Square Inc. (NYSE: SQ), Equinix Inc. (Nasdaq: EQIX) and even Adobe Inc. (Nasdaq: ADBE) in its portfolio.

Since August 2019, DTEC jumped around 24% in share price as the entire tech sector enjoyed a strong second half in 2019 and the start of 2020.

February’s drop pushed DTEC down to near that August 2019 levels, meaning it’s a relatively cheap ETF to buy into. It also means the ETF can experience 25% growth before reaching its previous high.

In terms of dividend payment, DTEC has an annual dividend yield of 0.49%, and its last payout was $0.13 per share — putting it in line with other similar ETFs.

The potential for a 25% gain in share price makes the ALPS Disruptive Technologies ETF one of our four artificial intelligence ETFs to buy now.

4. First Trust Nasdaq Artificial Intelligence and Robotics ETF

Assets Under Management: $71 million

Annual Dividend Yield: 0.52%

Management Fee: 0.65%

Fund Family: First Trust Portfolios

An ETF with slightly higher assets under management is the First Trust Nasdaq Artificial Intelligence and Robotics ETF (Nasdaq: ROBT).

It has a wide array of companies in its portfolio including Xilinx Inc. (Nasdaq: XLNX), which is one of our 5G dividend stocks to buy now. It also has Nvidia and Tesla Inc. (Nasdaq: TSLA).

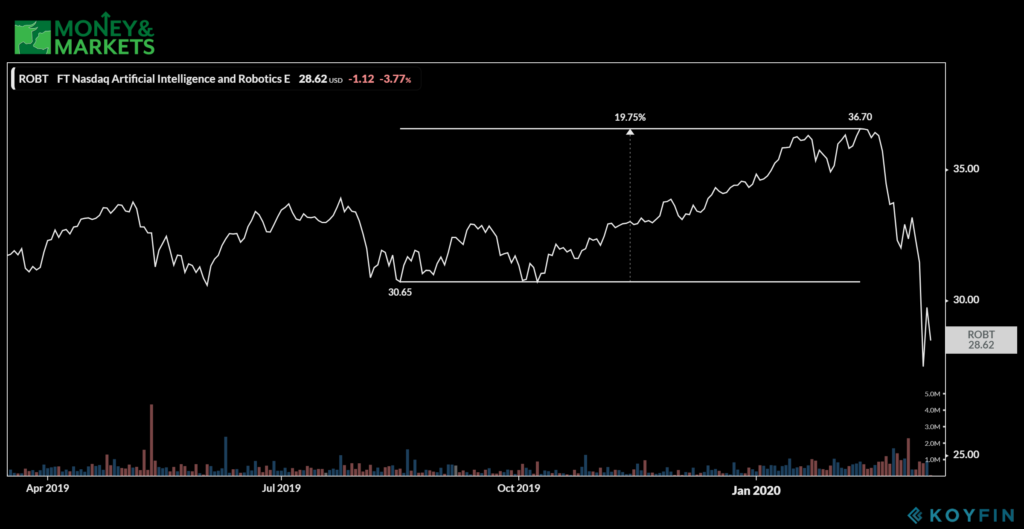

Just like our other three ETFs on the list, ROBT had a strong close to 2019 into the new year. Its share price jumped nearly 20% in almost six months.

It has since dropped to a new 52-week low in early March, but managed to bounce back almost by $2 per share.

This ETF remains a cheap option to get into, and it has a lot more room to grow compared to the others on our list.

It pays a small dividend — its latest was just $0.01 per share — but it’s the growth potential that has the First Trust Nasdaq Artificial Intelligence and Robotics ETF on our list of the four artificial intelligence ETFs to buy now.

All of these ETFs suffered the market downturn, but that can turn into a great potential buying opportunity for you as their prices are considerably lower than their high points.

Considering they track artificial intelligence — a field that is only going to grow — these all have the ability to rocket to huge gains.

That’s why they are on our list of the four artificial intelligence ETFs to buy now.

Editor’s Note: Looking for stocks to buy not on our list? Let us know in the comments below.

Related

- 6 Stocks to Buy and Hold for the Next Decade

- 3 Gold Stocks to Buy Now — Investing in the Precious Metal

- What Is the Best S&P 500 ETF to Buy?

- 3 Cheap 5G Stocks to Buy Right Now

- 6 5G Dividend Stocks to Buy Now

- 4 Tech Dividend Stocks to Buy Now

- 4 Cloud Software Stocks to Buy Now

- 4 Semiconductor Stocks to Buy Now

- 7 5G Stocks to Buy Right Now

- Top 5 ETFs to Buy in 2020

- 4 Stocks to Buy and Hold for 2020

- 5 Tech Stocks to Buy in 2020