Banyan Hill Publishing Chartered Market Technician Chad Shoop here, and I’m excited to be able to share with you more about my approach to investing I call “profit stacking.”

I’m a very short-term trader specializing in options, which is where you can make money even in down markets.

The staff here at Money & Markets has reached out to me over the past couple of months to get my insights on this wild stock market.

Banyan Hill CMT Chad Shoop

I’ve spoken to them at length about the broad market, looking at key levels for the S&P 500.

But I’ve also chimed in on specifics like Tesla (Nasdaq: TSLA) and airlines stocks.

You’ll notice that my take on stocks is not the usual “buy, buy, buy” approach.

In fact, I’m a very short-term trader specializing in options, which is where you can make money even in down markets

I manage three successful research services at Banyan Hill — Quick Hit Profits, Automatic Profits Alert and Pure Income. And each one is designed to be in a position for just a couple of months — or less.

And if you’ve seen my YouTube series, Bank It or Tank It, then you know I believe the best way to profit from these companies is trading their short-term swings.

To watch and subscribe to my YouTube channel, please click here.

My 12-month price targets are just guides. The real money is made along the way.

My S&P 500 forecast video is a great example. I’m bullish on the market long-term, and expected it to head higher in 2020 at the start of the year.

Then the coronavirus hit.

Now I see it potentially falling another 50% from current levels.

My analysis changed as the data came in. And you have to do that to make big money in the stock market.

Today, I am going explain how you can use short-term trends for massive profits…

Crush the Market with Profit Stacking

Common knowledge on investing tells you to buy and hold stocks, gobbling up well-run companies and holding them for years.

But that’s not your only option.

I take a different path, where I pinpoint short-term profits to stack our gains up well beyond the average buy-and-hold approach.

This is my Automatic Profits Alert research service.

In fact, I go so far to consider the buy-and-hold approach dead.

If your goal is to outperform the stock market and if you invest — that’s the ultimate reason, you want bigger returns — then you have to do better than buy and hold.

To do that, I want to introduce you to profit stacking.

The buy-and-hold approach means you have to average your returns because you’re likely holding dozens of companies at one time.

But what if you could add them up?

That’s what my profit stacking method does.

Instead of holding dozens of companies for years, we hold up to six companies at a time. But, we buy and sell them three or four times a year.

At the end, we have gone through dozens of companies, too, but many of ours won’t be average returns — we get to roll our capital from one trade to another in each of the profit stacks.

It gives us the power to compound our returns throughout the year.

But we can’t do this with random trades.

I have a proven system to guide us in and out of select trends known as “prime seasons.”

The Power of Prime Seasons

Prime seasons are seasonal trends in the stock market that have proven to be consistent to trade.

I’ve tracked the data on dozens of sectors to determine the most ideal times to trade them.

The seasonal trends that develop last just a couple of months at a time. That’s where my prime seasons come from. I’m not trying to trade every ebb and flow on the seasonal chart because not all of them are promising.

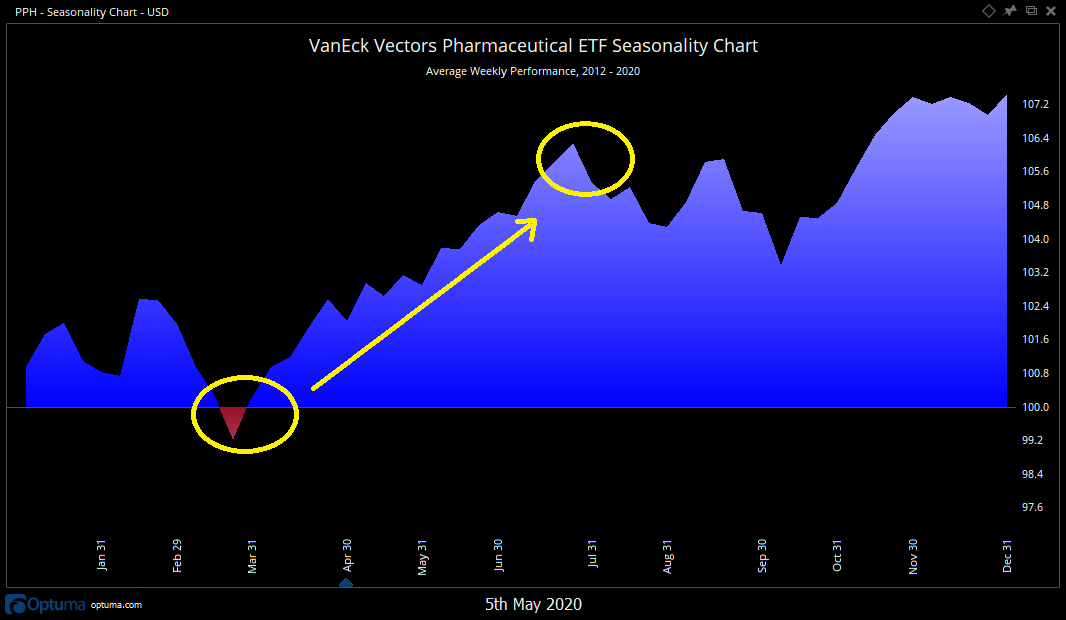

Take a look at this 10-year seasonal chart for the pharmaceutical sector to see what I mean.

The shadow graph highlights the seasonal analysis for the pharmaceutical sector. In yellow, I’ have highlighted the prime season I look to play.

As you can see, you want to get in around early April and hold through the end of July – that’s what this chart is telling us.

I know it’s already May, but with the volatility we’ve seen in the stock market, the rally in this sector has plenty of room to run higher — and plenty of profits to stack.

This seasonal trend has lined up perfectly with the moves the market is making with a bottom in late March, and a strong rally in April.

But, based on the prime season for pharmaceutical stocks, this sector can run through July.

So we still want to benefit from this seasonal trend, and this is the trade that will do it.

One Trade for Maximum Profits

Since I track ETFs for the seasonal trends, you may think trading them is the best way for profits.

But ETFs are funds that holds dozens if not hundreds of individual stocks.

Essentially, you are back to holding a broad index of stocks, which is exactly what we want to avoid so we can outperform the market.

That’s why I focus on the stocks with the most potential to deliver maximum profits during the prime season.

And one stock that is positioned for huge gains in the coming weeks is Bausch Health Companies (NYSE: BHC).

The pharmaceutical company makes a range of over-the-counter products, medical devices and medicines. Shares in the stock have been weighed down with the rest of the market in March, but it rebounded in April, following the seasonal trend for the pharmaceutical sector.

We will look for the stock to continue climbing higher in the next two months.

If shares follow the seasonal trend, we’ll be looking for a double-digit gain as high as 50% in the next two months.

And after this prime season ends, we’ll have another prime season to roll our capital into and begin stacking our returns throughout the year.

You can learn more about my profit stacking strategy by reading this exclusive interview.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert

• Chad Shoop is a Chartered Market Technician for Banyan Hill Publishing, and an expert at trading options with three different trading systems to stack profits.

Follow him on his YouTube channel, and on Twitter @ChadShoopGuru.