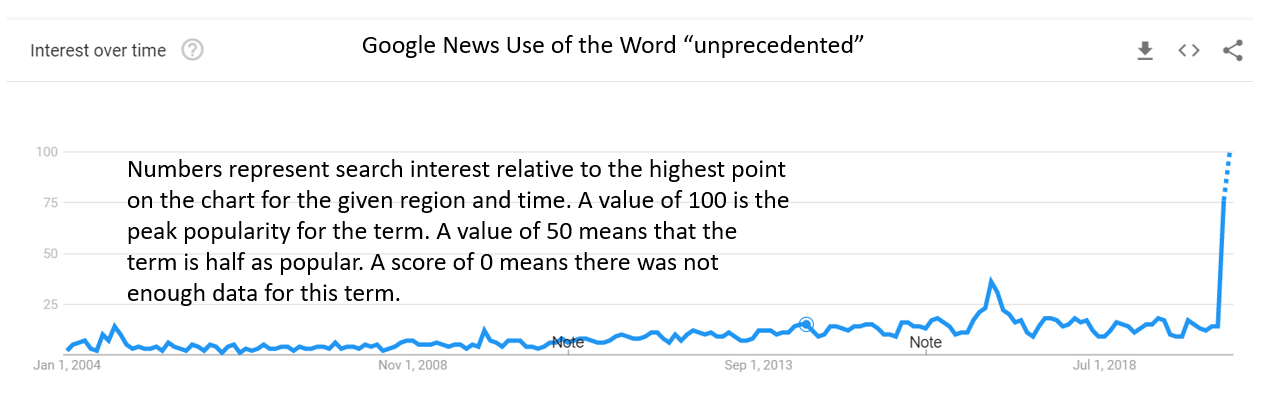

Today’s events are unprecedented. Even Google proves that’s the case.

This chart shows that the use of the word “unprecedented” in news stories reached an … unprecedented level.

The previous spike in usage came at the end of 2016 after Donald Trump’s unprecedented election win.

To those without a long view of history, coronavirus must be unprecedented based on the widespread impact of the disease.

Economists at the San Francisco Federal Reserve identified previous pandemics, or precedents for this unprecedented event, and posted the results in “Longer-Run Economic Consequences of Pandemics.”

There have been 12 events since 1300 that killed at least 100,000 people around the world. These include the Black Death from 1331 to 1353, four cholera outbreaks in the 1800s, the Spanish Flu after World War I, the Hong Kong Flu in 1968 and the H1N1 Pandemic that killed 203,000 people in 2009.

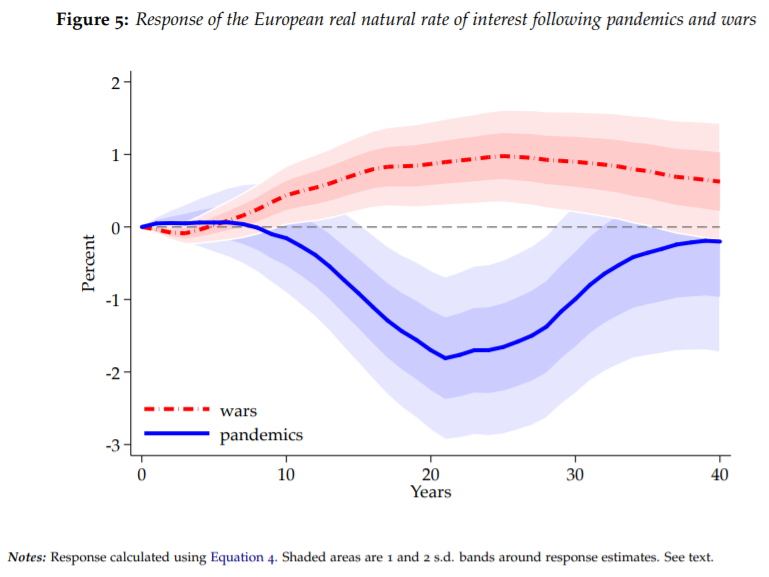

As a baseline, the economists compared the pandemics to large wars that killed at least 20,000 people in one year. Wars and pandemics both caused death. This comparison allowed them to determine whether pandemics had different effects than war.

One difference between the two is the impact on interest rates. This is summarized in the next chart, which is from the paper.

Wars result in higher than average interest rates. That could be because investors worry about new wars and demand extra compensation on their investments.

Pandemics are followed by an average of 40 years of below average interest rates. Rates fall for the first half of that period.

This means we should expect “depressed investment opportunities … possibly due to an increase in precautionary saving or a rebuilding of depleted wealth.” In other words, investors worry about additional pandemics and hold more cash and other short-term investments.

Of course, we don’t know exactly what will happen in the next 20 years. But low interest rates are likely. The good news is that this should allow governments to finance bailouts.

Since investors will be conservative as they recover from the shock of the pandemic, they should favor large cap stocks and safe dividends.

In this environment, an alternative is to think short term and capture gains when they are available instead of focusing on the long run, which will be less rewarding than average.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru