I don’t know about you, but I’m getting tired of the word “coronavirus.”

It’s not the pathogen or even the economic fallout from it. It’s literally the word itself.

I’m just sick of hearing it. It’s exhausting.

And for what it’s worth, it’s the same word in both English and Spanish.

I only know this because I’m stuck in Peru. They put the country on lockdown before I could leave, so I’ve been twiddling my thumbs on a Peruvian ranch for the past two weeks.

Being stuck in Peru isn’t all bad, by the way. I have an eight-foot wall around the property, plenty of food and a full liquor cabinet. It could be a lot worse. But I’d kill for a Whataburger and a Dr. Pepper over ice right about now.

At any rate, I know I’m not the only person losing my mind. When you’re stuck in your house with nothing to do but watch an endless stream of awful news headlines, it starts to affect your view of the world … and the stock market.

I’m the first to admit I don’t know what happens next to stock prices. You could make a credible case that, while the economy might be in for its worst recession since the 1930’s Great Depression, the S&P 500 could hit new all-time highs by year’s end due to the flood of Fed stimulus coming down the pipe. That’s not a crazy statement.

But you could also credibly argue that the market should take another major leg down, as buybacks will be off limits for large swaths of the market for the foreseeable future and earnings promise to be awful.

Rather than try to guess — and let’s face it, it’s a guess — let’s instead take a look at what the insiders actually running America’s largest companies are doing.

What Insider Buying Is Telling Us

Company executives and board directors aren’t geniuses. They’re regular people like you and me. They do, however, generally have a pretty good grasp of when their company shares are undervalued. While not necessarily market timers, they tend to be pretty good value investors. And to say they saw value in March would be an understatement.

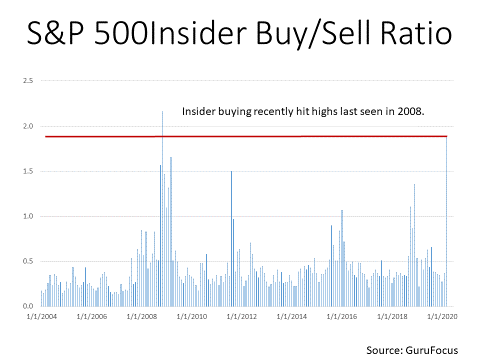

The ratio of insider buys to insider sells spiked higher, hitting levels last seen in 2008. And, interestingly, the buying spiked across virtually all industrial sectors. Financials, real estate, energy, health care, basic materials, communications — you name the sector and chances are good it saw above-average insider buying last month.

The only exceptions were technology and utilities.

Now, company insiders can sell their stock for any number of reasons. Perhaps they want to diversify or perhaps they want to buy a new house in Aspen. It’s not always easy to draw meaningful conclusions from insider selling.

But there’s only one reason an executive or director would whip out their checkbook to buy shares of their own stock. They consider it a good deal and expect it to trade higher.

Interestingly, the heaviest insider buying this past month was in the most beaten and battered sector: energy. Insiders bought 11 shares of stock for every single share sold.

On the surface, energy stocks look awful. With Saudi Arabia and Russia in an all-out price war, the price of crude oil continues to slide off a cliff and inventories keep stacking up. In Wyoming, the price of crude oil literally went negative. Producers weren’t just giving their oil away … they were paying people to take it.

Oilmen are known to be a little cavalier with risk. They’re oilmen, for crying out loud. But when you see company executives and directors backing up the truck to buy at the same time it looks like the world is ending … you might have the makings of a contrarian trade.

Energy stocks are worth a look.

• Money & Markets contributor Charles Sizemore specializes in income and retirement topics, and is a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore