If you’re invested in the housing market or housing stocks, the time to get out is now. I know, it’s probably tempting to view the latest pullback in the market as a buying opportunity.

“Buy the dip!” many of us are being told.

While this sentiment might be true for some market sectors, it couldn’t be further from the truth when it comes to housing stocks. If you’ve followed the housing sector this year, this dire warning might surprise you.

After all, the U.S. economy is booming and unemployment is at its lowest point in decades. Earlier this year, this equation added up to the strongest growth in the housing sector we’ve seen in years. Now, however, the rush is over.

As it turns out, the big rush on new home sales for nearly the past year was driven by the threat of rising interest rates. The Federal Reserve has hiked interest rates three times so far this year and is projecting another trio of hikes next year. This higher-rate campaign has pushed 30-year mortgage rates to multi-year highs.

On Wednesday, the 30-year fixed mortgage rate dropped to 4.75 percent, pulling back from near 5 percent levels. Despite the decline, rates are still up from 4.66 percent last month.

The bottom line here is clear: The easy money is gone. As a result, new home sales went into a tailspin, falling for two consecutive months in June and July — two historically strong months for home sales. August saw a bit of a rebound in home sales, up 3.5 percent from the month prior. However, the growth rate was the slowest in nearly 11 years.

August may well be the last hurrah for growth in the housing sector for some time. Not only are we entering a seasonal slowdown for new home sales, but the rise in home prices is outstripping wage growth. As a result, September housing starts fell 5.3 percent according to the Commerce Department.

You would expect with slackening demand that housing prices would take a breather. However, steel import tariffs, tariffs on construction materials and a skilled-labor shortage have all combined to keep home prices rising … putting them well out of reach of most middle-income Americans.

The Bottom Line for Investors

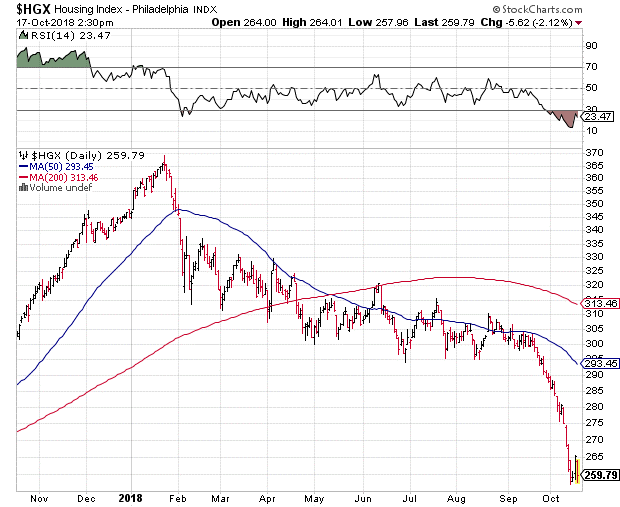

As you can see from any chart of the PHLX Housing Sector Index (HGX), 2018 has not been a good year for investors. Housing stock names like Lennar, KB Homes and D.R. Horton have been beaten up so far this year. The result is that HGX is down a whopping 42% from its January highs.

As I noted above, you may be tempted to buy into this dip. After all, HGX’s 14-day relative strength index is trading deep in oversold territory. But while a short-term bounce from these levels is possible, there is nothing left to drive HGX and the housing sector higher from here.

Until we see real wage growth rise fast enough to keep pace with soaring housing prices, expect the housing sector to continue to tank.