I have vaccines on my mind today. In the weekend edition of The Bull & The Bear, Matt Clark, Adam O’Dell and I broke down the three major COVID-19 vaccine makers: Pfizer Inc. (NYSE: PFE), Moderna Inc. (Nasdaq: MRNA) and Johnson & Johnson (NYSE: JNJ).

Of the three, we all saw more potential in Moderna, which I highlighted last week. Moderna is a leader in the emerging world of mRNA vaccines and therapies.

It’s one of the few companies you can say has the potential to change the world. Its emerging mRNA-based cancer therapies may be the cure that doctors have searched for.

But today, we’ll move beyond the “big three” of COVID-19 vaccines to take a deeper look at another pharmaceutical giant, Merck & Company (NYSE: MRK).

Merck is one of the largest diversified pharma companies in the world, with close to $50 billion in annual sales. The company dropped out of the COVID vaccine race earlier this year, instead opting to help rival Johnson & Johnson produce its vaccine.

Merck was also an early investor in Moderna, and the two companies are still collaborating today on new cancer therapies.

Apart from its work with Moderna, Merck is working on other mRNA projects. Earlier this year, Merck purchased mRNA manufacturer AmpTec. It’s clear that Merck sees mRNA therapies as the future of medicine.

But will that translate into sustainable growth for its stock?

I used chief investment strategist Adam O’Dell’s Green Zone model to check Merck’s stock rating. Adam designed this proprietary model to rate stocks on the six factors proven to drive market-beating returns. More on those below.

Merck Stock Rating

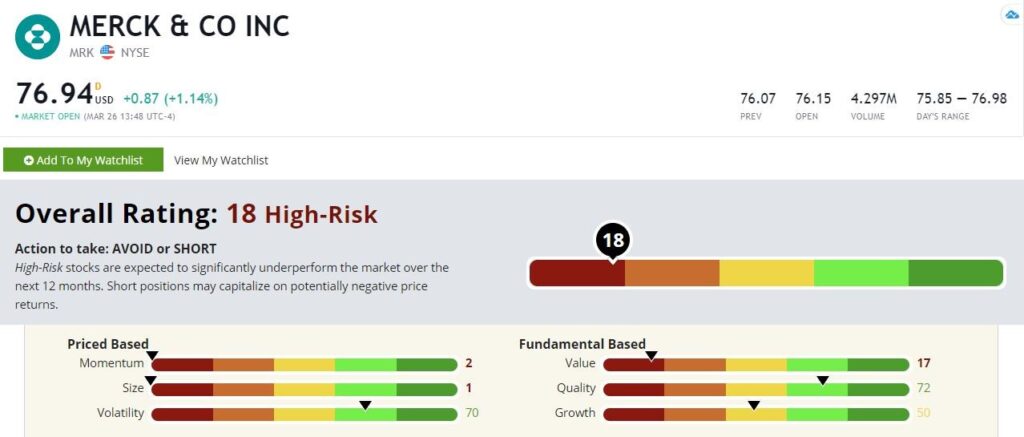

Merck & Co.’s Green Zone Rating on March 26, 2021.

This stock scores an 18 out of 100, making it a “High-Risk” stock in our system. Green Zone identifies it as a short-sale candidate.

Let’s dig a little deeper.

Quality — Merck’s highest factor score is in quality, where it rates a 72. Branded pharmaceuticals tend to be a high-margin business. The research and development costs are astronomical, of course. But once you launch a successful blockbuster drug or two, you enjoy fat profits for a while. And that certainly describes Merck. It’s a quality, high-margin business.

Volatility — The stock also rates well based on volatility, scoring a 70. The high score here isn’t at all surprising. Merck has a beta of just 0.43, implying it’s 57% less volatile than the broader market. (The market — for example, the S&P 500 — has a beta of 1.0.) This is, for the most part, a boring, no-drama stock.

Growth — Merck’s score drops off from here. Merck rates a 50 on growth, making it the definition of average. This makes sense when you look at Merck’s underlying business. While the company is large and diversified, it’s been a while since it had a newsworthy blockbuster. In fact, Merck has looked to buy growth rather than develop it in-house, as we saw in its partnership with Moderna and its purchase of AmpTec.

Value — Merck doesn’t rate well on value, with a score of just 17. Despite the fact that the stock has gone nowhere since 2018, its price is still high relative to earnings, sales and other common metrics. The shares trade hands at 27 times trailing earnings and 4 times sales. Those are growth stock multiples … but Merck isn’t a growth stock.

Momentum — With essentially no share price movement in three years, it’s no surprise that Merck rates low on our momentum score. Its 2 out of 100 means that 98% of stocks in our universe show stronger momentum.

Size — Merck is a massive company, with a market cap of nearly $200 billion. It rates a 1 on size, meaning a small-cap bounce won’t happen with this stock.

Bottom line: I’m bullish on biotech, and specifically genomics therapies, as are Adam and Matt. We believe that investors will make fortunes in this space. Check out Adam’s story here for more information about the DNA revolution.

It doesn’t appear that legacy big-pharma companies are the best way to play this trend. This stock is a clear loser.

We’re looking beyond the Mercks of the world.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

P.S. Check out The Bull & The Bear podcast every week for more investment tips from Adam O’Dell, Matt Clark and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.