There are many reasons to be bullish on gold.

Yesterday, I highlighted the fact the smart money in gold is betting on gains. Recently, Chad Stone also gave a bullish argument.

Money & Markets Chief Investment Strategist Adam O’Dell argues gold will soar from its current price around $1,800 to $10,000 an ounce, and he has developed a strategy to capitalize on its rise.

So we all agree gold is a good investment. But is there a best way to own gold?

Investors have options for owning gold. They can buy bars or coins. Exchange-traded funds offer indirect ownership of bars. Mining companies also offer a leveraged investment in the metal.

As an example, consider a mining company that spends $1,000 an ounce to produce gold. It produces 1 million ounces a year. If gold trades at $1,800 an ounce, the company earns $800 an ounce in profit, or $800 million.

If gold increases to $2,000 an ounce, and costs remain the same, the miner earns $1,000 an ounce, or $1 billion. Earnings increase 25% as the price of gold increased about 11%.

In this example, the miner offers more than 2-to-1 leverage. A 1% increase in gold prices results in a 2.3% increase in the earnings of the mining company.

Using Leverage in Gold Mining Stocks

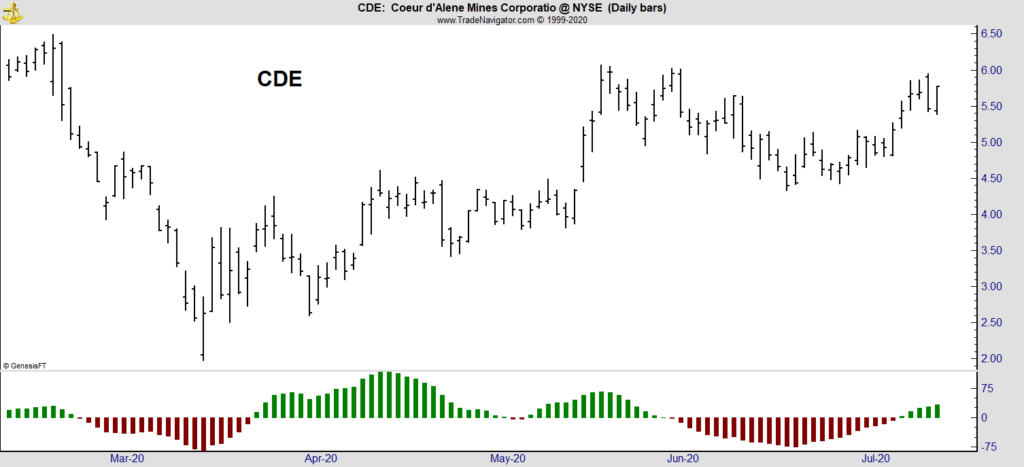

This leverage makes gold miners a way to squeeze extra gains out of gold. And Coeur Mining Inc.’s (NYSE: CDE) chart is especially bullish.

CDE produces gold, silver, zinc and lead, so it’s not a pure gold trade. You can see the stock with a momentum indicator at the bottom of the chart below. The indicator changes direction at the beginning of new trends. In the past few days, it gave a buy signal on CDE.

Coeur Mining Inc.’s Bullish Momentum Shift

Seasonals are also bullish. A simple seasonal investing strategy tests the results of buying on a particular day and selling one month later. Buying CDE now and selling one month from now has been profitable 70% of the time since the stock began trading in 1983.

Gold itself is a strong buy. And bullish momentum, along with strong seasonals, indicate CDE is among the best buys in the precious metals market today.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.