Next year will be one of rebuilding.

Many Americans will rebuild their financial lives by looking for a new job, starting a new business — or restarting one that had to temporarily close.

But millions of us will also look to rebuild our bodies after a year of socially-distanced neglect. As I joked last week, like the “freshman 15” college kids gain in their first year away from home, many of us are looking down at our guts and seeing the “COVID 19.”

The new year will inspire many of us to get active and back in shape.

Companies that focus on fitness and wellness should be the major beneficiaries of that trend.

Back in July, we added Celsius Holdings stock (Nasdaq: CELH), which makes health and energy drinks, to our Money & Markets weekly watchlist.

And in the five months since, the stock has gained an impressive 170%.

Now, after a move like that, you might think the run is over. But by our models, Celsius’ move could just be getting started.

Our strategy at Money & Markets is to buy high and sell higher. All else equal, we’re happy to buy at a cheap valuation, and Value is one of the six factors we consider. But we’re not looking to call bottoms or buy dips. We like stocks that are already trending higher.

And this brings us back to Celsius.

About Celsius Drinks

Celsius Holdings makes healthy energy drinks that promise to boost your metabolism and help you burn body fat.

Its products are sugar-free, gluten-free and soy-free. They’re low in sodium.

And they’re even certified kosher and vegan.

They’re a little high in caffeine, so if you have heart issues or caffeine sensitivity, you might want to tread carefully. But if you’re looking for a healthy energy boost to help you hit it a little harder at the gym, Celsius has you covered.

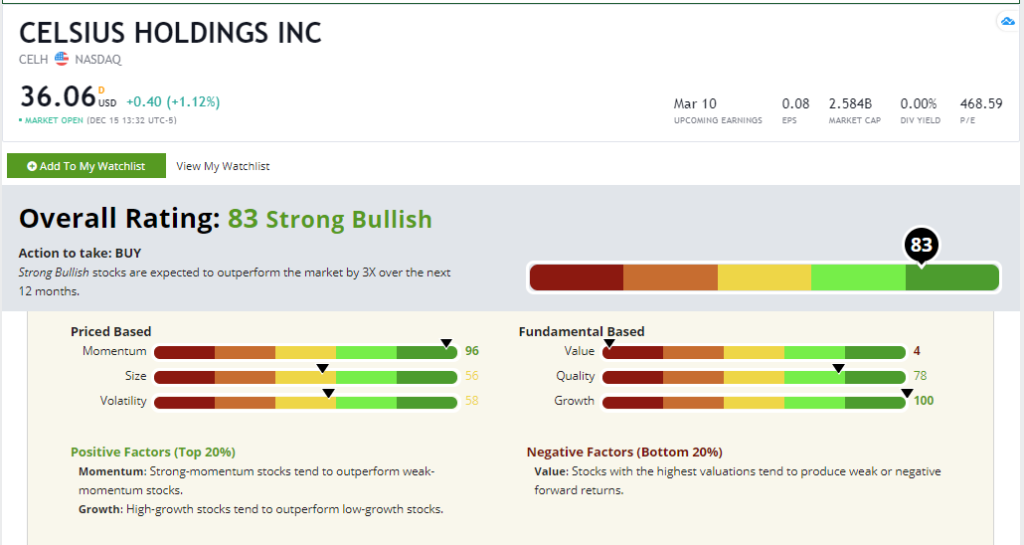

When Celsius first cracked our watchlist, it sported a Green Zone Ratings score of 90, making it a Strong Bullish stock by our model.

Today, it rates a little lower at 83, though it’s still in Strong Bullish territory.

Our historical backtesting suggests that Strong Bullish stocks should outperform the market by three times over the following 12 months.

Celsius Holdings Stock Rating

Let’s dig a little deeper to see what’s driving this Strong Bullish rating.

Growth: Celsius is a growth stock extraordinaire. It rates a 100 out of 100 in our model, meaning that it is in the top fraction of a percent in terms of Growth. It’s not hard to see why. Over the past 12 months, its revenues have jumped 47%, and there’s no sign they’re slowing down any time soon.

Celsius Holdings’ Green Zone Rating on December 15, 2020.

Momentum: As you might have guessed, based on its 170% return over the past five months, Celsius is a high-momentum stock. It scores a 96 in our model, meaning that only 4% of the stocks in our universe rate higher. Remember, we like to buy high and sell higher. We call it the “Momentum Principle.”

Quality: Oftentimes, high-growth and high-momentum stocks tend to rate somewhat low on our Quality score because their profitability and balance sheet strengths are underwhelming at that stage of their development. That’s not the case with Celsius, which rates a respectable 78. Celsius’ balance sheet strength primarily drives this score. The company has essentially no debt to speak of. Profitability has been more of a challenge, though Celsius turned a profit last year for the first time in its history. It’s continued that success in 2020.

Volatility: Celsius is in the middle of the pack in terms of Volatility, scoring a 58. That’s not bad. It’s still less volatile than the average stock (which would rate a 50), which is impressive given its Growth and Momentum. High-momentum stocks rate low in terms of volatility.

Size: Celsius is average in terms of Size, rating 56. Again, that’s not bad. Smaller companies tend to grow faster than larger ones, and a rating of 56 still puts Celsius in the top half based on size. (A higher score implies a smaller company here.)

Value: Now, Celsius bombs out on Value, scoring just a 4. That’s not unusual. High-growth and high-momentum stocks often trade at a premium price, and Celsius is no exception here. That said, improving profitability will help raise this score over time, as the price-to-earnings ratio is a significant contributor to the Value score.

We expected a Strong Bullish Stock like Celsius to outperform back in July, and it most certainly did. But based on its score today, we think it’s just getting started.

Celsius is on fire, with its promising momentum and growth.

But Chief Investment Strategist Adam O’Dell and I just zeroed in on an even more profitable company that’s set to soar in the New Year!

Its Momentum score is 97. It scores an 88 on Growth. And its Quality score is 99!

Go here now to see how to get all the details on this stock, plus receive exclusive access to Adam’s Millionaire Master Class report filled with all his trading secrets for just $1!

To join this elite investing community right now, click here.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business. Follow Charles on Twitter @CharlesSizemore.