The S&P 500, Dow and Nasdaq all closed at new record highs yet again Monday as the record long bull market continues to defy odds amid gloomy economic numbers, including the Atlanta Federal Reserve’s recent Q4 0.4% GDP revision downward.

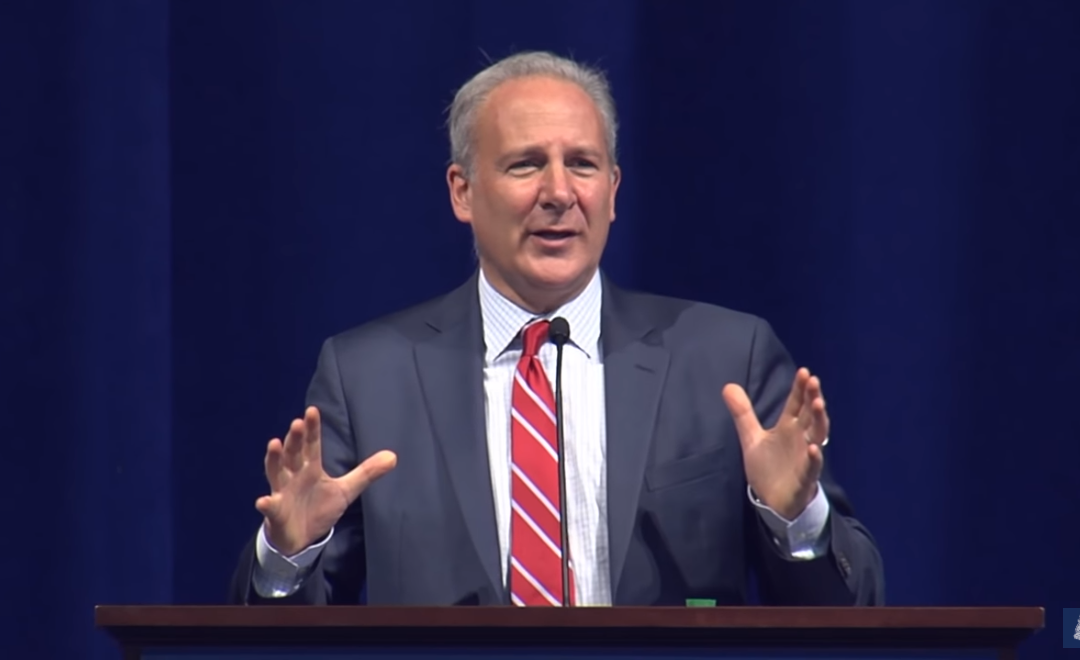

On his latest podcast, economist Peter Schiff again said the reason the market is continuing to rise is because of the Federal Reserve’s continued quantitative easing, which it says is not QE, to which those in the know are calling BS.

So the Fed’s “not QE” (wink, wink) is in turn inflating all sorts of new bubbles, which are going to pop at some point, according to Schiff, leaving investors holding the bag.

“Despite the weakening economy, the stock market continues to roar and Donald Trump continues to claim credit for the rising stock market and holding the stock market out as evidence of the success of his presidency,” Schiff said, which, ironically, is much like what we heard from then-President Barack Obama.

“When Obama was president, we had a rising stock market and a falling unemployment rate, and basically for the same reasons we have a rising stock market and a falling unemployment rate now. The stock market was going up because of the Fed, because of artificially low interest rates and quantitative easing. Well, that’s exactly why it’s going up now — artificially low interest rates and quantitative easing.”

Schiff then pointed out something we’ve mentioned here on Money and Markets a number of times — that the market seemingly rises and falls on every word uttered about the trade war between the U.S. and China.

“As long as the White House can goose the stock market by pretending there’s a trade deal, well, then they’re going to keep pretending,” he said.

However, the trade talk “goosing” is a distant second to the Fed’s easing in terms of the effects on the market as a whole. The Fed has cut interest rates three times this year, the first three cuts in more than a decade. Fed Chair Jerome Powell signaled the bank is likely to pause its rate cutting for the time being, but Schiff said it won’t hold off for long.

“The market is rising today for the same reasons it rose under Obama. Trump knew that that was phony. He knew that the stock market was a big, fat, ugly bubble and he called out the president,” Schiff said. “And that’s one of the reasons, or the main reason, I think, that he got elected. The same thing with unemployment.”

Schiff said no matter how often Trump tells you how great the economy is, the thing keeping the boom going is the Fed, citing the recent tanking of pot stocks and IPOs that have largely bombed (Uber, Lyft, WeWork’s on again, off again IPO that ended with its CEO being removed).

“These are warning signs. If you think popping bubbles are going to be contained to the IPO market or to the pot stocks, no,” he said. “All of the bubbles are going to pop, including the total bubble in the U.S. stock market overall — not just in these sectors, but the entire market is in a bubble. In fact, the bond market is in a bubble, the dollar is in a bubble. There are bubbles everywhere and they’re all going to pop.”

Schiff then discussed the growing talk of negative interest rates, particularly by Trump, who again on Tuesday tweeted that the U.S. should have the lowest rates of all, which means negative.

At my meeting with Jay Powell this morning, I protested fact that our Fed Rate is set too high relative to the interest rates of other competitor countries. In fact, our rates should be lower than all others (we are the U.S.). Too strong a Dollar hurting manufacturers & growth!

— Donald J. Trump (@realDonaldTrump) November 19, 2019

Last week Trump said, “Give me some of that. Give me some of that money. I want some of that money,” in regard to negative rates, to which Schiff said the U.S. is actually benefiting from other countries going negative interest rate policy (NIRP) while America has not.

“We are benefiting from negative rates by not having them, ” Schiff said before touching on Powell’s latest testimony to Congress in which he again touted the strength of the economy while also blaming Congress for the ever-ballooning national debt.

“It’s the Fed that is enabling all the deficits. The Federal Reserve cannot call out Congress and say, ‘Get your house in order, you have too much debt,’ while they’re doing quantitative easing, while they’ve got interest rates artificially low,” Schiff said. “Because as long as they’re doing that, Congress is never going to act responsibly.

“I think the day of reckoning is going to happen a lot sooner than Powell thinks.”

Editor’s note: Is the market rising today for the same reason it rose under Obama, as Schiff said? Is he not giving Trump enough credit, or is he right that it’s the Federal Reserve propping everything up? Share your thoughts below.