Nvidia’s origins were humble enough.

For most of its life as a public company, it’s been known as a graphics card maker for gamers.

But in recent years, engineers have found all sorts of new uses for its GPU chips.

Nvidia Corp. (Nasdaq: NVDA) has emerged as the chip of choice for Bitcoin mining, self-driving cars and medical research. Its chips are particularly adept at handling the number crunching for artificial intelligence applications.

We’ll take a look at how this shift has helped Nvidia’s stock rating in a bit.

Nvidia became a “story stock” during the early stages of the coronavirus lockdowns. Investors speculated that people trapped indoors would play more video games. That, in turn, would drive demand for the company’s chips.

There is some truth to that. But the far bigger story is Nvidia’s booming datacenter business.

Computing has been moving to the cloud for years, driven by Amazon.com Inc.’s (Nasdaq: AMZN) AWS and Microsoft Corp.’s (Nasdaq: MSFT) Azure platforms.

The COVID-19 outbreak accelerated that trend. Millions of Americans are working from home, streaming videos and doing daily videoconferences.

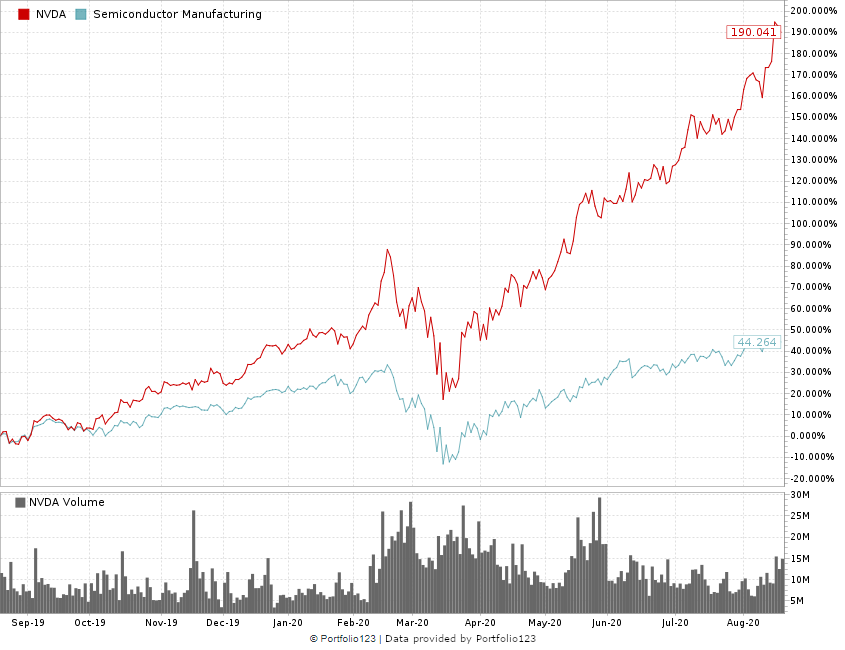

And that has driven demand into Nvidia’s stock. It has rallied almost 150% off March lows to trade close to $500 per share.

Nvidia Stock Has Become a Tech Darling

Nvidia released second-quarter earnings on Wednesday. It crushed Wall Street estimates, which were already aggressive for both revenue and earnings per share.

The company posted $3.87 billion in revenue vs. the Wall Street estimate of $3.66 billion and EPS of $2.18 vs. the Wall Street estimate of $1.97.

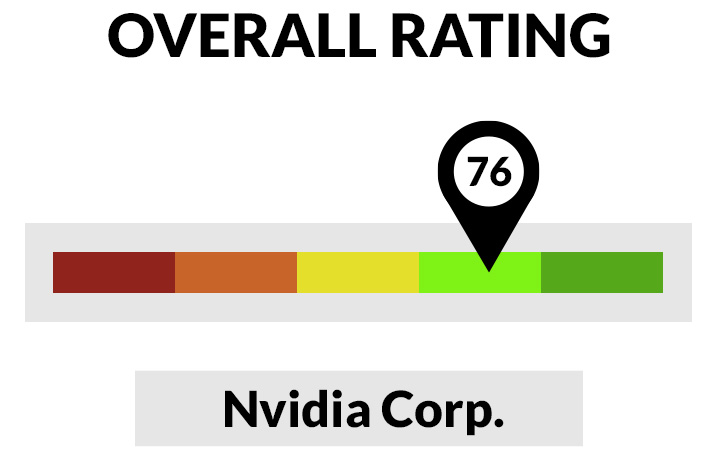

Nvidia’s stock rating has been bolstered by numbers like that. Let’s take a closer look using Adam O’Dell’s Green Zone Ratings system.

Nvidia Stock Rating Breakdown

Nvidia boasts an overall score of 76, driven most by quality, growth and momentum.

- Quality — Nvidia scores a 99 on quality, meaning it’s rare to find a stock that rates higher. Its returns on assets, equity and investment rate a 99, and its margins aren’t far behind at 98. This is a fantastic business firing on all cylinders.

- Growth — Due mostly to its booming datacenter business, Nvidia’s stock rates exceptionally high on growth as well, scoring a 98. Nvidia has enjoyed spectacular earnings and sales growth in recent years, and the post-virus economy has only accelerated this trend.

- Momentum — Nvidia rates high on momentum as well, at 96. Only 4% of stock have enjoyed better momentum in recent months.

- Volatility — The stock rates high on volatility, at 73. Many chipmakers are cyclical and volatile, but Nvidia has bucked that trend.

- Value — Nvidia is a fantastic company. But it’s far from cheap, rating at just 5 in value. This means that 95% of companies in the universe we track are cheaper.

- Size —Nvidia is a huge company, and that kills its size rating. It only scores a 0.05. This market has favored large growth stocks above all others. But as a general rule, smaller stocks tend to outperform.

What to Do With Nvidia

Nvidia is a fantastic company. It’s well positioned in one of the biggest and most durable macro trends of recent decades: the rise of Big Data.

But Nvidia’s stock rating took a knock due to its high price and massive size.

You might want to wait for a dip before making a large purchase here. You could also average into the position over a few weeks or months.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.