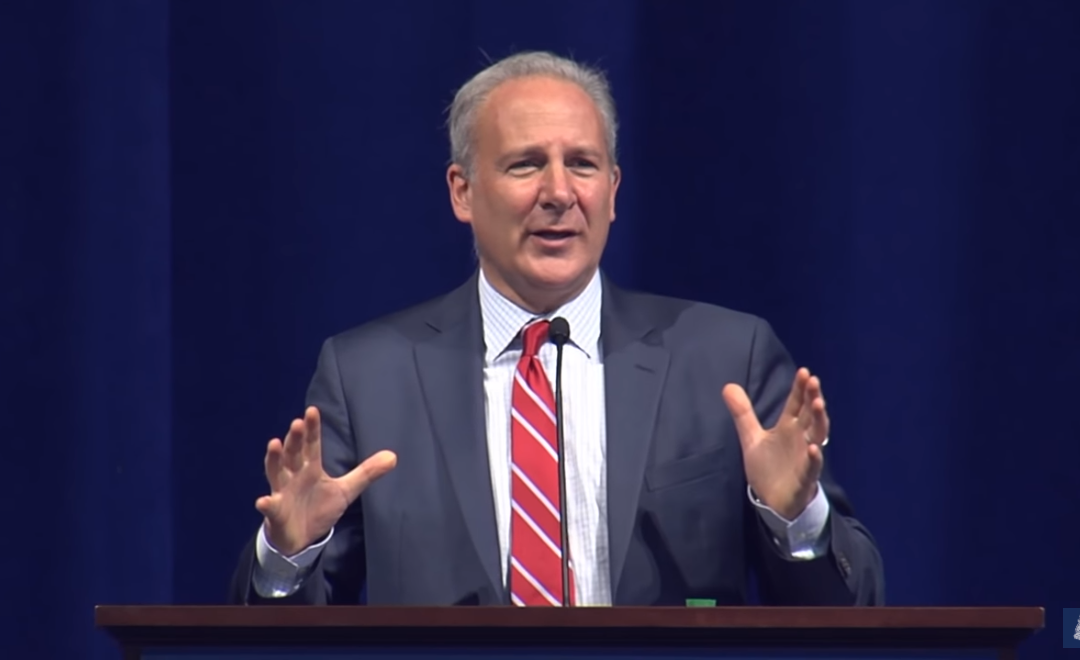

Economist and Euro Pacific Capital CEO Peter Schiff recently discussed the potential impact the coronavirus will have on the market and the Federal Reserve’s likely response, which has been its response to everything the past decade-plus — just print more money.

“And the reason they don’t want to admit it is because they had to do QE when we had a Great Recession.”

Schiff, appearing on “SmallCap Power” with Mark Bunting, discussed his feeling on the markets now, with the S&P 500 and Nasdaq both hitting new record highs yet again Wednesday, and he thinks the Fed is responsible for this continued bull run through quantitative easing and perpetually low interest rates.

Case in point, 2019’s 30% rise in stock prices amid sinking corporate earnings.

“That’s all the Fed. If we really had a good economy, you would have expected corporate earnings to reflect that,” he said. “But they didn’t.”

Schiff also has long lambasted the Fed’s ongoing repo intervention, which he previously called “stealth QE.” The Fed finally admitted the cash injection into the repo market could be considered “QE light.”

“It’s not QE light. It’s actually QE extra. Because they are doing more QE now than before. The only distinction they’re making, which is really a distinction without a difference, is that the last time they did QE, when they were doing QE3, they were buying longer-term government bonds. Now they’re buying shorter-term government bonds,” Schiff explained. “But they’re still buying government bonds. They’re monetizing the debt. Their balance sheet is expanding. And so it’s quantitative easing whether they want to admit it or not.

“And the reason they don’t want to admit it is because they had to do QE when we had a Great Recession. Now they’re pretending that we have a great economy while they have the same monetary policies as when the economy was lousy.”

Bunting pointed out that, just like before the ’08 crisis, Schiff is a “voice in the wilderness” pointing out bubbles while the market just keeps rising.

“It is very similar because it’s the same dynamic at play,” Schiff said. “And the same people who were being fooled by the illusion prior to ’08 are being fooled by it again.”

Peter Schiff on Where Gold Is Heading From Here

The topic turned to gold to close out the seven-minute interview, with Schiff saying “it’s no surprise I’ve been bullish on gold for the past 20 years.”

Schiff said too many people focus on where the price of gold is now compared to when it peaked at $1,900 in 2011, forgetting it rose to that peak from under $300 just a decade before.

“So that was a huge move in the price of gold. And, obviously, the gold price got ahead of itself somewhat in 2011. But the reason it corrected the way it did, down to $1,000, was because everybody began believing that the Fed was going to be able to normalize interest rates and shrink its balance sheet, and so the markets began to discount that into the gold price,” Schiff explained.

“Well now people are finally discovering that they were wrong to have believed that, that QE is going to go on indefinitely, that interest rates are never going to normalize. And during this environment, gold has finally moved up by 50% over the last four years. That’s not a bad move. And gold stocks have beaten the S&P over those four years. In fact, gold stocks beat the S&P last year; they beat the S&P over the last two years.”

Schiff then noted that while the price of physical gold is rising, gold stocks are down so far this year. The last time that happened? The year 2000 at the bottom of the 20-year bear market in gold and the peak of the Nasdaq dot-com bubble.

“In that environment, you had a lot of bearishness still left over for gold stocks,” Schiff said. “But here we are now, and why is there so much bearishness on gold stocks? Everybody is bullish except when it comes to gold stocks. I think this is a great contrarian indicator that these stocks are still really cheap.”