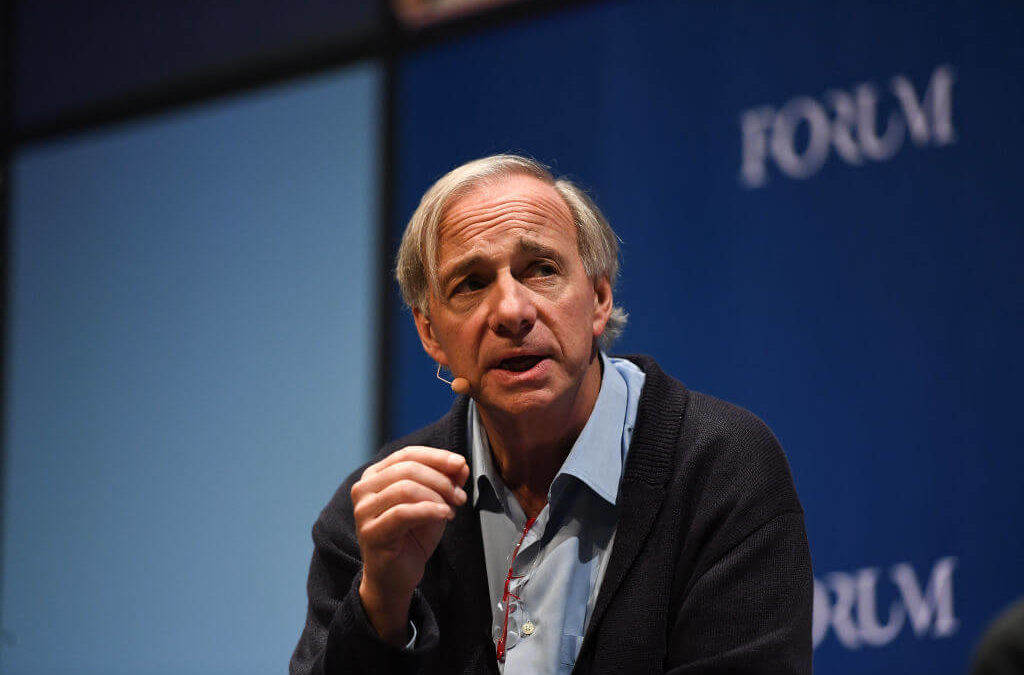

Billionaire investor Ray Dalio doubled down on his claim that “cash is trash,” especially while the U.S. Federal Reserve continues to run the money press and promises to keep interest rates low while the economy weathers the novel coronavirus.

CARR: “Cash carries a high risk of loss with no opportunity for rewards. Cash is trash in this environment.”

Earlier this week Dalio, who founded Bridgewater Associates, appeared on the social media forum Reddit in an “Ask Me Anything” event where he answered many questions about the current state of the economy and markets amid the COVID-19 pandemic.

Dalio had claimed “cash was trash” back in January when he called for investors to dive into markets, which in hindsight wasn’t the best call considering the recent market crash that saw Bridgewater’s Pure Alpha Fund II lose around 20% of its value by March 14.

But Dalio is sticking to his guns.

“Please remember that while it doesn’t move around in value as much as other assets, there is a costly negative return to it,” Dalio wrote on Reddit when asked about cash as an investment.

“So I still think that cash is trash relative to other alternatives, particularly those that will retain their value or increase their value during reflationary periods (e.g., some gold and some stocks).”

Banyan Hill Publishing’s Michael Carr thinks that while investors understand basic concepts like inflation, there’s more to it.

“A dollar in a checking account today will be be worth a dollar in the future, but it will buy less in the future. This is the risk of loss many investors understand,” said Carr, editor of

“But there’s a hidden cost of cash that Dalio seems to be highlighting. That’s the opportunity cost of cash. If you have cash in a checking account delivering a 0% return and Treasury bonds deliver a total return of 10% as interest rates drop, the opportunity cost of cash is 10% compared to bonds.”

And Carr agrees that in this environment cash is not a good investment vehicle.

“After all markets crashed in the past couple of months, returns are promising in many assets,” Carr said. “Holding cash guarantees missing those returns and on a risk-reward basis, cash carries a high risk of loss with no opportunity for rewards. Cash is trash in this environment.”

While Dalio thinks cash is trash as an investment, he recognized how important the U.S. dollar is right now as demand for cash is creating a “short squeeze” on the currency.

“I believe that because the dollar is now the world’s currency and most people borrow, save, and transact in it, that the world desperately needs dollars and, as a result, there is a global shortage of them, which supports the dollar,” Dalio wrote. “Having the world’s printing press to produce the world’s currency is the equivalent of having the world’s most important asset, especially in times when so many people need the world’s money.”

Editor’s note: Do you think “cash is trash” as an investment vehicle in this environment?