The gold rally is on — and it’s only getting started.

Spot gold prices soared to an 8-year high of $1,788.96 per ounce overnight Tuesday. And that was after closing at its highest level since September 2012.

All the positivity has gold bulls coming out of the woodwork.

Earlier this week, Citibank upped its three-month price target to $1,825 per ounce. It sees the gold rally hitting $2,000 early next year.

Goldman Sachs has also forecast gold to beat its September 2011 record high of $1,921.41 in the next 12 months. And Bank of America thinks the yellow metal can shatter records in the third quarter this year.

Money & Markets Chief Investment Strategist Adam O’Dell thinks gold is ready to soar to $10,000 per ounce in the not-too-distant future.

“These patterns say gold can make a new all-time high in (the second half of 2020) with Q3 on our mind,” wrote Paul Ciana, technical strategist at Bank of America.

And Banyan Hill Publishing’s metals and commodities expert Matt Badiali is right there with them.

“I have no doubt we will set a new record gold price in 2020,” Badiali said. “No doubt at all. We will see gold break $2,000 per ounce this year.”

Where Will the Gold Rally Go Next?

To see where the gold rally will go, it helps to look at the past.

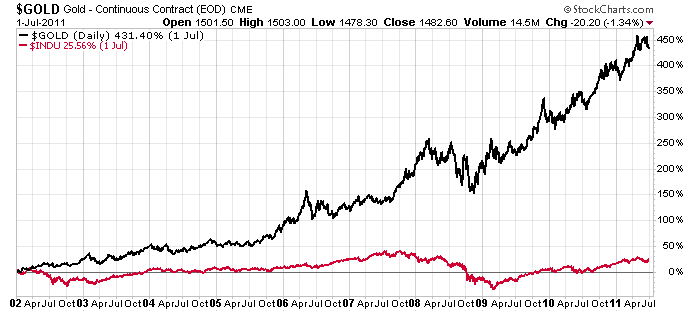

Badiali notes that the last gold bull market went from 2002 to 2011, when gold gained over 450% in just nine years.

If history repeats itself, gold will soar.

“The current bull market started in 2015 at around $1,050 per ounce,” Badiali said. “If this bull market repeated, it would put the gold price around $5,775 per ounce at its top. That’s a crazy thought, isn’t it?”

It may be some time before we see gains hit that mark. But the short-term prospects for the gold rally are great — thanks in part to the coronavirus outbreak.

COVID-19 sent an economic shockwave throughout the world. In response, central banks and federal governments have turned on the money-printing presses.

While it isn’t great the U.S. is officially in a recession, it is great for gold.

And Badiali doesn’t see the Federal Reserve putting away the stimulus bazooka any time soon.

“There’s no way we can escape this recession without more stimulus — more money printing,” said Badiali, Editor of Real Wealth Strategist. “It’s inevitable. And we know that the risk of all this liquidity is inflation. That will send gold to the moon.”

On top of that, we are in a zero-bound interest rate environment — which makes gold a go-to for savers looking for gains. And the Federal Reserve is in no rush to raise rates.

Fed Chair Jerome Powell once again signaled its benchmark interest rate will stay within a range of 0% to 0.25% until at least the end of 2022.

“We expect to maintain interest rates at this level until we are confident that the economy has weathered recent events,” Powell said in prepared remarks Tuesday.

The Fed is closely watching for employment to get back to its February levels of around 3.5%. That could take years.

All of this sets up a gold rally for the ages.

Pro tip: If you are looking for a different way to capitalize on the gold rally and make up to nine times greater profits, check out what Money & Markets Chief Investment Strategist Adam O’Dell has to say here.