Today, I’m happy to issue a “buy” alert on the stock I highlighted in our first Waaaait for It feature.

As I explained on September 10, stocks often step through semi-predictable patterns, much like salsa dancers hit the marks of the basic eight-step pattern. But there’s also a good degree of leeway and improvisation, both in salsa dancing and stock trading.

That’s why, in salsa dancing, there’s always a leader and a follower. The leader leads … deciding when and how to implement an improvisational move.

And the follower follows, so as not to step on the leader’s toes!

It’s the same way with stock trading: The market is always the leader.

And we traders are the followers.

That’s why each Waaaait for It feature highlights one stock or ETF that’s on my radar, but isn’t quite a “buy” just yet.

It will be a potential trade I’ve identified … one that promises to potentially trace out an exciting and lucrative series of dance steps … though we must wait to see if the market makes the move I’m anticipating, before making the move ourselves.

Well, today, I’m following up on Johnson Outdoors’ stock (JOUT), which, after waiting patiently for nearly a month, is now a “buy.”

Johnson Outdoors (JOUT) Stock Is Now a Buy

Wisconsin-based Johnson Outdoors Inc. (Nasdaq: JOUT) operates in the consumer discretionary sector as a manufacturer of outdoor sporting equipment. Its primary product lines include small watercraft, camping supplies and fishing and scuba gear.

I shared the chart below with you in last month’s Waaaait for It feature and told you this:

Johnson Outdoors stock is a buy if it breaks above $87.

As I explained, the stock had a nice run between 2016 and late 2018. Shares climbed from $20 to a high of $107, propelled by an impressive annual earnings growth rate of 41% since 2015.

Since topping out at $107 in September 2018, though, shares of Johnson Outdoors have traced a typical consolidation pattern, trading roughly in the range between $60 and $80, with multiple ups and downs between those levels.

More recently, during the broad-market recovery that followed the coronacrash lows of late March, shares of Johnson Outdoors make a bullish breakout above the $80 ceiling of its consolidation pattern. In fact, the stock reached a breakout high of $97 on July 31, minting a new two-year high.

The next step in this stock’s dance was a pullback. The company’s July 31 quarterly earnings report showed some expected contractions in sales and earnings, owed obviously to the near-total lockdown of the U.S. economy in April.

The company reported a strong bounce-back in sales for May and June, as the country re-opened timidly. But it wasn’t quite enough to make up for the lost business in April or entice new investors to buy shares north of $90.

Folks got a bit timid, and the stock pulled back from around $90 to $80.

It’s quite typical for a stock to make a “re-test” of a significant bullish breakout level. In this case, shares of Johnson Outdoors finally broke above that $80 ceiling during the coronacrash recovery. And after running up to $97 during that breakout, the stock re-tested this $80 breakout level.

As you might recall, I outlined two events we’d need to see before having confidence that JOUT’s re-test was successful … and that its bullish trend was likely to continue higher:

1) We need to see JOUT hold above the $75 to $80 range. It would be great if shares never fell below $80. But as long as they hold above $75 and then begin to bounce higher, we can consider the bullish breakout intact.

2) We need to see JOUT trade above $87. This will confirm the re-test is complete and show that new buyers are willing to bid the stock back above its latest earnings-report prices.

Update: JOUT Is a Buy Today (Lock in Increased Dividend!)

Now, both of those things have happened!

JOUT stock retested the $80 level not once but twice … and both times, shares never fell below $80.

The $0.21-per-share dividend will be paid on October 23 to shareholders of record on October 9. That means you have to buy shares before the market closes today, October 7.

More recently, shares have surged higher and made a bullish breakout above that $87 level I’ve been watching.

It seems the company’s announcement of a 23.5% increase in its quarterly dividend reinvigorated buyers who are now willing to bid the stock higher.

All told, this stock is now a “buy” in my book!

If you’re going to get in, I recommend getting in soon.

The $0.21-per-share dividend will be paid on October 23 to shareholders of record on October 9. That means you have to buy shares before the market closes today, October 7.

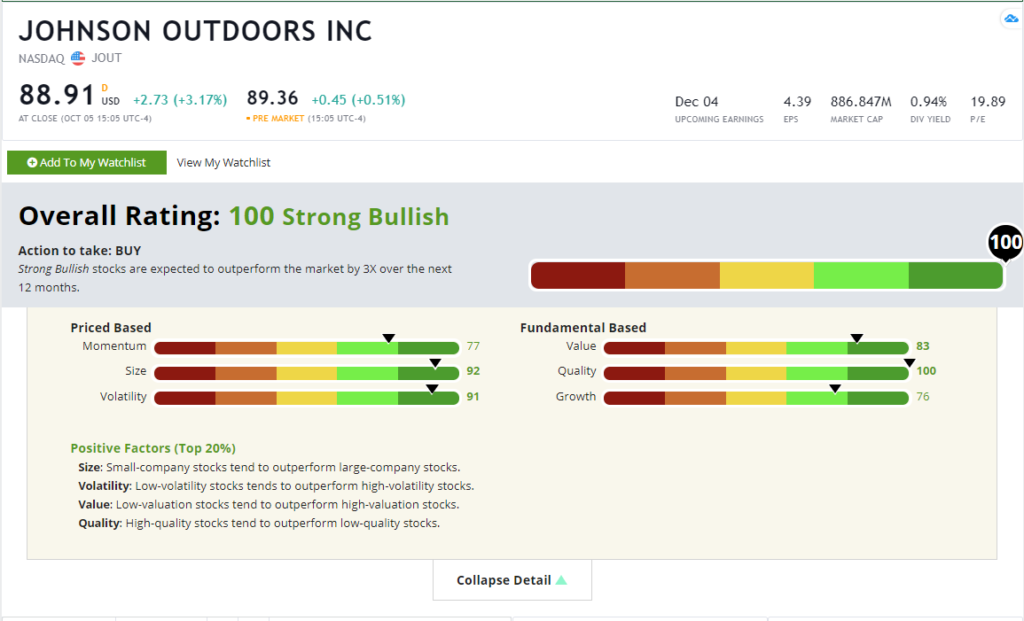

As I mentioned in my original highlight of Johnson Outdoors’ stock, it rated a 99 out of 100 on my six-factor Green Zone Ratings model for stocks.

It now rates a 100!

Johnson Outdoors Inc. (Nasdaq: JOUT) Green Zone Rating on October 6, 2020.

It has low debt … a healthy cash balance … and consistently growing net income and free cash flow figures. We want to see all of these in a dividend-paying stock that not only can maintain its payment to shareholders, but can grow it strongly over time!

Plus, beyond the dividend yield, I think this stock could go on a major run over the next couple of years — from $90 to north of $150.

I’m glad we waited for this stock to trace out the steps I outlined.

Between the double re-test of $80 and the bullish break above $87 on news of a double-digit dividend increase … we now have much more confidence in investors’ willingness to bid this stock higher than we had a month ago.

As I said then, patience pays!

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist

P.S. My hand-picked Green Zone Fortunes stocks are beating the market 4-to-1. To gain access to my next pick, due out next week, click here.