Investors have worried about government deficits since debt was first issued.

Looking back, sovereign debt made Antwerp the world’s first great financial exchange in the 1500s. Even then, war was expensive. So kings and queens borrowed to pay for their armies.

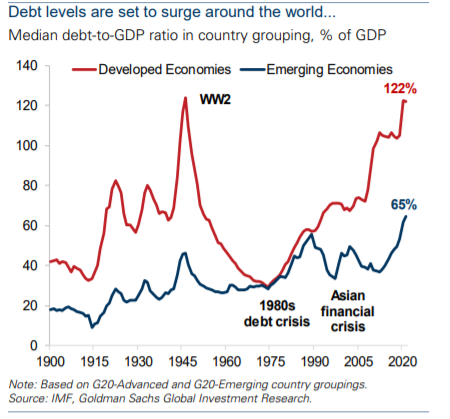

War led to a peak in debt in the 20th century, as the chart below shows.

Source: Goldman Sachs

The red line shows the consolidated debt of the world’s largest countries. These include the United States and Germany. The blue line represents less developed economies, such as Brazil and South Africa.

Governments borrowed as much as they could spend to win World War II.

Once again, governments around the world are borrowing. They know they need to sustain their economies during the war against the coronavirus.

Heavy borrowing isn’t unprecedented. Borrowing with limited ability to repay the debt is.

After WW2, paying off debt wasn’t a concern. Central banks fixed interest rates at a low level. That made debt service costs low.

Growth funded debt payments after the war. And growth was assured as the world repaired the devastation.

But there won’t be a surge of growth after the coronavirus. Policymakers are simply hoping to bring economic capacity back to 2019 levels as quickly as possible. An economy larger than last year’s is years away.

What High Government Debt Means for Investors

Economists and investors face the same problem as kings in the Middle Ages. Slow growth made it difficult to pay off debts. This led to wars of conquest so that plunder could fund previous conflicts.

Without the prospects of growth, or the decision to plunder nearby countries, this situation is unprecedented. There is no plan for paying down debt. And high debt stifles growth even more.

The long run looks more bearish all the time.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.