Futures markets are warning us that the great experiment of reopening an economy will be challenging. Investors should remain nimble in this environment.

We are in the middle of an economic experiment — hopefully it’s the middle. But it’s possible the experiment is just beginning.

COVID-19 forced policy makers into this unusual situation. The experiment consists of shutting down the global economy and someday fully reopening.

The shutdown was accomplished. The reopening is underway for now but a surge in new infections threatens to delay a return to normalcy. Futures markets confirm the economy isn’t rushing back to normal.

What Futures Markets Are Telling Us

Futures markets allow traders to buy and sell commodities for later delivery. This allows farmers, for example, to lock in a price for corn instead of risking a price decline by the time they harvest. These markets also allow large consumers, like Campbell Soup Company (NYSE: CPB), to prepay for corn they know they will use later.

These markets are generally good predictors of long-term economic trends. Right now, various futures markets are telling us to expect slow economic growth to continue.

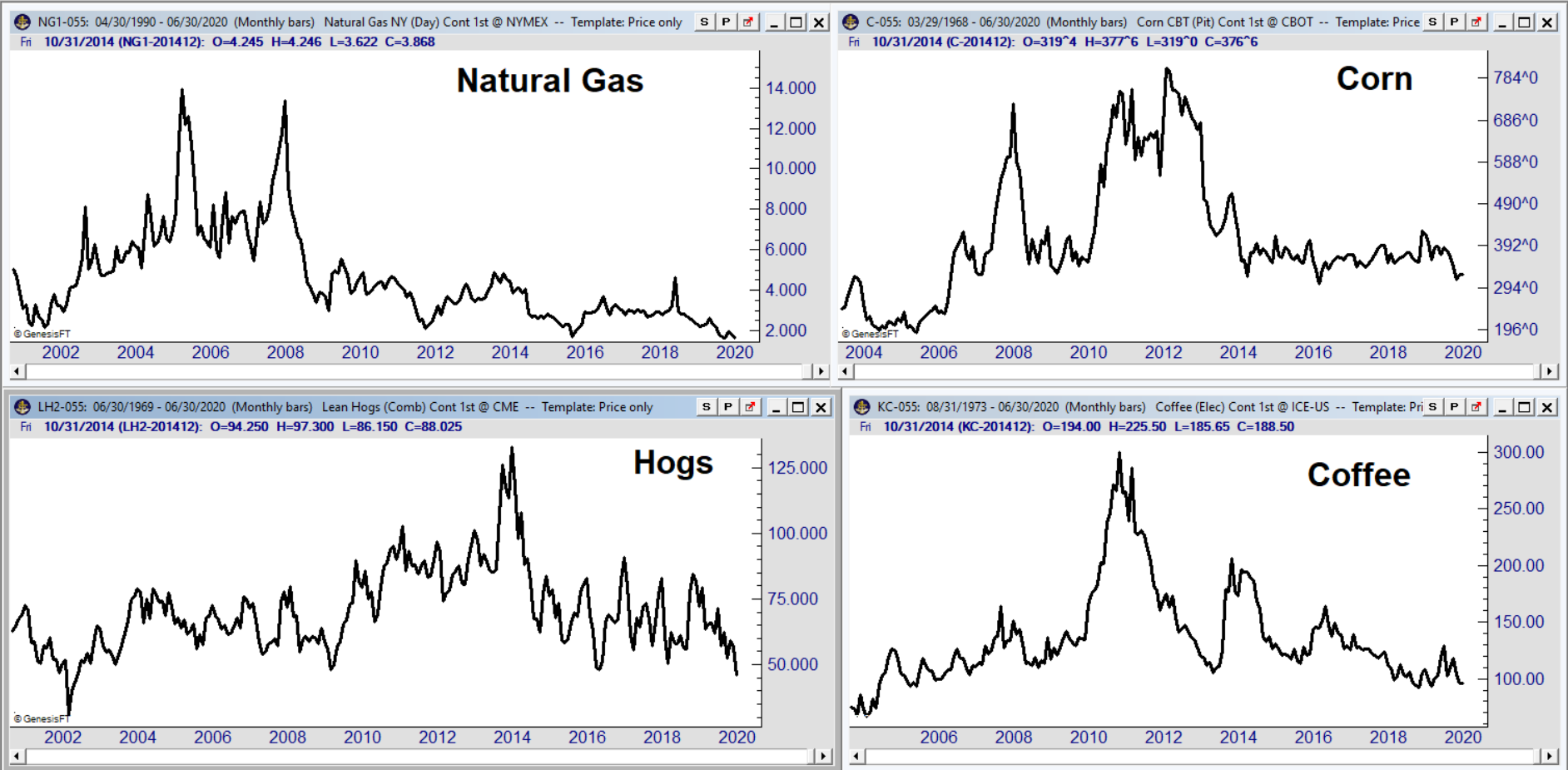

This can be seen in the chart below.

Source: Trade Navigator

Various markets are trading near 10-year lows. This includes energy markets, grains, meats and other food products.

Multiyear lows tell us consumer demand is weak. Until demand increases, the economy won’t be able to reach its previous production levels. That means unemployment will remain high and there will be serious issues for policy makers to deal with.

Some are already facing up to these facts.

After its last meeting, the Federal Reserve updated its economic projections trends. This report indicates the economy’s expected growth rate declined because of the shutdown. Unemployment is likely to be higher, and interest rates are likely to be lower.

Fed officials expect short-term interest rates to stay near zero until at least the end of 2022. This means inflation isn’t a concern and recent market action confirms that.

The Fed is trying to fight deflation. Although we haven’t experienced deflation in years, negative inflation has serious implications. Deflation was a major problem during the Great Depression. It was also a contributing factor to the Panic of 1837, which led to many states defaulting on bonds, sparking an international financial crisis.

Futures markets are warning us that the great experiment of reopening an economy will be challenging.

Investors should remain nimble in this environment.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.