The U.S. Federal Reserve is launching a heavy salvo of new monetary policies in an effort to prop up the economy and financial markets that have been hammered during the coronavirus pandemic, but it may not be the right solution right now.

“Monetary policy can only take us so far.”

On the financial front, the central bank announced it will increase its asset purchase program “in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy,” the Fed’s Monday statement said.

It also said it’s moving into uncharted territory by purchasing corporate bonds and offering direct loans to companies. New programs will be launched “soon” to buoy small- and medium-sized businesses that have been crushed as more and more people stay home to help “stop the spread” of the coronavirus (COVID-19).

“It’s their bazooka moment,” Ameriprise Financial Services chief economist Russell Price said.

Federal Reserve Monetary Policy vs. Government Fiscal Policy

Banyan Hill Publishing’s Ian King

Banyan Hill Publishing’s Ian King believes the Fed’s moves for more quantitative easing (QE) are needed, and he said the central bank ramping up monetary policy is similar to what others have done in the past in the face of financial turmoil.

“I think an open-ended QE is necessary to protect the plumbing of the financial system,” said King, the editor of and . “This is reminiscent of ECB President Mario Draghi’s ‘whatever it takes’ speech to backstop European sovereign debt (Greece, Portugal, Spain, Ireland) in the middle of the 2012 debt crisis,” King said via email.

But King thinks the Fed has an entirely new challenge on its hands this time around, and policy can only go so far.

“The problem right now is that this crisis is the polar opposite of 2008 and 2012,” King said. “Those were top-down crises driven by fears of counter-party risk. Banks could not transact with one another because they feared the other guy didn’t have the capital to settle transactions.

“In this case, our current problems are bottom-up. The health crisis has caused businesses to shut down and furlough employees.”

The Fed’s new programs aim to keep small businesses afloat.

It will lend against student loans, credit card loans and government-backed loans to small businesses. It will also buy bonds of larger employers and make loans to them in what amounts to four years of bridge financing.

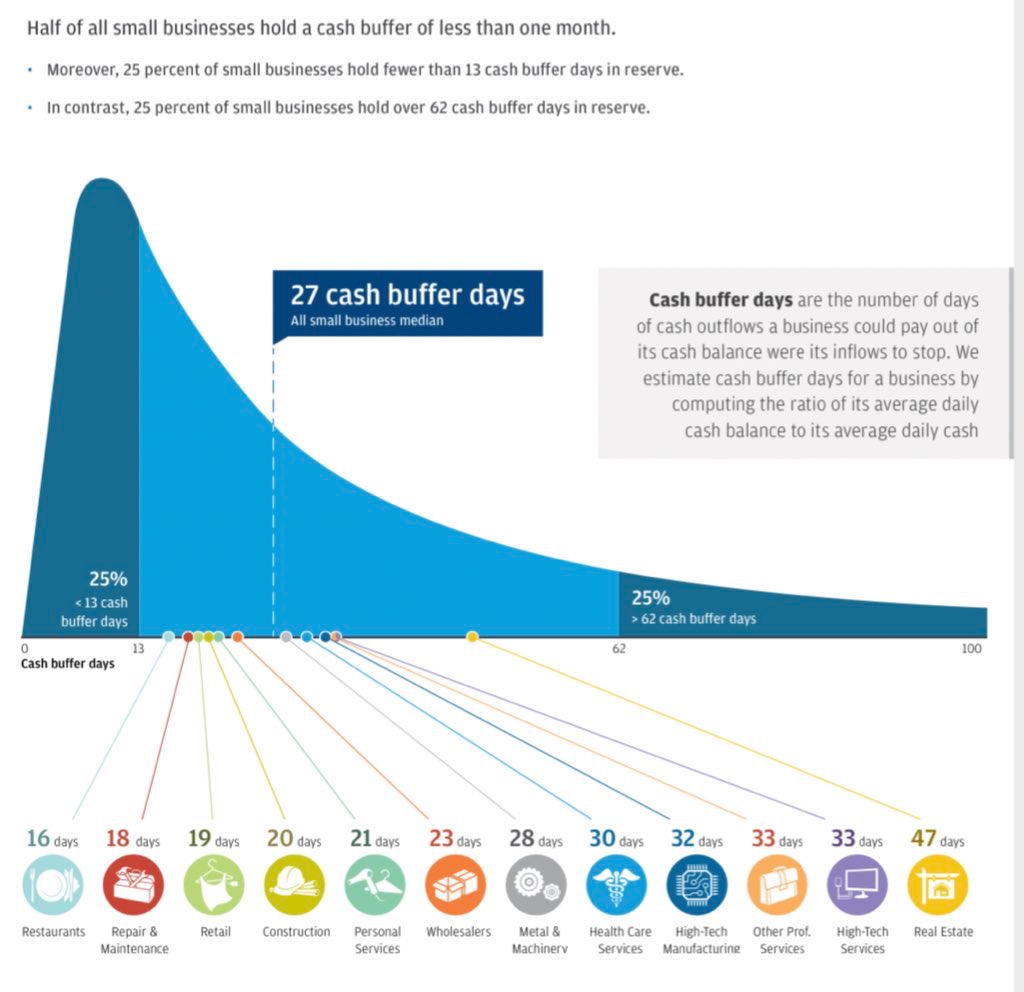

These programs will be of utmost importance, as King warns that “half of all small businesses only hold enough cash to cover one month of expenses.”

“If these businesses are forced to close, they are forced to shut down and lay off employees,” King said.

Layoffs are already happening, too, as Goldman Sachs estimates unemployment claims will jump by close to 2 million in the next week. Jobless claims jumped by 70,000 to 281,000 last week, according to the Department of Labor.

But the Fed’s moves may not be enough for these small businesses now, as King argues that fiscal action from the government is more important when faced with a “bottom-up” crisis like the COVID-19 pandemic.

“Furloughed workers and small businesses need money and they need it now. We are better off suspending rent and mortgage payments (and adding on to the duration of the loan or lease) for a few months than forcing these businesses to close permanently,” King said.

A coronavirus stimulus package is now being negotiated in the Senate after a key procedural vote failed Sunday.

Treasury Secretary Steven Mnuchin hinted that Congress is “very close” to agreeing on the stimulus package that is likely to cost at least $1 trillion, including direct payments to every American.

“Monetary policy can only take us so far, and investors are waiting to see what fiscal stimulus the government puts forth to get a better grasp on how this crisis will unfold,” King said.

This was reflected in the markets when all three major indexes rose initially on the Fed’s announcement after futures hit a “limit down” trading halt Monday morning, only to fall precipitously again later in the morning.

Both the Dow Jones Industrial Average and S&P 500 were trading 1.7% lower around 1;50 p.m. EDT. The Nasdaq composite, which has been bolstered by popular tech companies, was up slightly to 0.3%.

We’ll have to wait and see what a stimulus package does for the financial markets and the economy, but it’s clear the Fed’s actions haven’t done enough to calm volatility.