Investors know stocks are riskier than bonds. In many ways, it’s true. But one important data series tells us something else.

One way to look at risk is through income. Investments with higher risk should provide more income. This explains why junk bonds pay higher interest rates than Treasury bills. The risk of default and losses in junk is higher than it is in Treasurys.

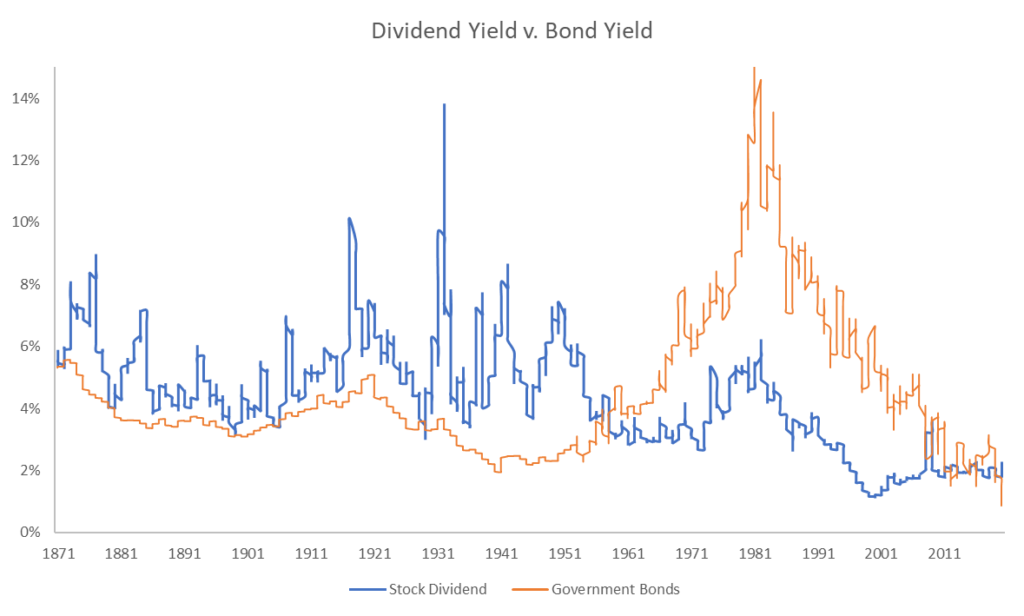

By extension, if stocks are riskier than bonds, they should offer higher income. For decades they did. But that changed in the 1950s.

The chart below shows the relationship between the dividend yield on the S&P 500 and predecessor indexes (the blue line) and the yield on Treasury bonds (the orange line).

Yields Are Shifting

Source: Robert Shiller

As the chart above shows, stocks provided more income from 1870 to 1950. The relationship changed in the 1950s, and bonds beat stocks until just a few years ago.

Researchers can’t explain this change.

In recent years, the relationship became unstable thanks to increased volatility in stocks and near-zero interest rates.

The Problem With Outdated Investment Models

This chart is more than a historical oddity. Investment models are based on the relationships that existed in the 1960s and 1970s. This was when the capital asset pricing model and other theories were developed.

Many of these models rely on interest rates that are significantly higher than current rates. Negative rates break some of the pricing models.

This poses a problem for investment professionals. Pension funds manage trillions of dollars and make allocation decisions based on models. If the models don’t work, funds might not be able to pay promised benefits.

As managers address this shortfall, there’s no way to know what the bond-stock income relationship will look like in 10 years.

Expect volatility in both investments as large investors recalibrate their models to account for these changes.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.