Investors and savers in Europe have suffered even more than their counterparts in the U.S. Interest rates on bonds, pivotal to the European Central Bank’s (ECB) strategy, in many countries have been below zero for years.

In Germany, rates on ten-year government bonds are at -0.33%. Government bonds issued by Austria, Finland, France, Latvia, Luxembourg, the Netherlands and Slovakia also trade with negative yields. Greek government bonds have the highest yield in the eurozone, with a yield of 0.88%.

The ECB has acted aggressively to hold rates down. Low rates make it possible for troubled governments in Greece, Italy and other countries to fund operations at low rates.

But inflation is threatening that arrangement.

The Financial Times reported: “Eurozone inflation rose to 2% in May, the first time the rate has surpassed the European Central Bank’s target in more than two years, complicating [the ECB’s upcoming] decision on whether to maintain ultra-loose monetary policy.

The jump from 1.6% in April followed an even sharper acceleration of consumer price growth in the U.S., which recently hit 4.2%. The eurozone’s increase is likely to fuel investor anxiety that central banks will hasten the winding down of the vast monetary stimulus launched last year in response to the coronavirus pandemic.”

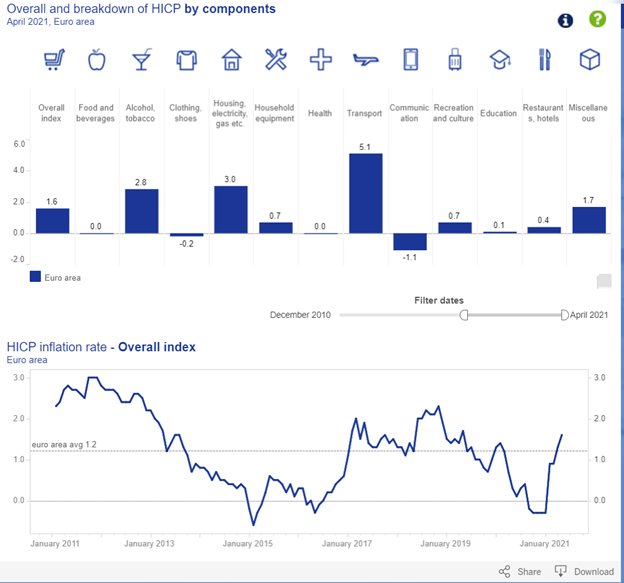

A detailed breakdown of April’s inflation showed that supply chain pressures are pushing prices high in Europe, similar to the problems seen in the U.S.

Rising Inflation May Complicate ECB Policy

Source: European Central Bank.

The ECB Relies on High Unemployment to Curb Inflation

Gains in transportation and utilities, the biggest gainers in the inflation race, are unlikely to be reversed.

Despite the data, the ECB is echoing the Federal Reserve and insisting that inflation is temporary.

Officials in Europe are hoping that high unemployment could hold down inflation. Unemployment in the EU is at 7.3%, but the rate never dropped below 6% in the previous expansion. In the U.S., the rate fell as low as 3.5%, a sign that the U.S. economy is more dynamic than Europe’s.

High unemployment is needed in Europe to help keep inflation low around the world. This is a sad commentary on the state of affairs where policymakers depend on a lack of jobs to ensure they can keep inflation and interest rates low.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.