Stocks go up when money moves into the stock market.

In theory, when the Federal Reserve increases the money supply, the stock market should move up.

Of course, other factors affect stock prices.

But money supply is important. Changes in Fed policy have triggered large reversals in the trend of the stock market.

Recently, Fed policy can be summarized as “flooding the economy with money.”

Economist Milton Friedman first outlined this strategy in the 1960s. It became known as “helicopter money.” Friedman noted that if the central bank policies fail to create the desired amount of inflation, they can always drop $1,000 bills from the sky.

Friedman didn’t think a central bank would ever do that. And, so far, they haven’t. But they’ve come close with various quantitative easing programs.

Right now, the Fed is adding money to the economy.

In addition, the government dropped $1,200 bills from the sky as coronavirus stimulus checks.

Investors can expect these initiatives to impact the stock market.

How Money Supply Affects the Stock Market

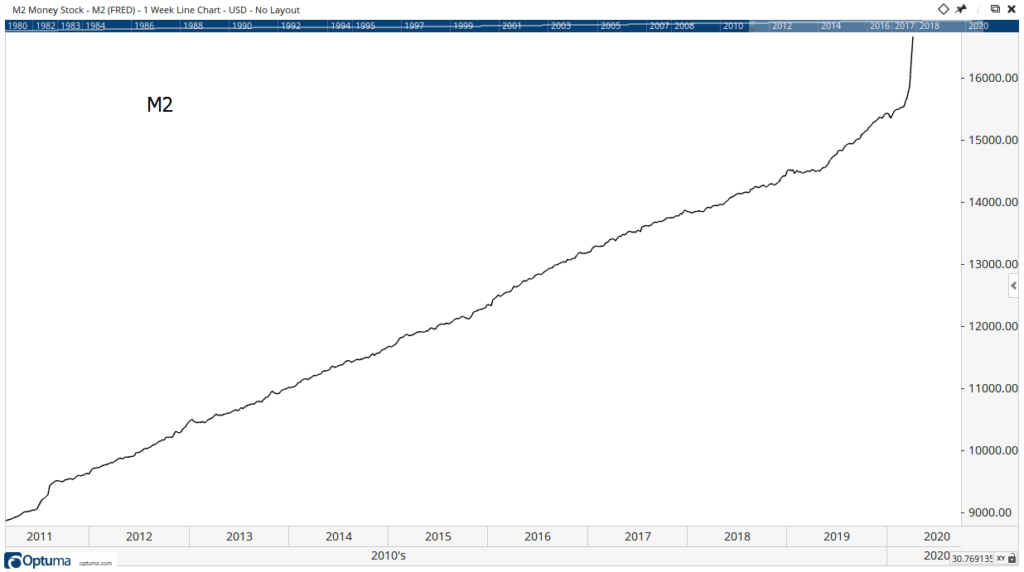

To measure the effect of these programs, we can track the amount of money in the economy.

One measure of money supply is M2. That includes all cash, money in checking and savings accounts, money market funds, and other instantly accessible sources of cash.

M2 has rocketed in the past few weeks. You can see that in the chart below.

Money Supply Has Rocketed

M2 grew over 8% in the past quarter. In the past 40 years, quarterly M2 growth averaged 1.5%.

The current rate of change is the highest on record.

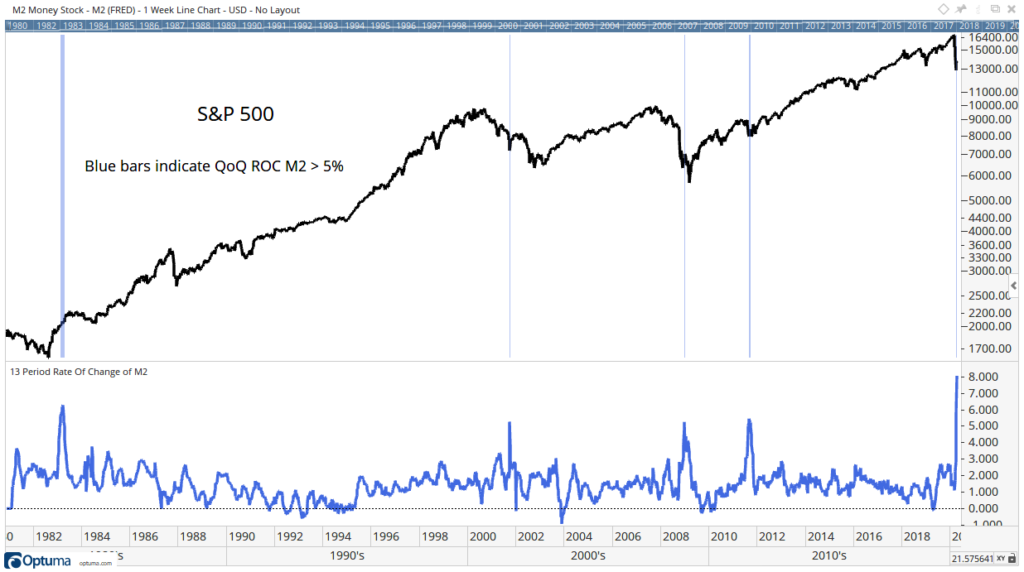

This is the fifth time since 1982 that the Fed increased M2 by at least 5% over a 13-week period.

These periods are marked by blue vertical lines in the next chart.

Money Supply Triggers 18-Year Bull Market

Three times, stocks fell further.

On the fourth occasion, in 1982, the Fed flooded the economy with cash for more than three months. That sparked an 18-year bull market.

The stock market’s fate is in the hands of the Fed. If money keeps falling from helicopters, the stock market should continue to rally.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.