If you are waiting to refinance, now could be the time to act. The same is true if you are a potential first-time homebuyer. That’s because mortgages are likely to get more expensive.

If you want to sell a home and buy another, there is no easy answer on timing. Mortgage rates are just one factor to consider, along with trends in local prices that affect how much you’ll make on a sale and how much you’ll have to pay for a new home. When making this kind of decision, there are many potential risks to consider.

That risk-filled scenario is similar to the situation banks encounter when deciding whether to offer a mortgage to a homebuyer. There are risks the home could lose value. The homebuyer could suffer a financial setback or lose their job. There are also scenarios where everything goes well.

Banks need to balance the possible risks against the potential rewards to price mortgages. Riskier loans should cost more, and safer loans should cost less. To determine what the right price for a loan should be, banks need a benchmark.

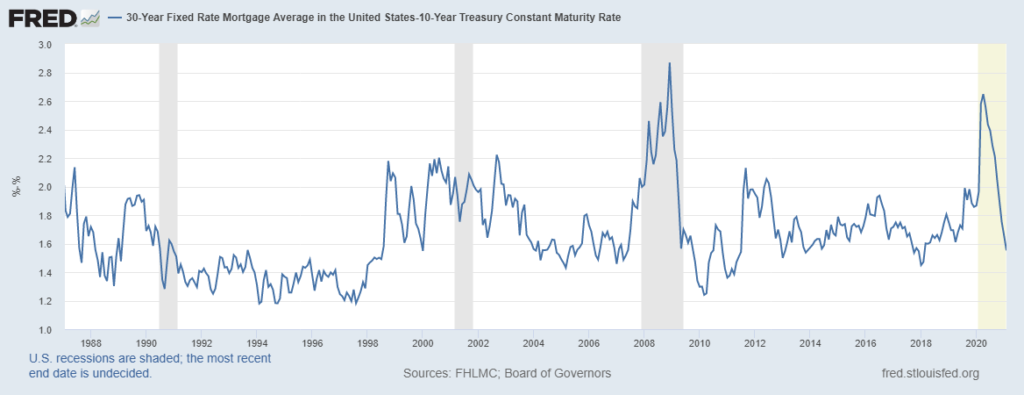

The chart below uses 10-year Treasury notes as the benchmark. Most mortgages are paid off in less than 30 years when the homeowner sells. That makes 10 years a suitable timeframe. Treasury notes are the amount a bank can earn without accepting any risks. Mortgage rates should be set above 10-year notes to account for risk.

The chart shows the price of risk. It’s the amount the average mortgage is above the 10-year.

Fixed-rate Mortgage Compared to 10-Year Treasury Maturation

Source: Federal Reserve.

The Fed’s Move Away From Mortgage Purchases

The chart shows the cost of a mortgage is 1.6% above the 10-year, close to the level it was for most of the 2010s.

In recent weeks, the cost of mortgages fell as the yields on 10-years rose — indicating the Federal Reserve was likely buying mortgages to keep rates down. If the Fed continues buying mortgages, it can keep rates low.

But the Fed is trying to reduce its activity in the markets — meaning mortgage rates are likely to rise. That’s especially true as the threat of inflation rises.

All this indicates mortgages could be more expensive by the summer. That will reduce demand for homes, threatening the housing market and the economy.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.