It’s been a monster quarter for the S&P 500.

It’s been so good, stock market strategists are worried some larger funds are going to a execute a massive sell-off at the end of the month.

But is this something retail investors need to worry about?

Before Wednesday’s stock market drop, the S&P 500 was up 21% in the second quarter. So it makes sense some funds managing retirement wealth for millions of people would consider banking those profits and moving into safer holdings.

“The end of the quarter is going to be pretty interesting, given how much the market has moved during this quarter,” said Dan Deming, managing director at KKM Financial in a CNBC interview Tuesday. “There could be volatility here.”

June 30 marks the end of the month and the end of Q2 2020. Some analysts see pensions moving between $35 billion and $76 billion out of stocks into bonds.

Michael Schumacher, director of rates strategy at Wells Fargo, thinks it could be the largest rebalancing efforts witnessed in six years.

“We estimate that U.S. corporate pensions will move about $35 billion into fixed income,” Schumacher told CNBC. “The reasons are pretty obvious. You had this massive rally in stocks and bonds haven’t been keeping pace.”

Talk of a massive stock sell-off may have some investors worried, especially ones that are newer and enjoying the run-up from March lows.

Is a Massive Stock Sell-Off Coming?

Banyan Hill Publishing Chartered Market Technician Michael Carr doesn’t think it will happen — at least as quickly as some worry.

“While pension funds will reallocate their portfolios, this won’t be a market moving event,” Carr said. “Managers have some discretion over the allocations and the timing.”

Carr, Editor of One Trade, gave an example using California’s CalPers pension fund below:

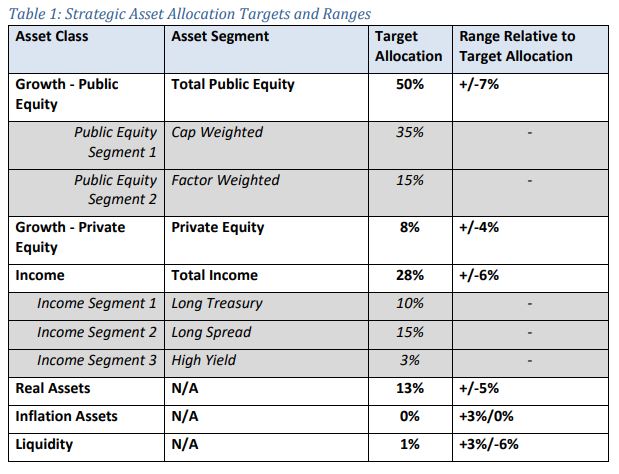

Source: CalPERS

“The CalPERS, California’s $380 billion pension fund, allocates about 50% of its portfolio to publicly traded equities,” Carr notes. “Based on market conditions, the managers can change this by as much as 7%. For bonds, the allocation is about 28%, plus or minus 6%.”

Carr added that these moves are already likely being made because these funds aren’t run by your average Joe.

“Large funds are already making required shifts because smart managers want to avoid moving markets,” Carr said. “And, if you’re managing billion-dollar pension funds, you’re a smart manager.

“These shifts will play out over weeks and no one will notice.”

But that doesn’t mean investors should be complacent. As we saw Wednesday, volatility is still high and massive stock sell-offs can happen at any moment.

Other Factors to Watch

While the stock market has rallied from its March lows, some major headwinds are pushing against the rally moving higher.

A surge in coronavirus cases across some states in the U.S. triggered an 800-point crash on the Dow Jones Industrial Average on Wednesday.

A smaller sell-off occurred in futures trading Monday night after a slip-up concerning the trade deal between the U.S. and China.

Some analysts are worried the stock market is highly overvalued as well. The so-called “Buffett Indicator,” named after value investing king Warren Buffett, shows the stock market is “significantly overvalued as of Wednesday morning,” according to GuruFocus.

The indicator is a historical ratio of total market cap over gross domestic product. It’s a great gauge for comparing the stock market to the economy.

It was sitting at 145.8% Wednesday morning. Looking back in history, the indicator was around 140% during the dot-com craze in the late 1990s.

That doesn’t seem like a healthy stock market environment to me.

A rebalancing in pensions and other large funds likely won’t trigger a massive stock sell-off — but there are still plenty of other things that could.