Last week I wrote about how smart money is buying gold. This is based on data from the futures market, where large traders are required to report their positions every week. But it’s not just gold. Smart money is buying other commodities.

And, as consumers know, prices are already rising.

Gasoline prices averaged $2.87 a gallon, up 50% in the past year as the economic recovery accelerated, and are expected to top $4.00 a gallon in California soon.

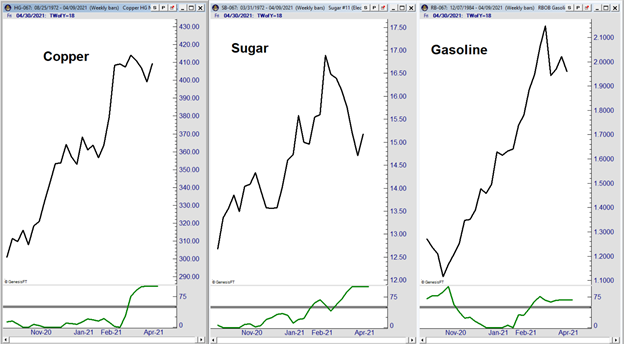

Futures markets indicate gas prices could rise further. Gasoline is on the right side of the chart below. Sugar and copper are also in uptrends.

Commodities in Uptrend as Smart Money Hedges Against Inflation

Source: Trade Navigator.

To Side With Smart Money, Investors Should Buy Commodities

This is a selection of futures markets that affect consumers. Copper is used in many products and is an indicator of future economic activity. Food producers use sugar in many products consumers find in the aisles of grocery stores. And, of course, gasoline is needed to get to that grocery store, work and many other places.

The indicator at the bottom of the chart is based on a report issued by the Commodity Futures Trading Commission. The Commitments of Traders report tells us who is buying these futures contracts and other commodities like gold.

Analysts call one group “smart money.” This group tends to be right about major trends more often than not. In the report, this group was called “commercials.”

Commercials are companies that produce and consume commodities in large quantities. Building supply manufacturers might buy copper in this market from a mining company. Sugar producers could use the market to offset risk with companies like Coca-Cola. Commercials in gasoline include refineries and operators of large fleets.

In the chart, the position of commercials is the green line. To make the data easier to understand, the lines show degrees of bullishness or bearishness over the past six months. The horizontal line shows the 50% level, the line separating bulls and bears. High values are bullish.

Now, commercials, the green line are the most bullish they’ve been in about six months.

This tells us smart money is bullish and concerned about higher prices. In the past, smart money has usually been right when there’s a difference of opinion like this.

To side with smart money, investors should buy commodities. While futures are not the best choice for many investors, an exchange-traded fund like Invesco DB Commodity Index Tracking Fund (NYSE: DBC) could be attractive.

Is this stupid … or brilliant?

I found a way to trade the markets making the same trade every week.

We do this because any given week, this trade can knock it out of the freaking park.

I recommended 59 of these trades last year. We saw five trades go up 100% or more — each in a week or less.

And a total of 18 went up 50% or more — in an average of two days each.

All told, someone could have doubled every dollar they invested last year trading this way.

I want to give you the same chance.

P.S. I’ve been telling my readers that someone could double their money in a year with this. By the end of 2020, I proved that to be true. My “One Trade” strategy has never had a losing year across 12 years of back testing. And last year’s live results were even better. Click here to see how it all works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.