Editor’s Note: Earlier this week, Super Micro Computer (Nasdaq: SMCI) was delisted from the Nasdaq 100 after only five months of trading on the index. It was a brief and brutal stint, with the stock losing 71% of its value since peaking in March.

Chief Research Analyst Matt Clark has been tracking SMCI since October 2022, when our Green Zone Power Ratings system flagged it as a “Strong Bullish” buy. But back in July … right before SMCI was slated to join the Nasdaq 100 … he noted a worrying trend in the underlying numbers. And we wanted to highlight that piece in our “Best of 2024” series because it really shows the power of our systems.

Since publishing the story on July 17, SMCI stock has crashed 60%!

Read on to see why Matt and Green Zone Power Ratings were cooling on one of the hottest AI stocks around way before the worst of the stock’s 2024 crash…

I spend a lot of time looking at data, charts and graphs.

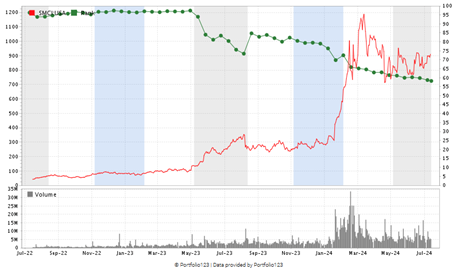

The chart below is one of the most impressive ones I’ve seen in a long time:

That’s a 1,383% gain for a single stock from October 20, 2022, to now!

I bring this up now because that’s when I found this stock using Adam O’Dell’s proprietary Green Zone Power Ratings system and wrote about it here.

The stock is Super Micro Computers Inc. (Nasdaq: SMCI), and it has had one of the most impressive runs of any stock in the market.

My point isn’t to show how great a job I did in finding the stock but rather to illustrate the power of Adam’s system as an investment tool.

At the time, I looked for a company at the forefront of “edge computing” — a technology that allows companies to process data faster than typical processes that require remote locations, like data centers.

SMCI is not only a leader in edge computing … but it was the strongest stock at the time, according to Adam’s system.

At the time, it rated 100 on both Momentum and Growth. It also earned “Bullish” ratings on Quality and Value.

Since October 2022, SMCI has been on a tear… and things may be getting even better.

SMCI Achieves New Heights

The Nasdaq 100 Index is comprised of 100 of the largest nonfinancial companies in the Nasdaq Composite Index.

To be listed on the Nasdaq 100 Index, a company needs to maintain a weighting of at least 0.1% of the index’s market value.

With a value of more than $20 trillion, a company needs a market cap of at least $20 billion to be listed on the 100.

Starting July 22, SMCI will join the Nasdaq 100 Index as its market cap has reached more than $53 billion. It is replacing Walgreens Boots Alliance Inc. (Nasdaq: WBA).

This addition could mean good things for SMCI in the near term.

The stock has flattened out a bit since hitting a peak in March 2024, but the “membership effect” of being added to the Nasdaq 100 could mean a few things:

- Increased demand: Not only is SMCI joining the index, but it will also be added to the popular tracking exchange-traded fund, the Invesco QQQ Trust Series 1 ETF (Nasdaq: QQQ) — which follows the performance of the Nasdaq 100.

- Increased valuations: Studies show that stocks gain an average of 1% immediately after being added to the index.

- Decreased cost of capital: Trading volumes increase along with stock liquidity after being added to the index.

The powerful message here is that Adam’s Green Zone Power Ratings system found SMCI’s trend … before it happened!

Green Zone Power Ratings Journey: Super Micro Computers Inc.

While 2023 was a fantastic year for Super Micro Computers, this year has been just as strong.

Despite flattening out after reaching a 52-week high in March, the stock is still outperforming the Nasdaq Composite Index in 2024 by almost 10X:

Since the start of the year, SMCI has gained 218% compared to the Nasdaq’s 25% gain.

But the big takeaway here is that Adam’s Green Zone Power Ratings system identified SMCI as a “Strong Bullish” stock well before its incredible rally:

SMCI Was “Strong Bullish” Before Big Run

In 2022, SMCI was rated “Strong Bullish.” This indicates that we expect the stock to outperform the broader market by 3X over the next 12 months.

As the two charts above show, SMCI did that … and more.

Since October 2022, SMCI has gained 1,384%, while the Nasdaq Composite Index is up just 73%. The S&P 500 has gained 54% over that same time.

Adam’s system told us it was a buy, but its current data also gives us a signal.

The stock’s run-up has pushed its valuation ratios above industry averages, and its flat performance since March indicates an increase in volatility.

SMCI currently rates 59 out of 100, moving it into “Neutral” territory.

These points suggest that now is not the time to buy into SMCI. However, the stock’s inclusion in the Nasdaq 100 Index could change that.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets