Last week, I had the opportunity to attend an advanced screening of Marvel’s new movie, Deadpool & Wolverine.

It was so good I went back over the weekend and saw it again.

Apparently, I wasn’t the only one, as the movie brought in more than $200 million in the U.S. and $440 million worldwide in its first weekend.

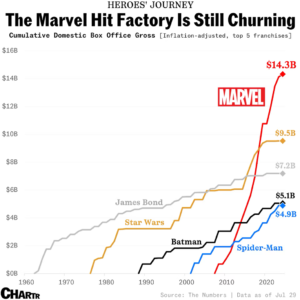

In researching this story, I came across this data nugget:

Since Marvel’s first movie, Iron Man, released in 2008 — the MCU has brought in $14.3 billion in domestic box office sales.

That’s more than Star Wars, James Bond and any other superhero franchise dating back to the 1960s.

Considering that kind of success, it begs the question…

Why would The Walt Disney Co. (NYSE: DIS) pivot to cross-promoting sports and cut back on potential box office blockbusters?

The answer is a bit surprising.

The Cost of Doing Business

Producing full-length feature movies isn’t cheap … and Marvel movies are no exception.

Let’s take last year’s MCU release, The Marvels, as an example.

The film’s initial budget was around $130 million; however, increased special effects and the cost of assembling an ensemble cast more than doubled the production budget to $270 million. According to Screen Rant, it was the fourth most expensive Marvel movie produced.

If you factor in other costs like distribution and marketing, the film would have to make $450 million to be profitable.

The movie went on to gross $199.7 million worldwide … falling well short of that goalpost.

Two things stand out here:

- The Marvels wasn’t that good, especially compared to the wildly popular Captain Marvel and other Avengers movies that preceded it.

- In an effort to generate big revenue, Disney flooded the market with Marvel content — movies in theaters and streaming series on Disney+. By the time The Marvels was released, audiences felt some “Marvel fatigue.”

Disney’s problem is that, while the MCU movies are widely popular, it is hard to achieve a profit for anything other than the Avengers series. With its latest summer blockbuster, the Mouse is proving that it’s willing to let Deadpool and other franchises do what it won’t — but only time will tell if that leads to sustainable profits.

And that’s why Disney is shifting focus by trimming back on cinematic content and expanding into one of the most profitable businesses around…

The Profitability of Sports Rights

With television broadcast rights for sports, everyone makes out like a bandit.

That’s why Disney — which owns ABC and ESPN — recently joined forces with NBCUniversal and Amazon to lock in an 11-year media rights deal worth $77 billion to broadcast NBA games.

The leagues profit from the massive contracts. The teams in those leagues get a windfall as well.

Even individual players can earn revenue from broadcast rights.

Take Inter Miami player Lionel Messi. The world’s most prolific player signed a deal to move from Paris to Miami, but it wasn’t the team paying all of his wages.

Part of the deal structure included Apple paying a percentage of its MLS Season Pass subscription revenue directly to Messi.

And the networks recoup their costs from advertising revenue and licensing fees. Streamers also earn back revenue from new paid subscribers to the service.

While movies can draw in solid crowds, their profitability is more unpredictable than broadcasting popular sports on streaming platforms.

It makes sense that Disney would pivot from sinking hundreds of millions on making movies that may not be profitable to cross-promoting sports programming that will almost guarantee new subscribers and money in the bank.

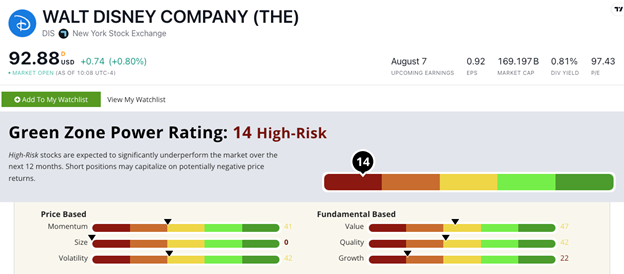

With that as a setup, let’s see how Disney stock’s Green Zone Power Ratings look…

Green Zone Journey: The Walt Disney Co.

The Walt Disney Co. (NYSE: DIS) currently rates a “High-Risk” 14 out of 100 on Adam O’Dell’s system.

That “High-Risk” rating means we expect the stock to greatly underperform the broader market over the next 12 months.

The stock has “Neutral” ratings on Momentum, Volatility, Value and Quality. It’s “Bearish” on Growth and Size.

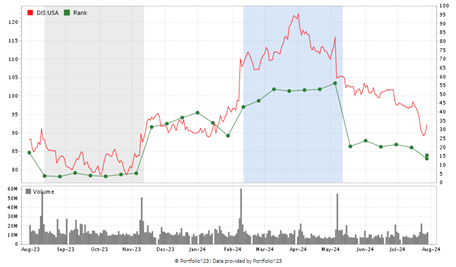

After being in the gutter of Green Zone Power Ratings through the end of 2023, DIS stock’s rating was climbing higher to start this year…But its recent performance — a 24% stock price drop since April coupled with a minuscule increase in year-over-year revenue and a decline in adjusted earnings per share — pushed the stock’s rating from near “Bullish” to where it sits now.

DIS Stock’s Rating Tanked in Spring

DIS trades with a price-to-earnings ratio of 100 compared to the industry average of 26. The company also has a gross margin of 35%, while its industry peers average 50%.

What it all means: The idea for Disney is to increase its profit by focusing more on cross-promoting its sports programming from ESPN instead of relying on its Marvel cash cow.

This pivot may work, but it will take time to see if this is the right decision for the company.

For now, however, Adam’s Green Zone Power Ratings system says DIS is a pass for your portfolio.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets