If you ever want to retire (or stay retired!), you’ve got a big problem. Bonds don’t pay much now, and they’re likely to pay less and less in the months and years ahead.

I probably don’t have to tell you that the yield on the 10-year Treasury note has crashed to 1.6%. In other words, a $500,000 investment would get you a pathetic $4,000 in interest income every six months (as Treasurys only pay semiannually, unlike the three strong monthly dividend payers I’ll show you shortly).

Then there’s the specter of negative interest rates, something folks in many countries already know: Today, $15 trillion of government bonds around the world are sloshing around with yields below zero.

Imagine that: You put your cash in a “safe” Treasury and a decade later get back less than you invested!

Wall Street is already dialed into this threat. Bob Michele, CIO and head of global fixed income at JPMorgan Asset Management, recently said he sees the yield on the 10-year going to zero. Former Fed chief Alan Greenspan said this: “There is no barrier for US Treasury yields going below zero. Zero has no meaning, beside a certain level.”

Your Retirement Lifeboat: Safe Dividends Paid Monthly

With negative rates a real possibility, we need to move your income stream from this …

Treasuries’ Shrinking Payout

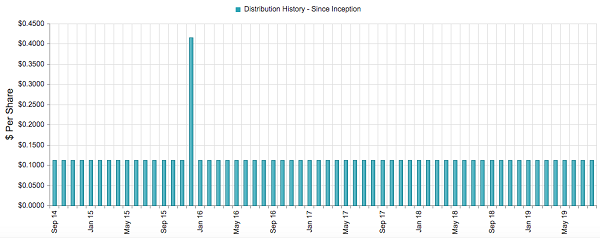

… to steady 5%-plus payouts like this one, from pick No. 3 below …

A Retiree’s Dream

Source: CEF Connect

Unlike Treasurys and S&P 500 stocks, the three 5%-plus dividends I’ll show you today drop cash into your account monthly, giving you a payment stream that nicely lines up with your bills.

So let’s dive in, starting with …

Monthly Dividend Pick No. 1: LTC Properties (LTC)

Healthcare real estate investment trust (REIT) LTC invests in 204 facilities in 28 states. Fifty percent are assisted-living (which help seniors live independently for as long as possible) and 50% are skilled-nursing (for more frequent care).

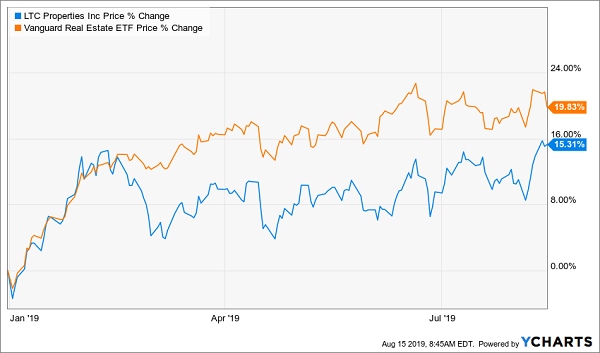

So, you can see right away that LTC is in the path of a wave of retiring baby boomers. Even so, it’s trailed the REIT benchmark Vanguard Real Estate ETF (VNQ) this year:

LTC’s Lag Gives Us Our In

That’s because LTC is dealing with three troubled operators, including one that filed for bankruptcy protection.

However, LTC has already moved six buildings run by one of these operators to others; it expects to sell most of the 11 run by another operator by the end of 2019; and it has other takers waiting to grab the 11 run by the third troubled operator. As a result, management feels it can now focus more on growth.

Meantime, management kept per-share funds from operations (FFO, a better REIT metric than earnings) steady, between $0.75 and 0.77 in each of the last four quarters. That leaves the dividend at 75% of the last 12 months of FFO — low in REIT-land, where ratios of 85% and up are common.

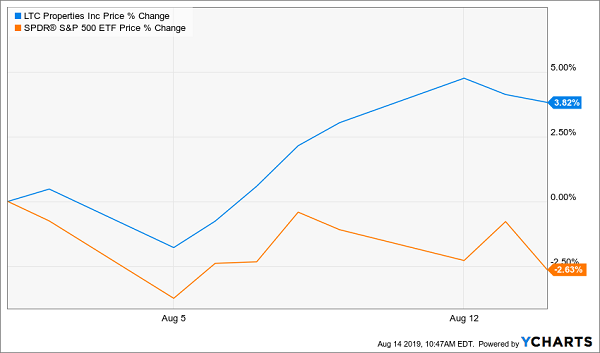

And here’s something else that makes LTC even more stable: The stock boasts a “beta” rating of 0.44, so it’s less than half as volatile as the S&P 500. And thanks to its domestic focus, it doesn’t give a hoot about the trade war, which is why it’s gained since Aug. 1, while the S&P 500 faltered:

Your Rx for Trade War Worries

Finally, LTC trades at 15.8-times FFO, a discount to industry leader (and quarterly payer) Ventas (VTR), at 18.3-times.

Monthly Dividend Pick No. 2: Tekla Healthcare Opportunities Fund (THQ)

For a more diversified healthcare play, look to THQ, a closed-end fund (CEF) boasting an outsized 7.9% monthly dividend.

And how’s this for a steady payout?

A Retirement-Friendly 7.9% Dividend

Source: CEF Connect

THQ is young, launched in early 2014. But don’t let that stop you, because this fund is run by a biotech all-star team.

That would be Tekla Capital Management, a Boston firm boasting a team of medical doctors, researchers and investment pros. Dr. Daniel R. Olmstead runs Tekla, which he joined nearly 20 years ago. His researchers come from big players, like Merck & Co. (MRK.B), as well as tiny biotech firms.

With pharma stocks, success is all about the drug pipeline. And THQ’s savvy crew gives us the closest thing to inside knowledge of these firms’ pipelines we can get.

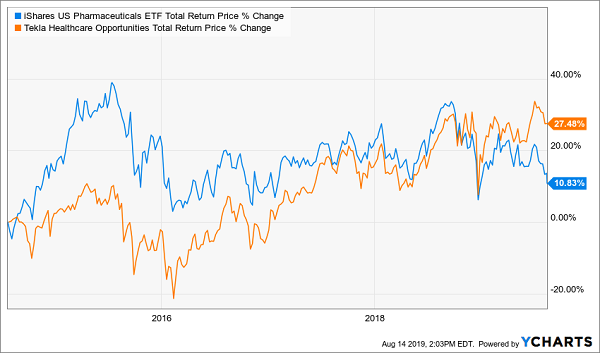

Their approach has paid off: THQ has pummeled the iShares US Pharmaceuticals ETF (IHE), including its huge 7.9% dividend, since the CEF’s launch:

The Power of Expert Management

These days, THQ is honing in on the biggest companies in the space, with the most robust pipelines, like Amgen (AMGN), Gilead Sciences (GILD) and Abbott Laboratories (ABT). THQ also holds healthcare picks beyond pharma, like insurer Anthem (ANTM).

The kicker? THQ is a bargain, at a 9% discount to net asset value (NAV, or the value of the stocks in RNP’s portfolio). That’s way too cheap for a “megatrend” fund yielding 7.9% — and dropping that payout monthly.

Monthly Dividend Pick No. 3: Cohen & Steers REIT and Preferred and Income Fund (RNP)

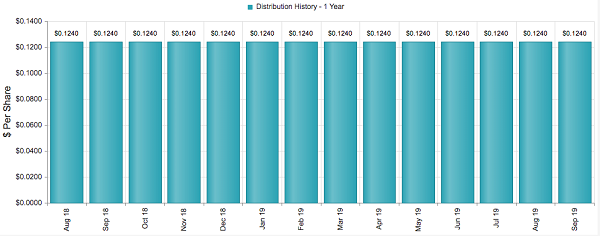

RNP owns the steady monthly dividend I showed you before we talked about LTC: a $0.124-per-share (or $1.49-a-year) payout that hits your account every 30 (or 31) days. The fund yields 6.6% today.

RNP gives you a ton of diversification in just one buy: It splits its portfolio 48% to REITs and 52% toward preferred shares issued by banks, insurance companies, utilities and REITs themselves.

If you’re not familiar with preferreds, they’re hybrids offering aspects of both stocks and bonds. They can trade on an exchange, but they trade around a par value and dole out a set regular payment, like a bond.

And those payouts can be huge: Many preferreds yield in the 6% to 7% range.

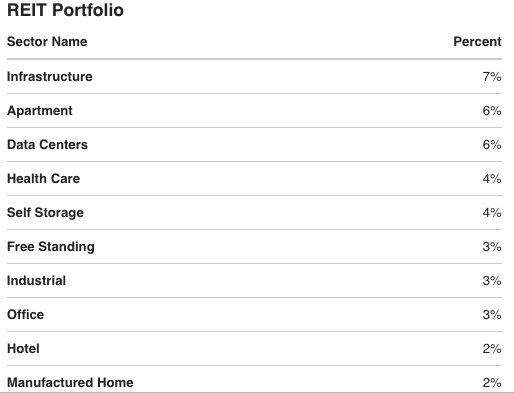

Here’s something else I love about RNP: It zeroes in on sectors tied to megatrends like infrastructure spending, data demand and, yes, the aging population. Meantime, it downplays trade-war losers like industrials (3% of the portfolio) and shopping malls (3%).

Source: Cohen & Steers

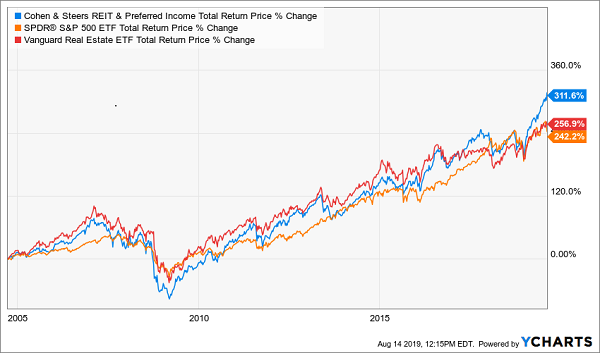

This savvy management has driven RNP (in blue below) ahead of both the S&P 500 (in orange) and VNQ (in red) since inception in 2004.

Let’s talk valuation: You can grab RNP at a 5.5% discount to NAV today.

That’s not as cheap as it was early this year, but we still have plenty of upside here, especially as lower rates cut the borrowing costs of both RNP—like many CEFs, the fund uses a modest amount of leverage to boost returns—and the REITs it holds.

To learn more about generating monthly dividends as high as 8%, click here.

• This article was originally published by Contrarian Outlook. You can learn more about Brett Owens and Contrarian Income Report right here.