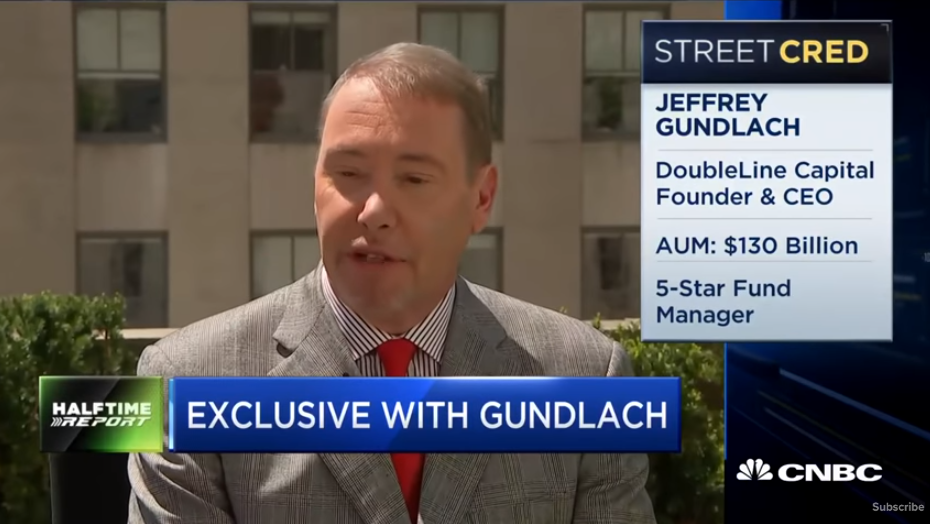

Billionaire “Bond King” and DoubleLine Capital CEO Jeffrey Gundlach said the odds of a recession hitting the U.S. economy by 2020 have increased to 75%.

“There’s no way to sugar coat it. When you have a 40-basis-point inversion, well, then that usually leads to a problem.”

This past June, he upped the odds of a recession in the next 12 months to 65%, but upped the chances of one before the 2020 election to 75% Tuesday during a call with Yahoo Finance.

Gundlach noted the yield curve inversion on Treasurys right now is “full-on recessionary,” and it looks “a lot like 2007.” The inverted yield curve happens when the yields on long-term debt is lower than yields on short-term debt.

“There’s no way to sugar coat it,” Gundlach said. “When you have a 40-basis-point inversion, well, then that usually leads to a problem.”

He then added that the yield curve will likely steepen, but that’s not a good sign.

“That would almost seal the fate of a recession coming,” he said. “It’s not so much the inversion — the inversion is a warning that there’s one coming. But you start to get in the imminence category once it first starts steepening out from the inversion, because, by then, the Fed has realized it’s behind the curve, the market knows it too, and everybody knows the Fed’s going to be slashing interest rates.”

Gundlach went on to highlight key recession indicators and where they stand currently.

“Leading economic indicators are heading south in a hurry,” he said. “The PMIs are weakening up substantially. You’re starting to see some warning signs from sentiment surveys, from CEO sentiment a little bit, and there’s a flashing signal from consumers’ expectations of the future being much worse than than thoughts of the present.”

If consumers’ views of the present begin to deteriorate as much as they have for the future, the recession is on, Gundlach said: “If that happened, you’re almost definitionally in a recession.”