What a difference a few days make in the gold market.

Last Friday gold pumped and dumped on a statement by Federal Reserve Chair Jerome Powell and a subsequent tweet by President Donald Trump. Then the FOMC comes out with a very dovish statement but puts off lowering rates for another month to save face.

This sent gold up against hard resistance at $1,362 where it traded sideways for a few hours until reports came in that Iran shot down a U.S. drone flying in its air space.

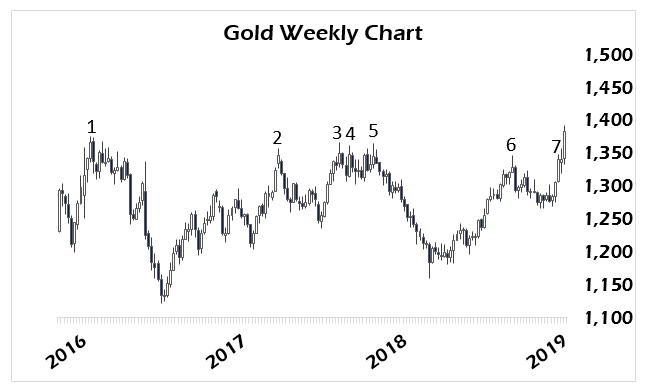

That sent gold right through the massive overhead resistance formed since the 2016 Brexit vote between $1,360 and $1,375. Gold has attempted to push through that level no less than seven times in the past three years. Multiple Q1 rallies have failed at that level.

Until yesterday.

In fact, February’s failed rally was the weakest attempt thus far, and looked like a harbinger of a big wash out in gold prices later in the year based on past trading performance and the Fed’s tightening monetary policy regime.

But, as I pointed out previously, the shallowness of this year’s correction in March and April was a signal that the bulls were changing the rules of the game. This isn’t last year or the year before. The twin threats of war and political collapse in major governments are putting a big bid under gold.

Iran shooting down a U.S. drone shouldn’t have caused gold to pop through $1,375 and stay above it. And we’ll need to see that level held through the end of the week to begin the confirmation process that the cycle has now flipped from bearish to bullish.

It was Powell’s dovish statement that provided the fuel for this move. Iran simply lit the match.

Now Trump has to respond to this. One could ask why our drone was flying in airspace we knew Iran would respond to. But I’ll leave that speculation for another forum.

Our focus has to remain on the markets.

Powell’s statement pushed the dollar down, per Trump’s demands. It over-rode ECB President Mario Draghi’s statements made the day before, sending the euro back up to challenge $1.13, but no higher. It also sent stocks much higher on the hope of monetary easing in July.

In my last article I concluded that I thought any dovishness by Powell would be met with dollar weakness, but that the weakness would become a “false move” that puts short-term position traders off-side.

This would provide a snap-back rally in the dollar, given the right catalyst at some point in the future.

After the euphoria died down, absent any exogenous shocks like a confrontation with Iran, the dollar would resume knocking on resistance at 98 on the USDX. There are simply too many people synthetically short dollars to see it collapse while Europe’s political and financial prospects deteriorate. Draghi has pledged to further punish savers by lowering rates to leave the ultimate Ponzi scheme for his replacement in October.

I would watch the USDX here to see how far it can be pushed down before turning back up. The last significant low was at 95.03 back in January. If that level holds before the dollar bounces, then that thesis is the correct one and the next attempt at breaking 98 to the upside will be successful.

The prevailing wisdom will be that gold will falter if that happens, but that’s the wrong read after a major technical breakout like we’re experiencing. The right read is that this will be the mother of all safe-haven moves, whereby gold rises on political tension and the dollar rises on a massive short squeeze that overwhelms any loosening of the Fed’s policy.

Because, as I said previously, the Fed admitting their policy was in error in 2018 leads the smart money to be rightly scared of why the Fed now feels it necessary to cut rates when the economy is supposedly so strong — unemployment low, jobs and wages growing, etc.

And that will have them fleeing into high-quality assets. It will force collateral requirements to rise as riskier paper will be — and is being — rejected to post as collateral. U.S. treasuries will not be turned down, hence the inverted yield curve.

Conventional wisdom is good at describing events during conventional times. These are anything but conventional times, however. Look at the disposition of the markets. U.S. assets are at or near all-time highs. Yields are crashing and gold is rising. All of this is driven by the massive synthetic short position against the dollar, which will only unwind when U.S. yields are pushed to their limit down.

It is tied together with one common theme: high-quality assets that are liquid.

This is may be the moment where the conventional wisdom of what is and is not a risk-on versus risk-off asset shifts. And that’s what I meant in the title about gold’s “Golden Moment.” It’s that moment where it trades independently of the foreign exchange markets as an asset of uncommon quality to protect investors from chaos.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.