Old traders like to say: “Don’t fight the Fed.” This could be the most important factor in the stock market right now.

This saying means that the Federal Reserve is strong enough to drive trends in the stock market. When the Fed is following an easy money policy, traders should be bullish. It’s time to turn bearish when the Fed follows tight money policies.

Tight monetary policy is defined as policies designed to slow an overheated economic growth. This includes interest rate hikes and reducing the money supply. Easy money policies like rate cuts and increased money supply fuel economic growth and often drive stock markets higher.

Right now, one reason for gains in stocks is the Fed.

The central bank has been doing all it can to increase the money supply. Much of that money has found its way into the stock market.

One measure of the money supply is M2, which includes all cash, money in checking and savings accounts, money market funds and other instantly accessible sources of cash.

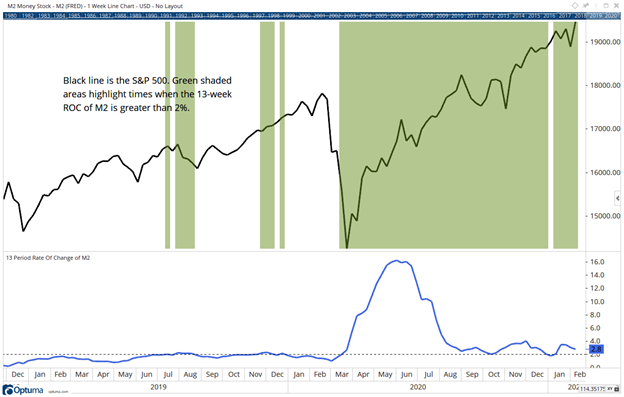

The chart below shows the S&P 500 at the top and the 13-week rate of change in M2 at the bottom. Thirteen weeks is about three months, or one quarter. The dashed line is at 2%. Green boxes highlight times when the rate of change (ROC) of M2 exceeds 2%.

M2 ROC Sends S&P Upwards

Source: Optuma.

Increased Money Supply Drives Stocks

After responding with overwhelming force to the crisis, the Fed slowed the pace of money creation. At 2.8%, the current pace of M2 growth supports higher stock prices.

The stock market’s fate might be in the hands of the Fed. If the Fed continues to rapidly increase the money supply, stocks could continue to reach new highs. In this environment, valuations don’t matter. All that matters is the Fed.

Traders should remember that adage — don’t fight the Fed — and expect gains until the Fed reverses course.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.